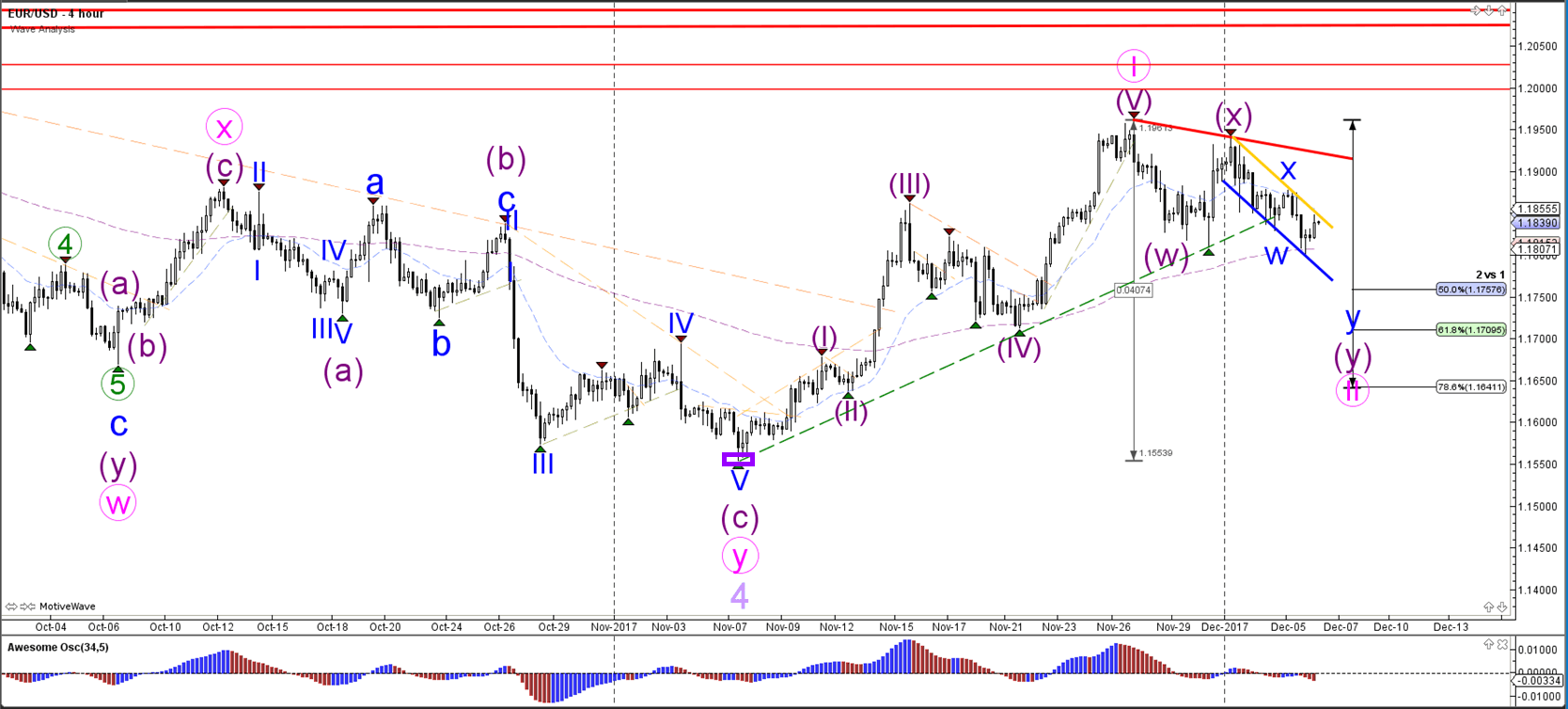

EUR/USD

4 hour

The EUR/USD is building a bearish correction as expected. The choppy and corrective price action is making a wave 1-2 (pink) pattern more likely. The bearish channel could take price down lower to the Fibonacci levels of wave 2. A break below the bottom (purple box) invalidates this wave pattern.

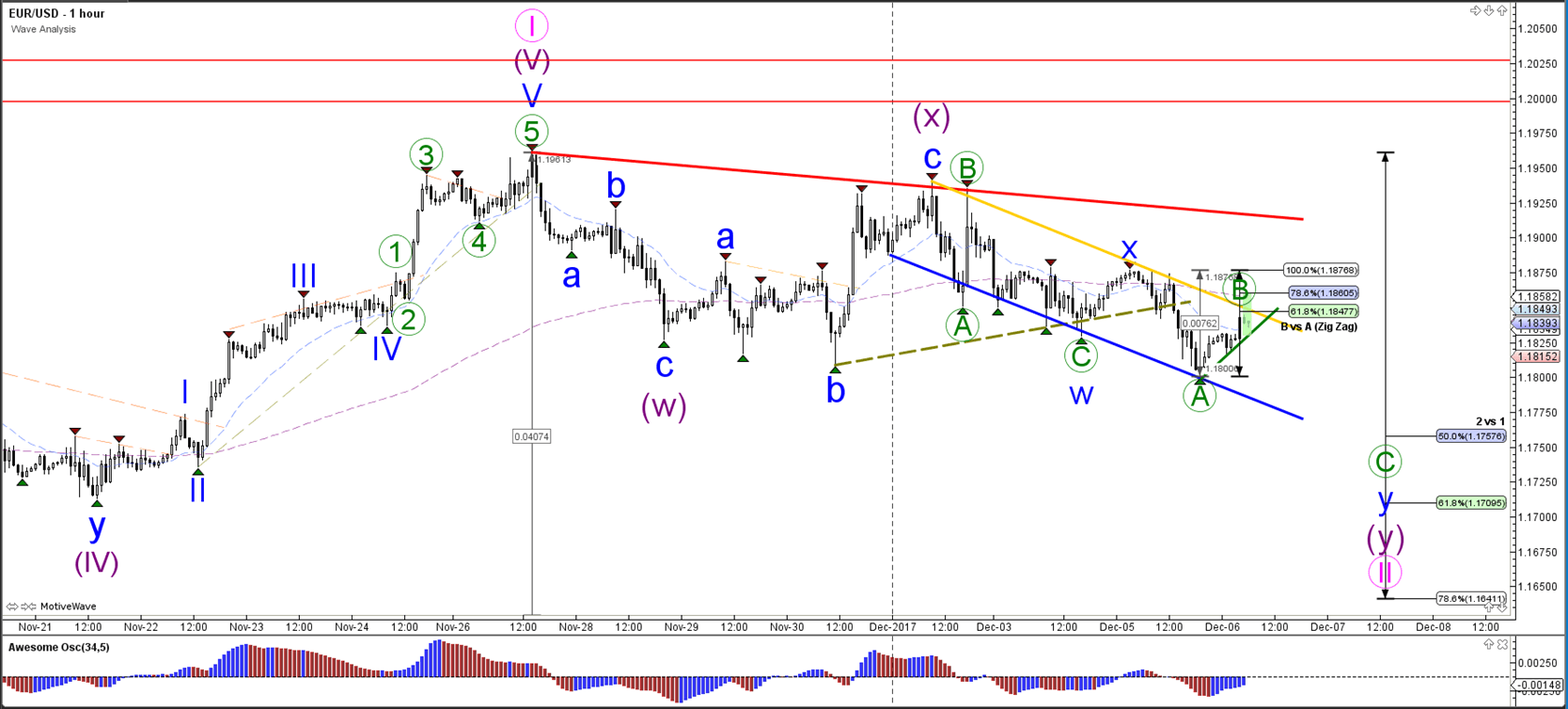

1 hour

The EUR/USD broke below the support trend line (dotted green) and fell below 1.18 but is a sturdy pullback. This could be part of a wave B (green) within a larger bearish ABC zigzag.

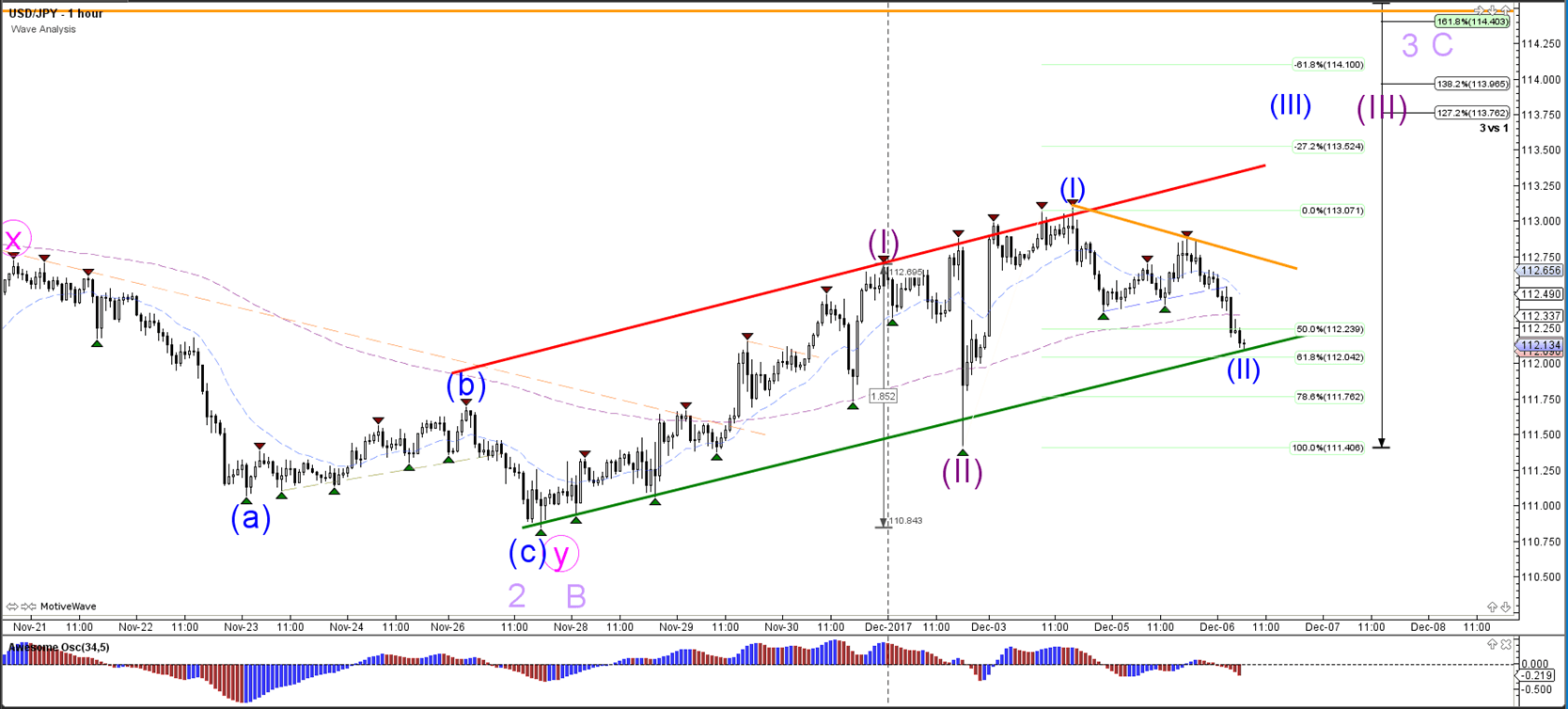

USD/JPY

4 hour

The USD/JPY is testing the bottom / support (green) of the uptrend channel. An impulsive bullish bounce could indicate that price is building a wave 2 (blue) whereas a sideways movement could mean a bear flag pattern and more downside.

1 hour

The USD/JPY will need to bounce at support first of all and later on break above the resistance (red/orange) to confirm the wave 3 pattern (purple). For the moment, price could have built a bearish ABC pattern within wave 2 (blue) and the Fibonacci levels and the support trend line could stop price from falling.

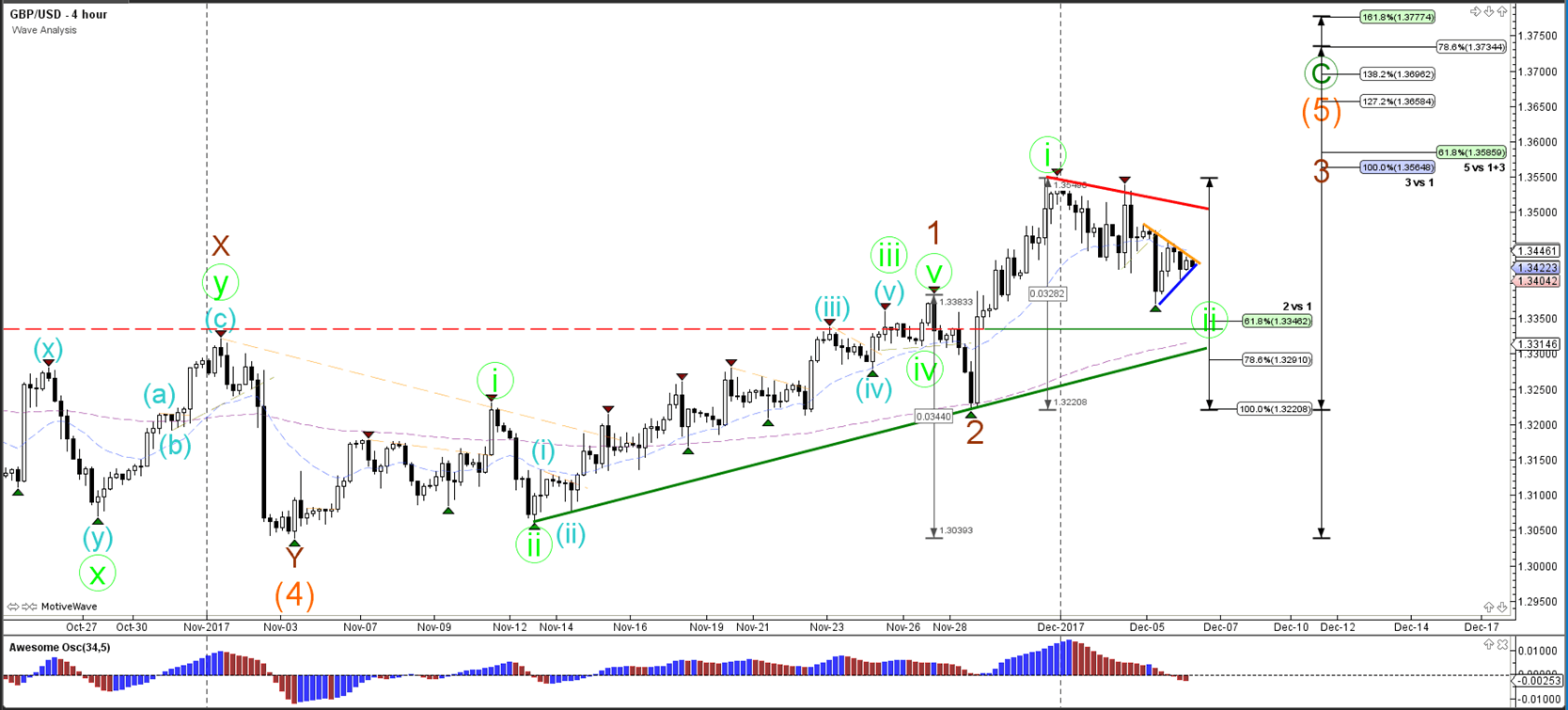

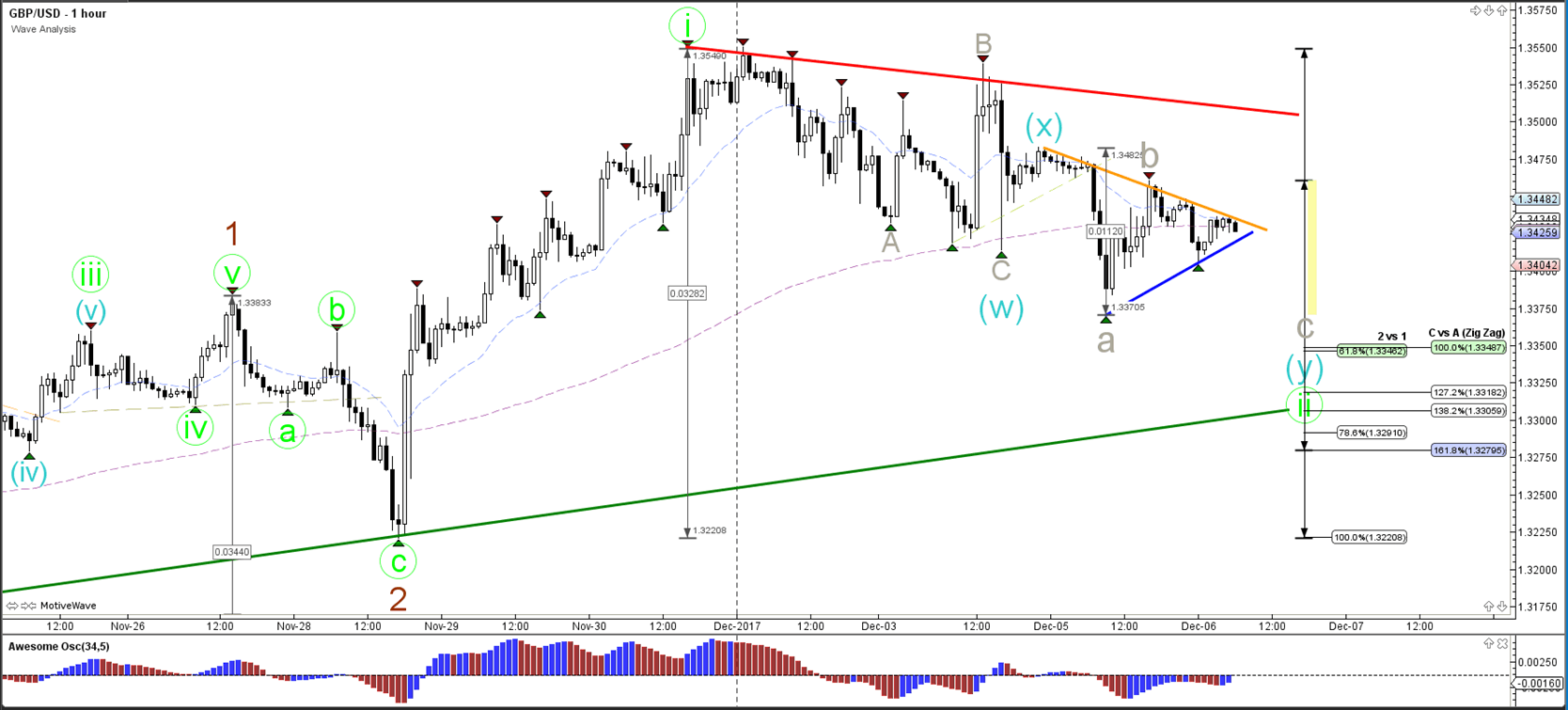

GBP/USD

4 hour

The GBP/USD is building a bearish correction which is probablypart of a larger a wave 1-2 (green).This is invalidated if price breaks below the 100% Fibonacci level of wave 2 vs 1.

1 hour

The GBP/USD is showing a triangle chart pattern (orange/blue). A break below or above the triangle could indicate a potential breakout.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.