The dollar is going down, and it is bullish for the markets. The two most closely monitored instruments of the world markets, EURUSD and S&P500, signal a breakthrough of their downtrends.

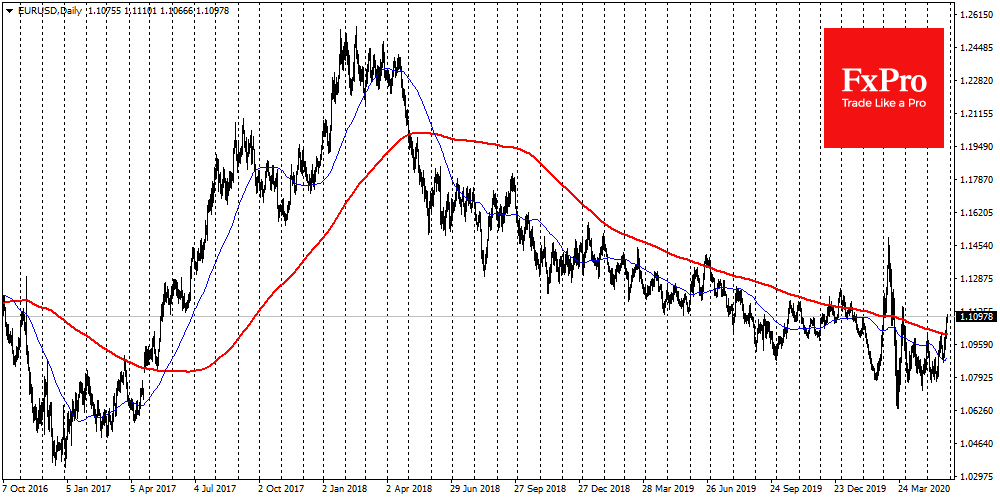

The dollar not only declines against the euro but also retreats against the pound and the yen. Nevertheless, the single currency deserves the most interest in this trio. It managed to overcome the boundary of 1.1000. It was indicative that the sellers in the pair tried to get it back below the psychologically important mark, but surrendered. This morning EURUSD is already one step away from 1.1100 on the last trading day of the month.

Closing the week and month above the 200-day average and significant round mark will allow us to speak about a technical break of the downtrend formed in early 2018. And it is interesting because the fundamental reasons for this downtrend remain valid.

Initially, the euro declined on the first signs of trade wars between the United States and China, as it was a harbinger of the weakening of European growth. In recent weeks the problems between the US and China are gaining strength again, and the yuan is losing ground. All this on top of Europe's own problems with the economy.

However, it seems that the euro has nowhere to fall. It is now quite low by historical standards, that means the absence of sellers. Moreover, it receives support from the SNB, which is selling francs for the euro.

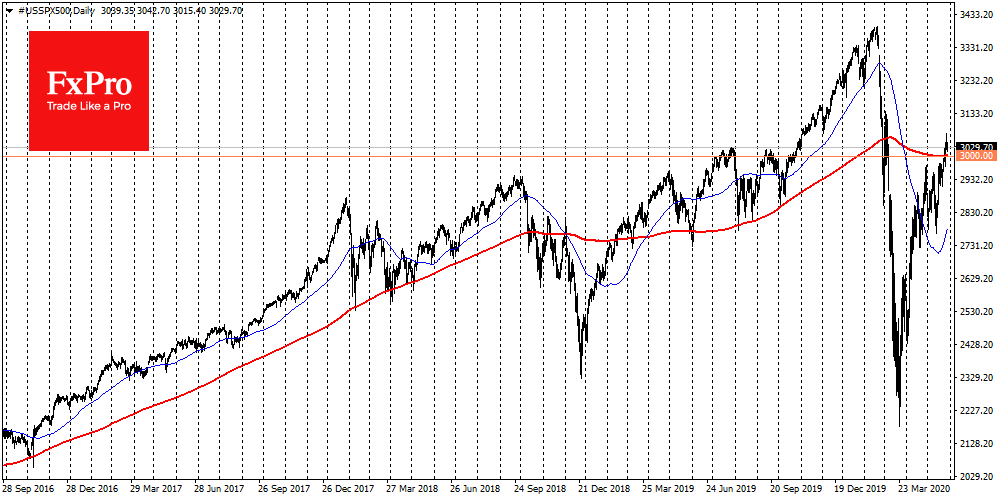

The S&P 500 closed yesterday with a 0.2% decline, but remained above its 200-day average and demonstrated growth during the previous four trading sessions. Formally, one can find reasons to buy the stocks, such as a decrease in continuing claims and a less sharp slump of durable goods orders than expected. Again, these are more technical and short-term reasons to buy than fundamental motives for an optimistic view of the future.

Thus, markets are generating very volatile growth based on technical factors and short-term impulses, but without taking into account the fundamental weakness of the economy and the high risks of widening disputes between China and the United States. This is a very fragile structure that could collapse at any moment.

Trade Responsibly. CFDs and Spread Betting are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.37% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider. The Analysts' opinions are for informational purposes only and should not be considered as a recommendation or trading advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.