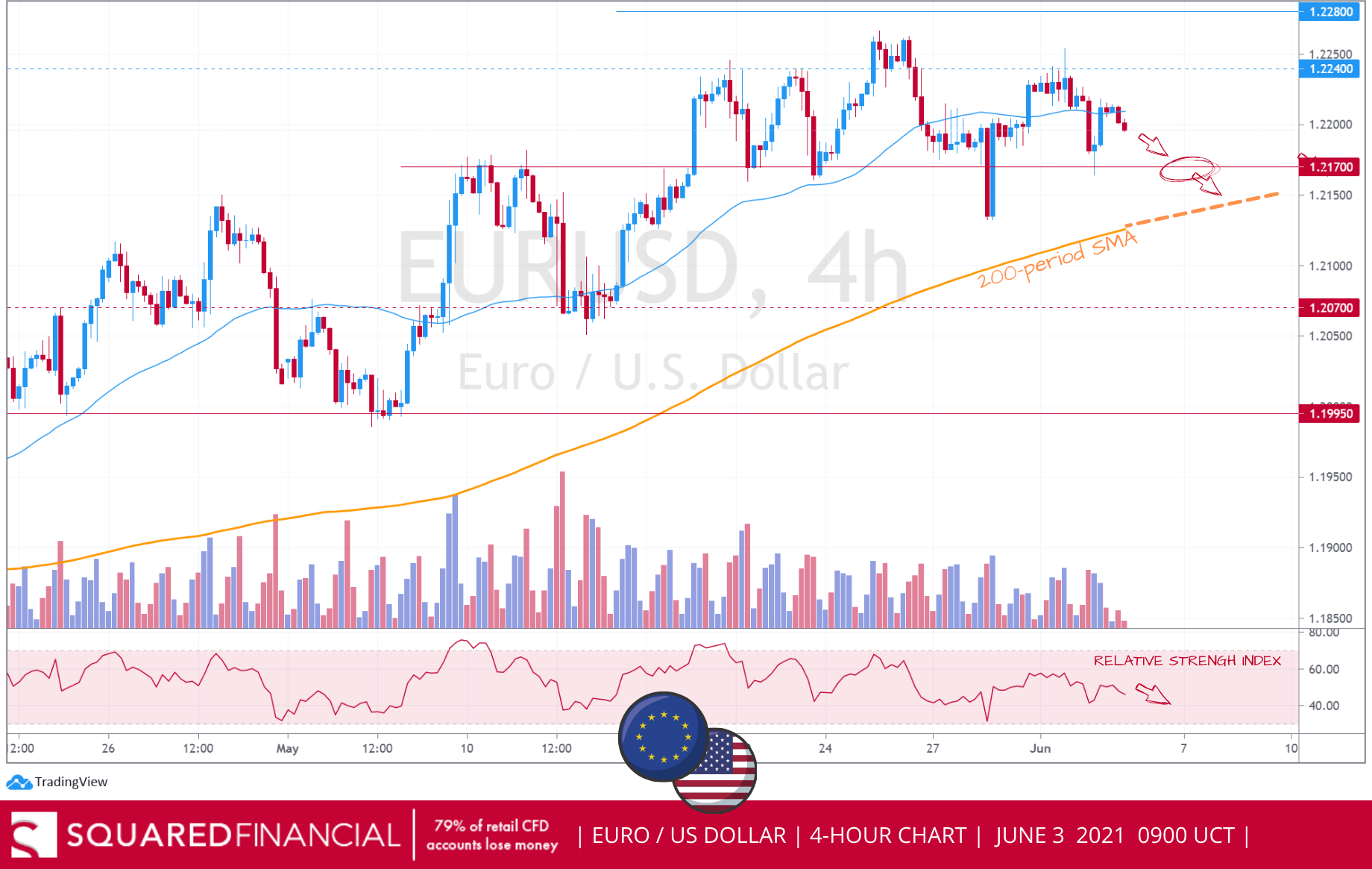

EUR/USD

The Euro fell to our support level around 1.2170 after the US Dollar surged on the back of Philadelphia’s Fed Bank President Patrick Harker mentioning the sensitive subject of tapering bond-buys. The selloff did not last long, however, as the EURUSD currency pair quickly reversed higher and is now once again drifting around in familiar ranges, while technical indicators favor further decline with the 200-period SMA as next key support line.

Support: 1.2170 / 1.2130.

Resistance: 1.2240 / 1.2280.

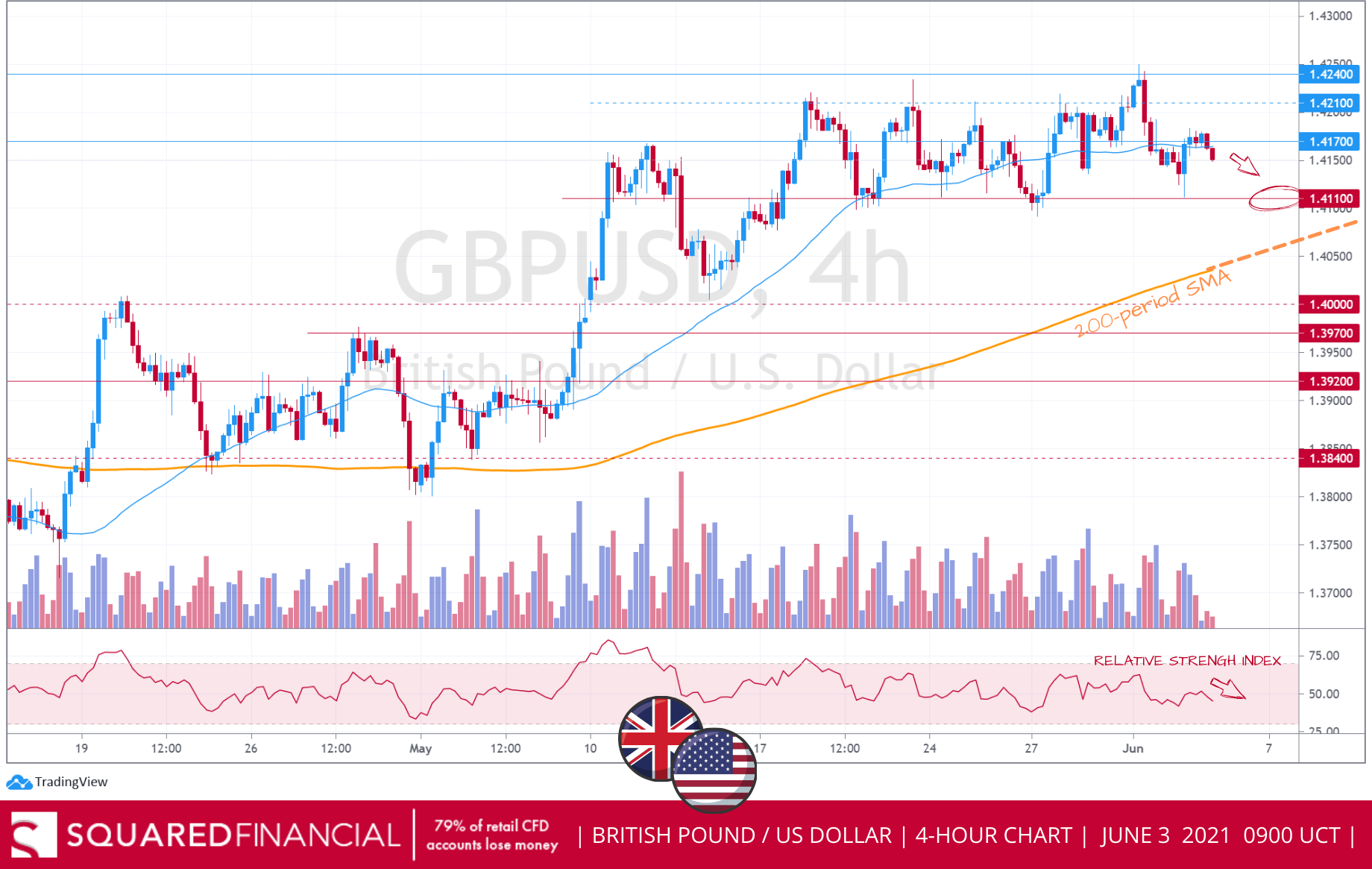

GBP/USD

The British Pound fell to our target at 1.4110 on the back of a stronger US dollar, and although the GBPUSD currency pair did bounce back slightly higher, it is still depressed below our key resistance level at 1.4170 as traders await the latest UK PMI data, US Initial Jobless Claims, and US PMI data to gauge the market sentiment, with technicals still signaling weakness ahead.

Support: 1.4110 / 1.40.

Resistance: 1.4170 / 1.4210.

This information is only for educational purposes and is not an investment recommendation. The information here has been created by SquaredFinancial. All examples and analysis used herein are of the personal opinions of SquaredFinancial. All examples and analysis are intended for these purposes and should not be considered as specific investment advice. The risk of loss in trading securities, options, futures, and forex can be substantial. Customers must consider all relevant risk factors including their own personal financial situation before trading.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.