EUR/USD Current price: 1.1649

- Holidays in London and Wall Street to see the week starting in slow motion.

- European inflation and US employment data to provide fresh clues this week.

Geopolitical fears returned last week, and the greenback once again had an upbeat performance against its European rivals, losing ground, on the contrary again safe-haven rivals. The EUR/USD pair settled at 1.1649, its lowest since November last year, and accumulating a roughly 800 pips' decline since topping around 1.2410 mid-April. The common currency had its fair share of own trouble, with political jitters in Italy and Spain, and data indicating that the pace of growth continued decelerating into Q2. US Treasury yields continued easing, with the yield on the benchmark 10-year Treasury note, down roughly 10 basis points from the multi-year high achieved this month, now at 2.93%.

With a holiday in London and Wall Street, the week is set once again to start in slow motion. Nevertheless, the macroeconomic calendar will be quite active for both economies these upcoming days, with fresh inflation figures for Germany and the EU, and the US Nonfarm Payroll report next Friday, among others. These numbers will give fresh clues on the imbalances between the two economies and their central banks' policies, and regardless sentiment will set the tone for the pair.

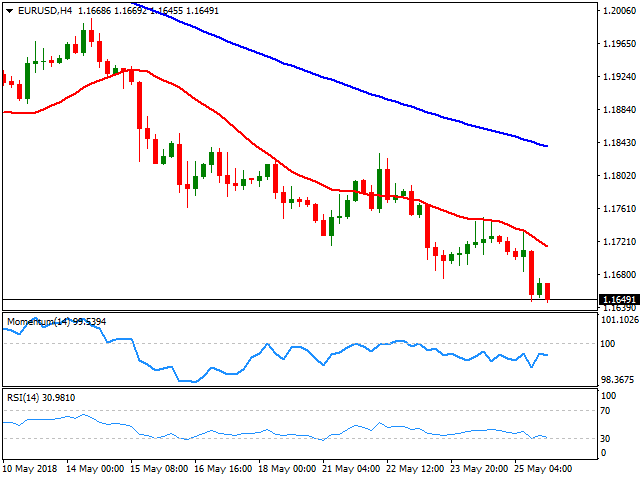

Technically, the pair is down for a sixth consecutive week, and despite extremely oversold, there are no signs of a trend-change just yet. In the daily chart, the 20 DMA heads firmly lower above the current level and after crossing below the larger ones, while the Momentum indicator hovers within negative territory, with no certain directional strength, but the RSI accelerates south, now at 22. In the 4 hours chart, the pair is developing below all of its moving averages, with the 20 SMA providing a dynamic resistance at around 1.1720, and technical indicators turning lower within negative territory, the RSI currently at 30, all of which favors additional declines, now targeting the 1.1550 region, where the pair bottomed in November 2017.

Support levels: 1.1620 1.1590 1.1550

Resistance levels: 1.1695 1.1720 1.1750

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.