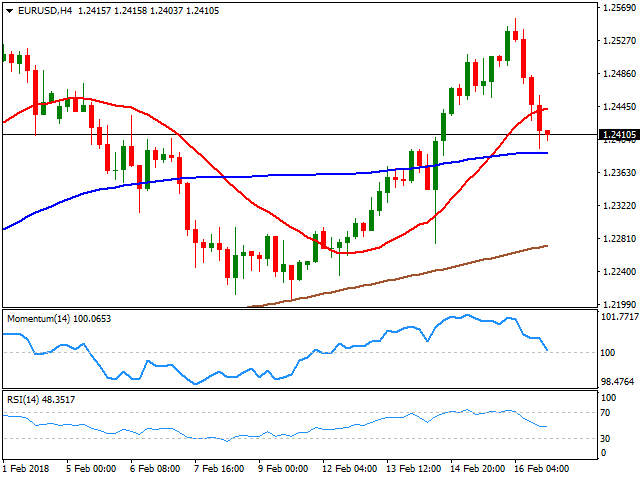

EUR/USD Current price: 1.2410

- US political jitters to keep the greenback under pressure, despite Friday's recovery.

- Strong US macroeconomic fell short of reversing the negative sentiment toward the greenback.

After being under pressure all through the week, the greenback edged higher on Friday but stayed well-short of trimming its weekly losses. The EUR/USD pair closed at 1.2410, reversing its previous weekly slump, and reached these last days, a fresh 3-year high of 1.2554. Political jitters in the US kept indexes and bond-yields swinging back and forth, somehow offsetting concerns about higher inflation, as the focus shifted to the country's deficit, now seen skyrocketing to $1 trillion for 2019, as a consequence of the tax cut and the latest expending plan approved by the Congress. Dollar's gains on Friday can be attributed to some solid macroeconomic figures, but also to profit-taking ahead of a long weekend. The housing sector seems to have picked up in January, as Housing Starts jumped 9.7%, while Building Permits surged by 7.4%, doubling market's expectations. The preliminary February Michigan Consumer Sentiment index came in at 99.9, surpassing expectations of 95.5 and reaching its second-highest level since 2004.

China, the US, and Canada will be on holidays this Monday, which means no big news will come from there, while the EU will only release minor figures. For the rest of the week, there are no first-tier reports scheduled, which leaves chances of further sentiment-related trading high.

Technically, the daily chart shows that the pair may have to have started drawing a double top around 1.2540/50, although the neckline of the figure, which will confirm the formation is the low set on February 9th at 1.2205. In the same chart, the pair settled above the 20 DMA, which losses upward strength and currently stands at 1.2390, while technical indicators eased, the Momentum pressuring its 100 level, and the RSI at 57, suggesting the downward correction may continue, particularly on a break below 1.2390, although the decline will remain a correction. Shorter term, and according to the 4 hours chart, the pair is at risk of correcting further lower, as it broke below its 20 SMA, while technical indicators are crossing into negative territory with strong downward slopes. The 100 SMA stands around the mentioned 1.2390 region, reinforcing the relevance of the support.

Support levels: 1.2390 1.2355 1.2320

Resistance levels: 1.2445 1.2480 1.2520

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.