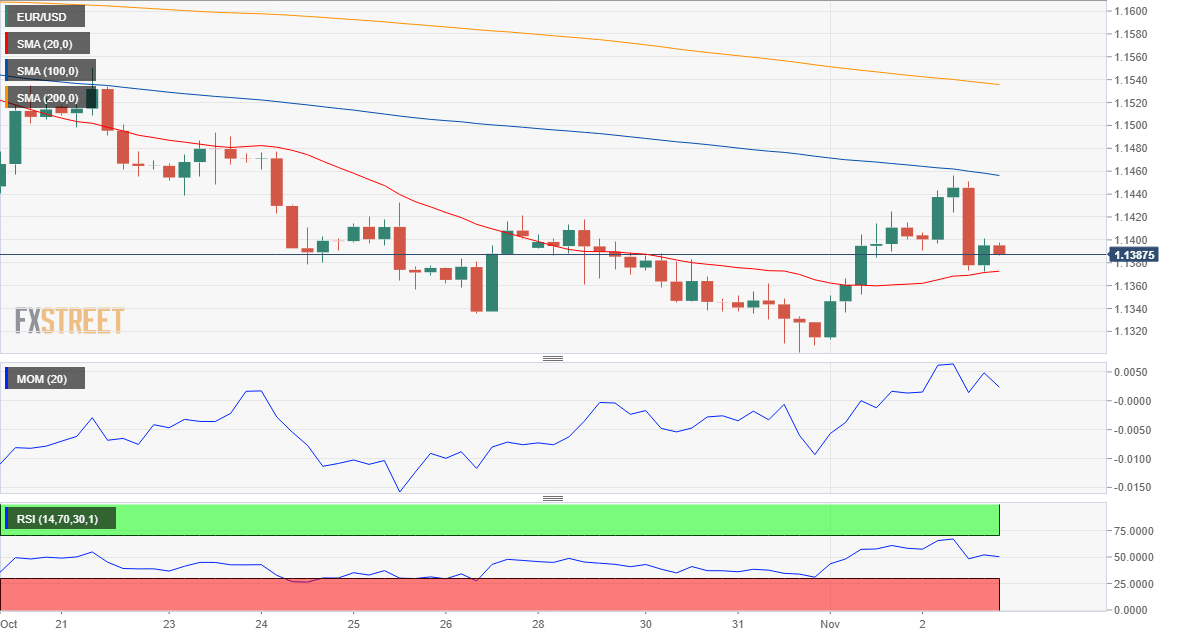

EUR/USD Current price: 1.1387

- US final Markit Services and Composite PMI seen matching preliminary estimates.

- Political headlines to keep overshadowing macroeconomic releases.

The EUR/USD pair hit a weekly high of 1.1455 on Friday but ended up giving up daily gains and closed at around 1.1385. Dollar's bearish stance amid risk appetite overshadowed the US Nonfarm Payroll report, which, despite posting solid figures, failed to give the dollar a relevant boost. According to the official release, the US economy added 250K new jobs in October, largely surpassing the 190K expected, although the September headline was downwardly revised to 118K from the previous estimate of 134K. The unemployment rate remained steady at 3.7%, while average hourly earnings were up 3.1% YoY, above 3.0% for the first time in over nine years. Solid wages' growth was already expected, offsetting the effect of the strong number. The EUR/USD pair eased from such high on the back of profit-taking ahead of the weekend, with the decline exacerbated by reports indicating that the ECB will consider fresh TLTRO buying in its December meeting, as a result of banks needing fresh funds.

Markit Manufacturing PMI for the EU and the US were a miss, and this Monday, the US will see the publication of the final Services index for October, expected at 54.7 as previously estimated, while the Composite index is expected also unchanged at 54.8. The EU won't offer anything relevant.

The daily chart for the EUR/USD pair shows that the pair is developing below all of its moving averages, with strong selling interest aligned around the shorter one, rejecting the advance. Technical indicators have resumed their declines well into negative territory after correcting oversold conditions, keeping the risk skewed to the downside. The chart also shows that the pair failed to sustain gains above the 23.6% retracement of the September/October decline at 1.1420, another sign that the upward potential is limited despite greenback's sell-off these last few days. In the 4 hours chart, the pair retreated from a bearish 100 SMA but settled above a now flat 20 SMA, while technical indicators held within positive ground, aiming higher but far from their daily highs. Renewed buying interest beyond the 1.1420 price zone could see the pair extending its advance beyond the mentioned high, while below 1.1360, the pair will likely spend the upcoming sessions in the red.

Support levels: 1.1360 1.1330 1.1300

Resistance levels: 1.1420 1.1455 1.1490

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.