EUR/USD Current price: 1.1387

- Soft US employment data weighed on the greenback.

- US Nonfarm Payroll report expected to show that the economy added 205K jobs last month.

Multiple US employment reports, which came in below the market's expectations, weighed on the American currency this Thursday, although escalating trade concerns limited its decline against European currencies, with risk aversion dominating the scene. Stocks were in free-fall all through the different sessions after Canada arrested Huawei CFO for extradition to the US, exacerbating tensions between China and the US. Government bond yields dropped, with the yield of the 10-year Treasury note breaking below 2.90%, while oil resumed its decline with the back and forth around future output cuts. Fear ruled.

US employment data, relevant ahead of the Nonfarm Payroll report to be out this Friday was overall disappointing, with the only positive number being the November Challenger Job Cuts, which showed that the number of planned layoffs totaled 53,073, below the previous 75K. The ADP survey for the same month showed that the private sector added 179K, below the expected 195K. Initial Jobless Claims for the week ended November 30 were up to 231K, while the Unit Labor Cost rose by just 0.9% in Q3. Nonfarm Productivity in the three months to September came in as expected at 2.3. Better-than-expected services index did little to calm the mood. The week will end on a high note, with the EU releasing Q3 GDP and the US the Nonfarm Payroll report. The US economy is expected to have added last month 205K new jobs, while the unemployment rate is seen steady at 3.7%. Wages are foreseen up by 3.1% YoY.

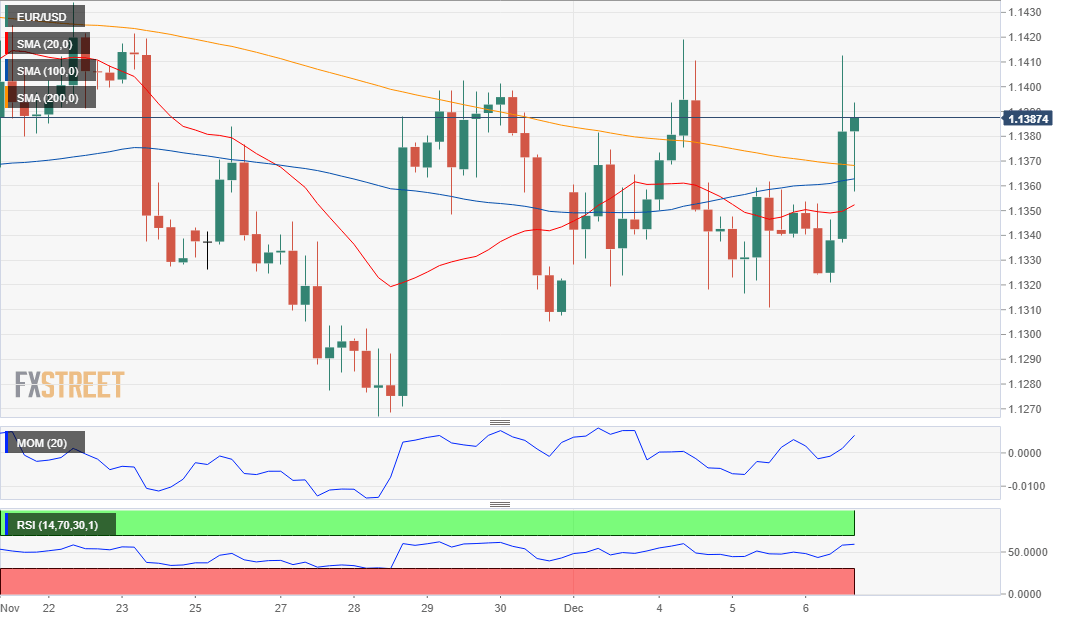

The EUR/USD pair hit a daily high of 1.1412 but retreated to the 1.1380 price zone, where it stands ahead of the Asian opening. The peak stalled below the weekly high of 1.1418, as investors are unwilling to push it outside its recent range ahead of key data and due to the ruling political uncertainty. Having been ranging for over a week, the short-term picture for the EUR/USD pair is neutral, according to technical readings in the 4 hours chart, as the Momentum indicator heads modestly higher below its 100 level while the RSI consolidates above its mid-line, rather reflecting price action than indicating certain directional strength. In the same chart, the price settled a handful of pips above a congestion of directionless moving averages, leaning the risk toward the upside. Still, the pair would need to clearly break above the 1.1420/30 region to be able to attract more buying interest.

Support levels: 1.1350 1.1315 1.1290

Resistance levels: 1.1425 1.1460 1.1500

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.