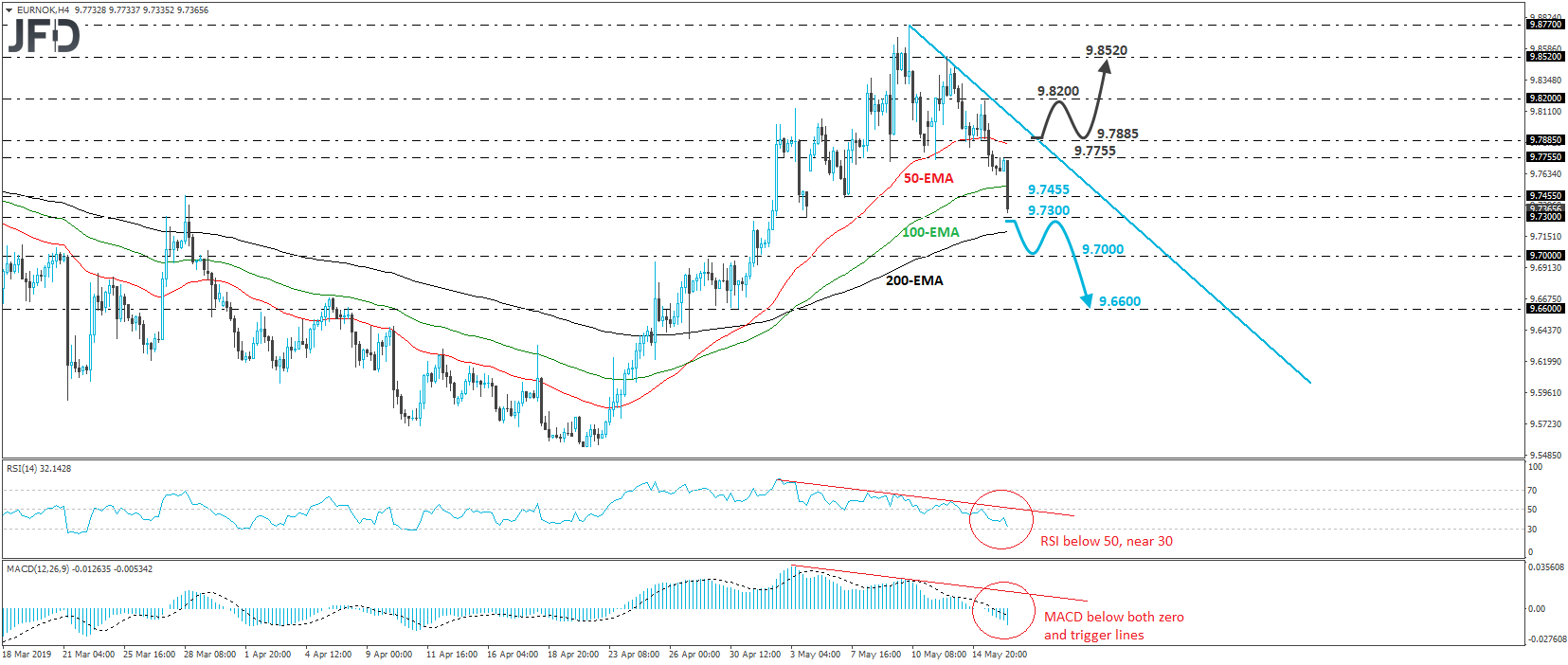

EUR/NOK came under strong selling interest during the European morning Thursday, after it hit resistance near the 9.7755 barrier. After it peaked on May 10th, this pair has been printing lower peaks and lower troughs below a new downside resistance line and thus, we would consider the short-term picture to have turned negative.

At the time of writing, the rate looks to be heading towards the 9.7300 support, defined by the low of May 3rd, which if broken may encourage the bears to drive the battle towards the psychological zone of 9.7000 fractionally above the inside swing highs of April 29th and 30th. If that area fails to halt the slide, its break may set the stage for more downside extensions, perhaps towards the low of April 30th, at around 9.6600.

Both the RSI and the MACD detect strong downside momentum and corroborate the case for this exchange rate to continue drifting lower for a while more. The RSI has been in a sliding mode and could challenge its 30 line soon. The MACD lies below both its zero and trigger lines, pointing south as well.

On the upside, we would like to see a break above 9.7885 before we abandon the bearish case. This could bring the rate above the aforementioned downside line drawn from the high of May 10th and may allow the recovery to continue towards the high of May 15th, near 9.8200. Another break, above 9.8200, may encourage the bulls to put the 9.8520 resistance on their radars. That level stopped the rate from moving higher on May 13th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.