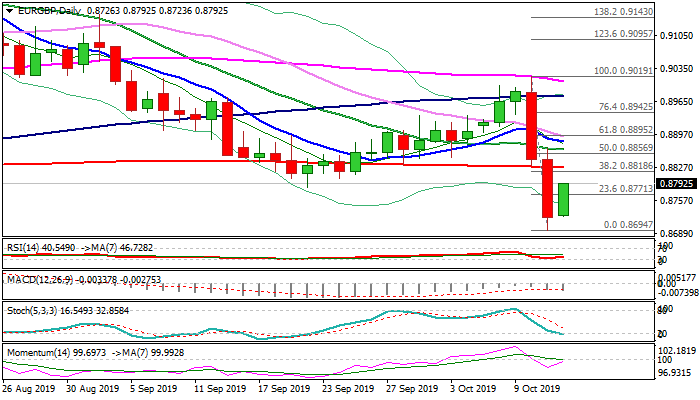

EUR/GBP

The cross bounces from new five-month low at 0.8694, posted after pound's strong advance last Thu/Fri, on rising Brexit optimism. Last week's strong fall (2.1%) failed to close below cracked weekly cloud base (0.8724) that signals bears may take a longer breather. Recovery approaches weekly cloud top (0.8792), break of which would spark further correction. Daily momentum and RSI turned north while stochastic enters oversold territory, supporting further recovery and test of strong barriers at 0.8818/27 (Fibo 38.2% of 0.9019/0.8694 / broken 200DMA). These barriers are key and should cap correction to keep larger bears intact for extension of downtrend from 0.9324 (2019 high, posted on 12 Aug). Strong optimism for reaching a deal for Brexit keeps sterling underpinned and supports this scenario. Alternatively, firm break above 200DMA would put bears on hold for extended recovery towards next pivotal barriers tat 0.8864/95 zone (20/10DMA's/Fibo 61.8% of 0.9019/0.8694 bear-leg).

Res: 0.8818; 0.8827; 0.8864; 0.8880

Sup: 0.8771; 0.8723; 0.8694; 0.8686

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.