EUR/GBP

The EURGBP rose in early European trading on Tuesday, regaining strength after last Thu/Fri drop on dovish ECB.

Brexit tensions and delay to end Covid restrictions for another one month, due to rising numbers of rising number of new cases of Delta variant, increased pressure on sterling.

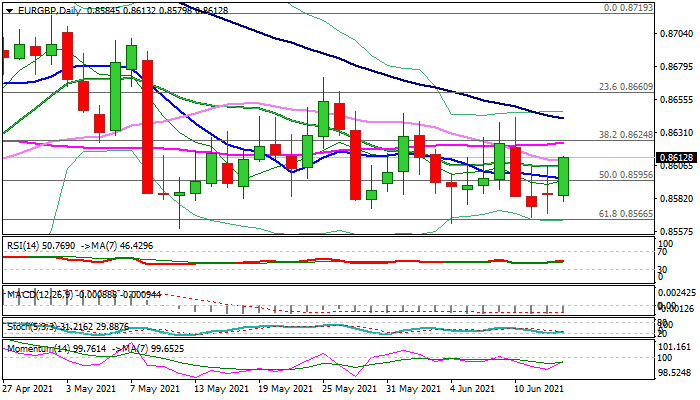

Fresh bounce add signals of basing after the action in past one month repeatedly failed to clearly break important support at 0.8566 (Fibo 61.8% of 0.8472/0.8719) and signal bearish continuation.

Return into daily cloud (spanned between 0.8595 and 0.8623) eases pressure, but fresh bulls need sustained breakthrough pivotal barriers at 0.8623/30 (daily cloud top / Fibo 61.8% of 0.8671/0.8563 bear-leg) to neutralize downside risk and signal stronger recovery.

Conversely, bears would tighten grip on repeated close below daily cloud base.

Res: 0.8623; 0.8630; 0.8646; 0.8661.

Sup: 0.8595; 0.8579; 0.8566; 0.8530.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.