EU and UK Services PMI

Today we have the EU and UK Service PMI numbers coming out with a 30-minute difference. The European Services PMI is expected to stay the same at 55, where the UK’s figure is forecast to slightly diminish by half a point. It is expected that the new figure could go down from 54.5 to 54. The previous month’s figure of 54.5 was a good rise from January’s 53 mark, even though the expectations then were that the Services PMI could only rise to 53.3. Certainly, the number must still pick up the pace, in order to get back to the highs of Autumn 2013. UK’s Services PMI accounts for around 80% of the country’s economic output, hence why it is so heavily monitored by economists and traders.

Germany, Sweden, Ireland, Spain and France are also joining the group of those, whose Service PMI figures will be out today, during the morning of the European trading session.

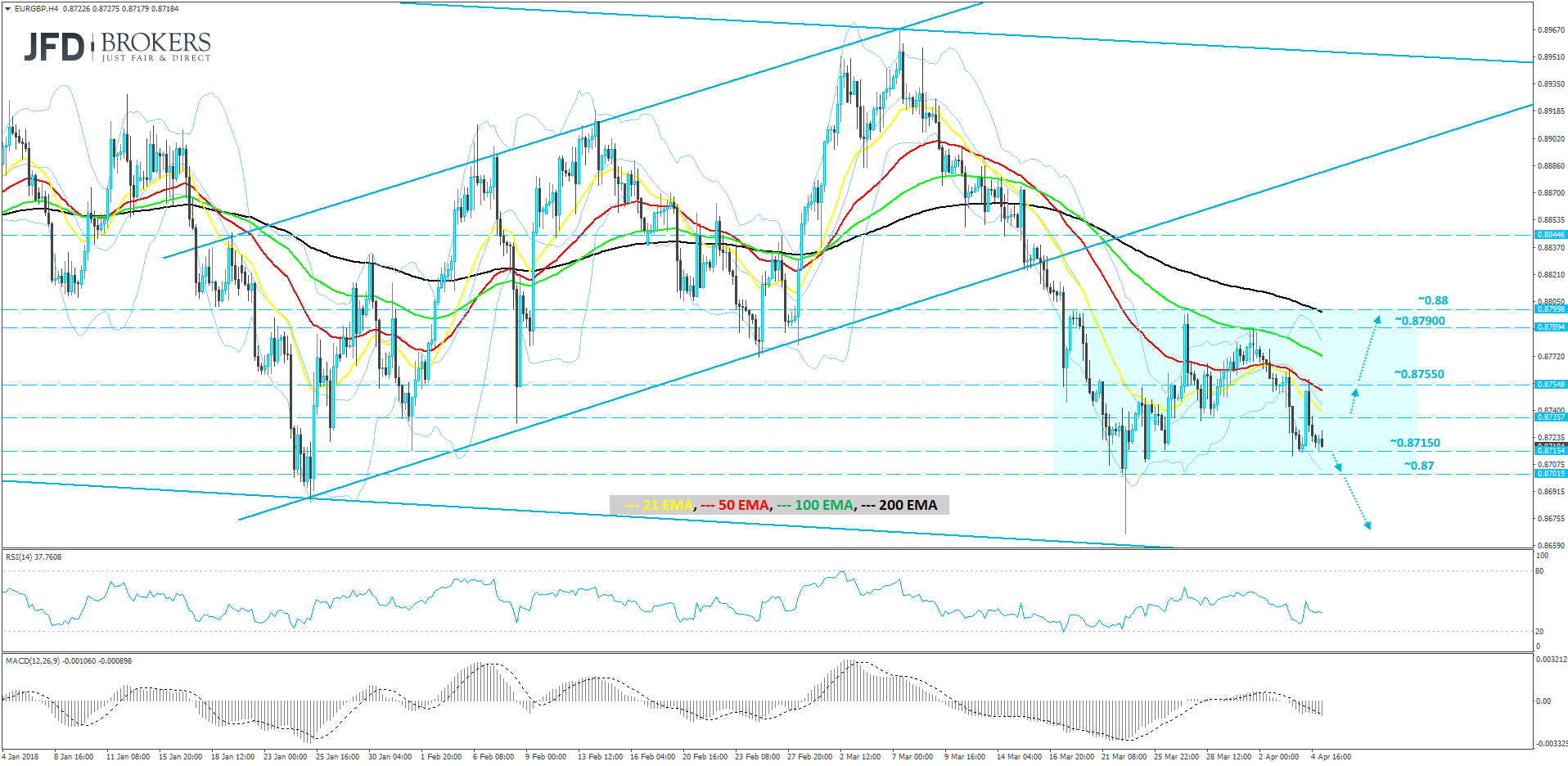

EUR/GBP – Technical Outlook

The EUR/GBP had a choppy session yesterday, potentially stopping out traders from their positions. We can see that for now, the pair is struggling to break below the 0.87150 level, which is acting as a strong support. Overall, the EUR/GBP is still within a downwards moving channel, but recently, it looks like the pair started to form a range between approximately 0.87 and 0.88.

EUR/GBP is creating some interest with a potential range formation. If this sideways price action continues for quite a while, then the potential to trade a breakout becomes quite significant. We are neutral on this pair for now, but we are keeping a close eye on the potential breaking points outside of the aforementioned range.

If we see a break below the current support level of 0.87150, then we could potentially see a slight pull towards the 0.87 mark, which would be the bottom side of the range. A break below, could trigger some further selling activity, that could push the price towards the bottom side of the long-term downwards moving channel, that started around the 26th of September last year.

Alternatively, a move back up to the 0.87550 level could mean that the bulls are not ready to give up on this pair. A break above that level could open the path towards the 0.87900 or even the 0.88 areas. If these levels of resistance prove not to be strong enough to withhold the price from accelerating, then we might see a break outside of the aforementioned range and move higher.

Are you interested in institutional-grade research? Sign up for our Weekly Strategic Report HERE – it’s free!

You want more? Visit our Research Website HERE, or subscribe to our JFD YouTube Channel HERE.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.