We would be lying if we said we were prepared for what transpired overnight.

While most Americans were sleeping, the European Union leaders (specifically Mario Draghi) hinted at further stimulus to keep their economy running. Ironically, global equity markets took this sign of weakness in fundamentals as a buying signal. Equities across the pond and domestic stock index futures rallied sharply on the news. Further, bond prices around the world spiked higher pushing interest rates even lower.

We are optimists who love seeing the stock market gain in value, but when markets rally on bad news it should raise an eyebrow. Further, price action in the bond market is anything but optimistic. Something has to give (and we think it will be the bond market).

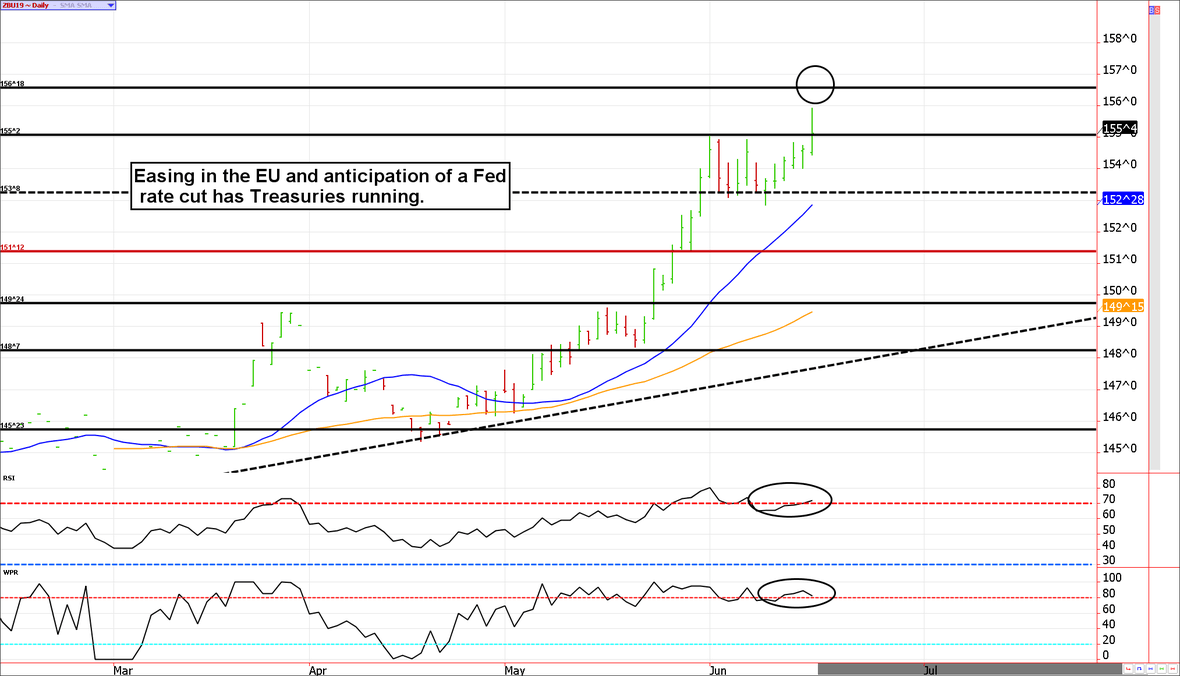

Treasury Futures Markets

We are surprised at the resiliency in the Treasury market (as well as short-term interest rate products such as the eurodollar).

While we understand the desire for overseas investors to put money to work in higher-yielding and lower risk instruments such as US Treasuries. We are likely nearing the point in which interest rate and currency risk will outweigh the benefits. In our view, the odds of interest rates remaining this low in the long run are bleak. Thus, anybody buying into fixed-income securities at these levels could pay a price.

Additionally, the US dollar is high and despite not showing any signs of weakness the world has rarely seen a dollar index much higher than it is now for any long period of time. For clarity, we have been higher but the index generally stays below 100 and we are currently in the 97.00 area.

An overdue correction in either of these markets could leave overseas investors running for the exit.

As of late, Treasuries have outperformed our wildest expectations, but sometimes markets are messy. We can't rule out another probe higher on the Fed announcement, but the path of least resistance should eventually be lower.

Treasury futures market consensus:

Resistance in the mid-to-high-156'0s should hold for now.

Technical Support:ZB : 151'12, 149'24, 148'07 AND 145'23 ZN: 125'23, 125'01, 124'10, AND 123'07

Technical Resistance:ZB: 155'04 AND 156'15 ZN: 127'18 AND 128'03

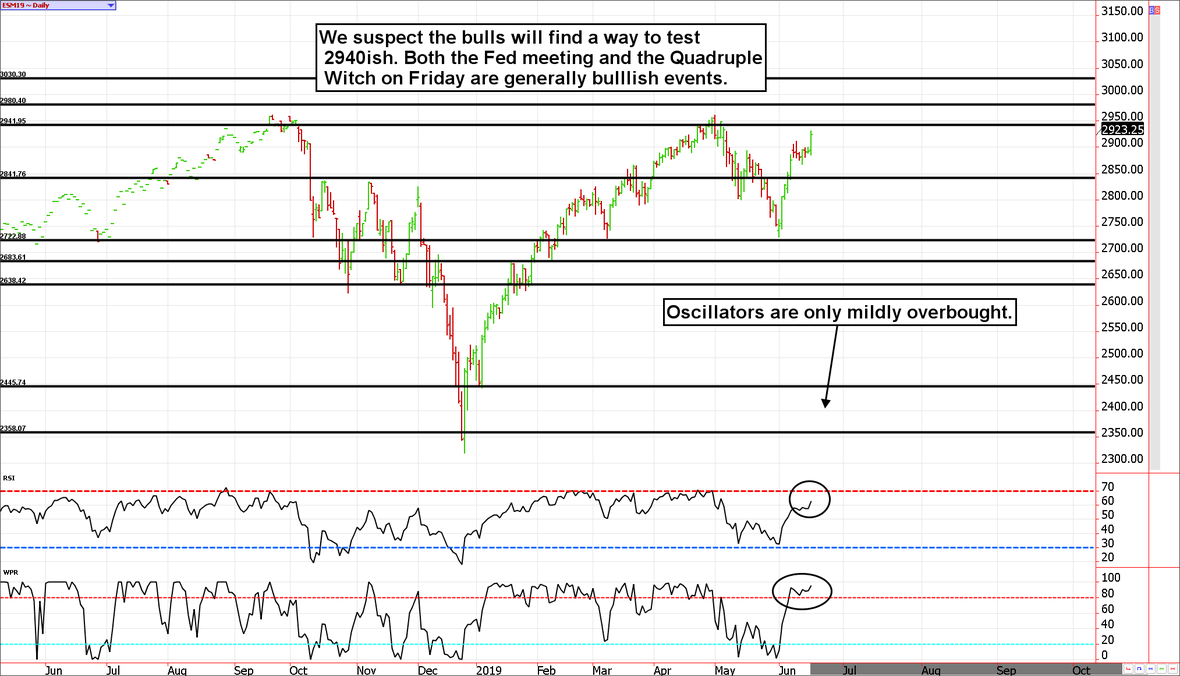

Stock Index Futures

When the ES lingers, the shorts suffer.

The ES traded sideways for far too long creating an environment of nervous bears and plenty of buy stops to fuel the rally. There is a reason "they" say "never sell a quiet market". Today is an example of why.

It is hard to fight the Fed; tomorrow we will know if that will even be an issue. The Federal Reserve isn't expected to do anything, but traders will want to know if they plan on cutting rates later this year.

Because the equity markets are planning on rate cuts, We could see some sharp selling come in if the Fed doesn't confirm such a plan.

Stock index futures market consensus:

If the Fed doesn't deliver with promises of a rate cut, the market might throw a tantrum.

Technical Support:2840/2830, 2722/2718, 2638, 2445, and 2358

Technical Resistance:2940, 2979, 3000, and 3032 E-mini S&P Futures Day Trading Ideas

These are counter-trend entry ideas, the more distant the level the more reliable but the less likely to get filled

ES Day Trade Sell Levels: 2940, 2962, and 2980

ES Day Trade Buy Levels: 2904 (minor), 2881, 2872, 2850, and 2832

In other commodity futures and options markets...

September 12 - Roll the September Bloomberg Commodity Index into the December contract.

December 13 - Roll the December Bloomberg Commodity Index into March.

February 21 - Exit half of the Bloomberg Commodity Index futures position (we added on a dip in January).

May 29 - Buy July 10-year note 125.50 put for about 22 ticks.

May 31 - Sell diagonal call spreads in the 10-year note using the August 127 call and purchasing the July 128.50 call for insurance.

May 31 - Sell diagonal put spreads in oil using the August 46 put and July 45 put.

June 14 - Roll BCI into the September contract and double the quantity (to dollar cost average).

June 18 - Exit the crude oil put spread with a small loss.

Due to time constraints and our fiduciary duty to put clients first, the charts provided in this newsletter may not reflect the current session data.

Seasonality is already factored into current prices, any references to such does not indicate future market action.

There is substantial risk of loss in trading futures and options.

These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.

Due to the volatile nature of the futures markets some information and charts in this report may not be timely. There is substantial risk of loss in trading futures and options. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.