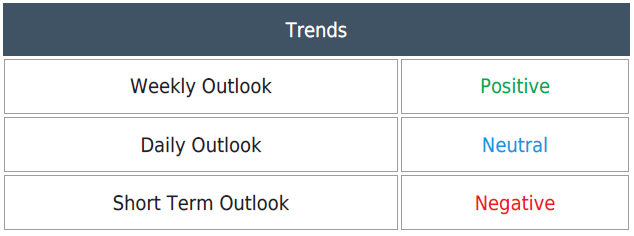

Emini Dow Jones – Nasdaq

Emini Dow Jones December bounce from the September low at 26420/400 topped exactly at the first target of 26800/850. We then collapsed again to very strong support at 26200/150.

Nasdaq we wrote: Gains are likely to be limited with resistance at 11370/420. Shorts need stops above 11480.

Shorts here worked perfectly on the collapse from 11457 to strong support at 11100/000 for 350 tick profit.

Daily Analysis

Emini Dow Jones breaks very strong support at 26200/150 to hit 25953. However we are very oversold & it is possible we bounce back so obviously watch the 26100/200 area. Holding above here puts bulls back in control targeting 26400/450 & resistance at 26700/800.

A break above here is a buy signal in targeting 27000/100. A break below 25950 however keeps bears in control, despite oversold conditions targeting 25880 & 25750/700, perhaps as far as 25550/500.

Nasdaq tests very strong support at 11100/000 in oversold conditions. A break lower meets a buying opportunity at the 2 year trend line 10800/750.

Longs need stops below 10650. A weekly close below here is an important longer term sell signal. Longs at very strong support at 11100/000 need to see prices back above 11200 which then opens the door to 11300/350. A break above 11400 is a buy signal targeting 11500/550.

Chart

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery gains above 1.0650

EUR/USD stays in a consolidation phase following Wednesday's rebound and trades in a narrow range above 1.0650. The improving risk mood doesn't allow the US Dollar to gather strength as markets await mid-tier data releases.

GBP/USD clings to moderate gains above 1.2450

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside retreating US Treasury bond yields. Fed policymakers will speak later in the day.

Gold shines amid fears of fresh escalation in Middle East tensions

Gold trades in positive territory near $2,380 on Thursday after posting losses on Wednesday. The precious metal holds gains amid fears over tensions in the Middle East further escalating, with Israel responding to Iran's attack over the weekend.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.