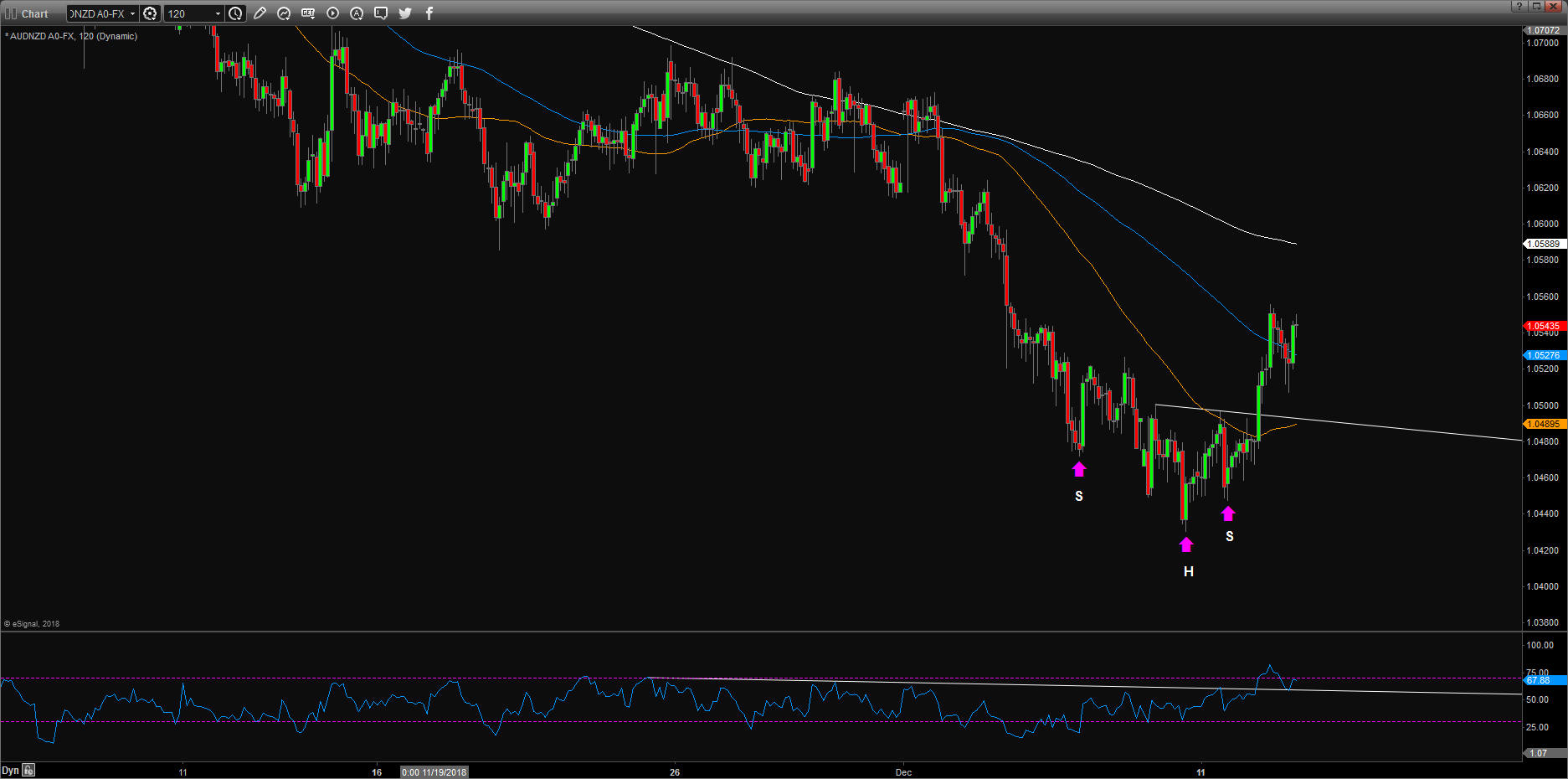

AUDNZD closed above the necklace of a potential inverse head-shoulder bottom.

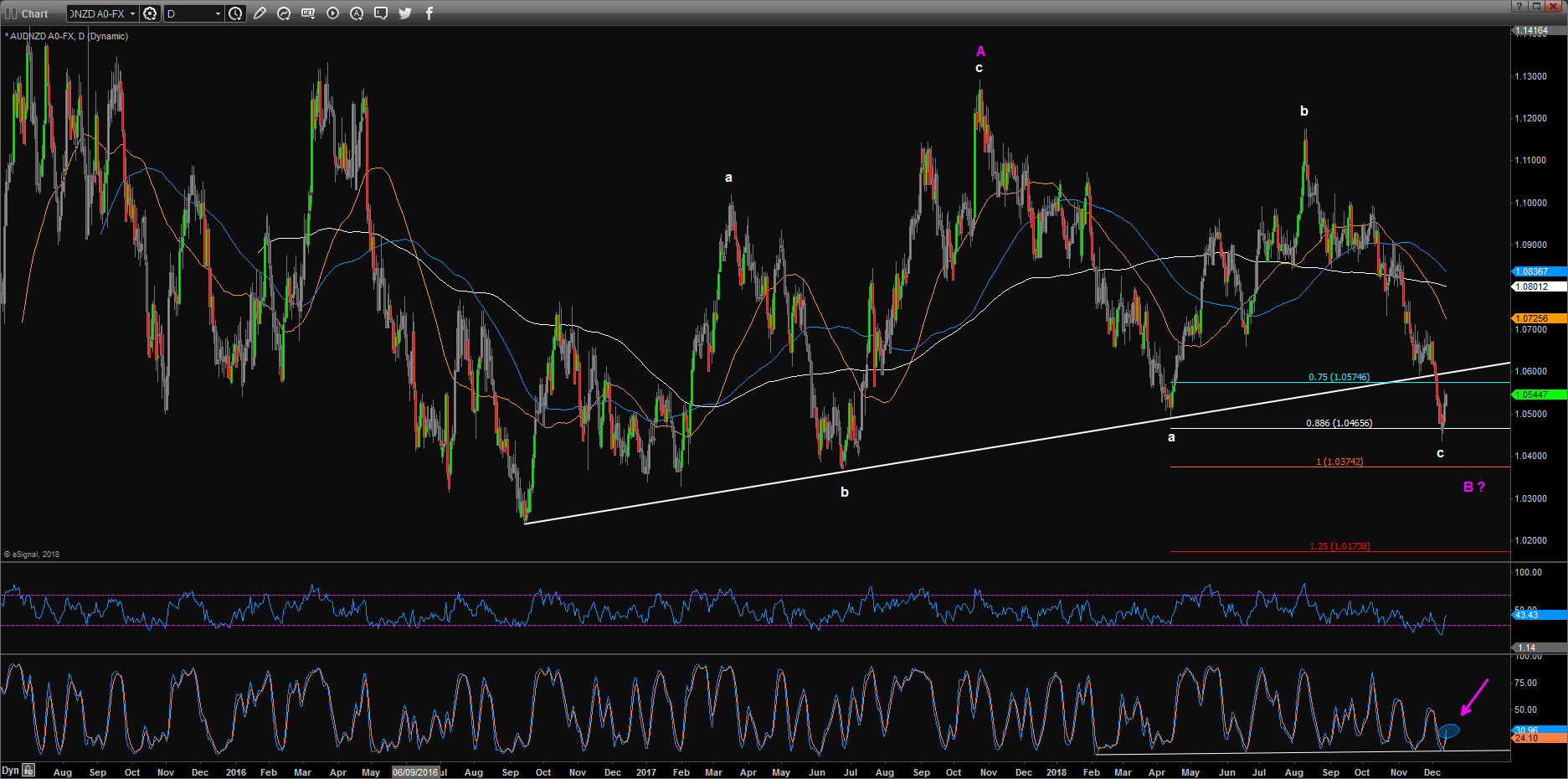

Daily oscillators are cross-over from their range lows.

For now we could use 1.0528-1.0496 as a pivot zone.

Holding above here, further upside toward 1.0617 is very likely.

Daily close back below 1.0528/1.0496, directly bearish toward 1.0373 could not be ruled out.

We still hold the long position from 1.0468, move stop from 1.0350 to the entry.

For sure you could partial close here, then the trade is overall risk free.

If seen, look to add on dips toward 1.0510.

AUDNZD Trade Idea: (Spot 1.0543)

Buy LImit @ 1.0510 SL 1.0420 Take Profit @ 1.0610

Click on the image to enlarge

We provide Daily FX Report, Trade Copy, Email Alert and MT4 EA Rental. Free trial and 30 Days Money Back policy will be valid forever! All the services could be Free

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.9% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.