It was an interesting week that ended pretty much in a stalemate. Price first rallied for a few day to test the 61.8% retracement level of the most recent decline, and it repeatedly failed to close above it. This led to a strong rebound towards the downside where the market made a new low, but just barely.

Right now our reasons for favoring the bearish view haven’t changed and are still as strong as they were last week. However, any impulsive rally at this point will provide compelling reason for abandoning our medium-term bearish view and moving to our alternate daily count.

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

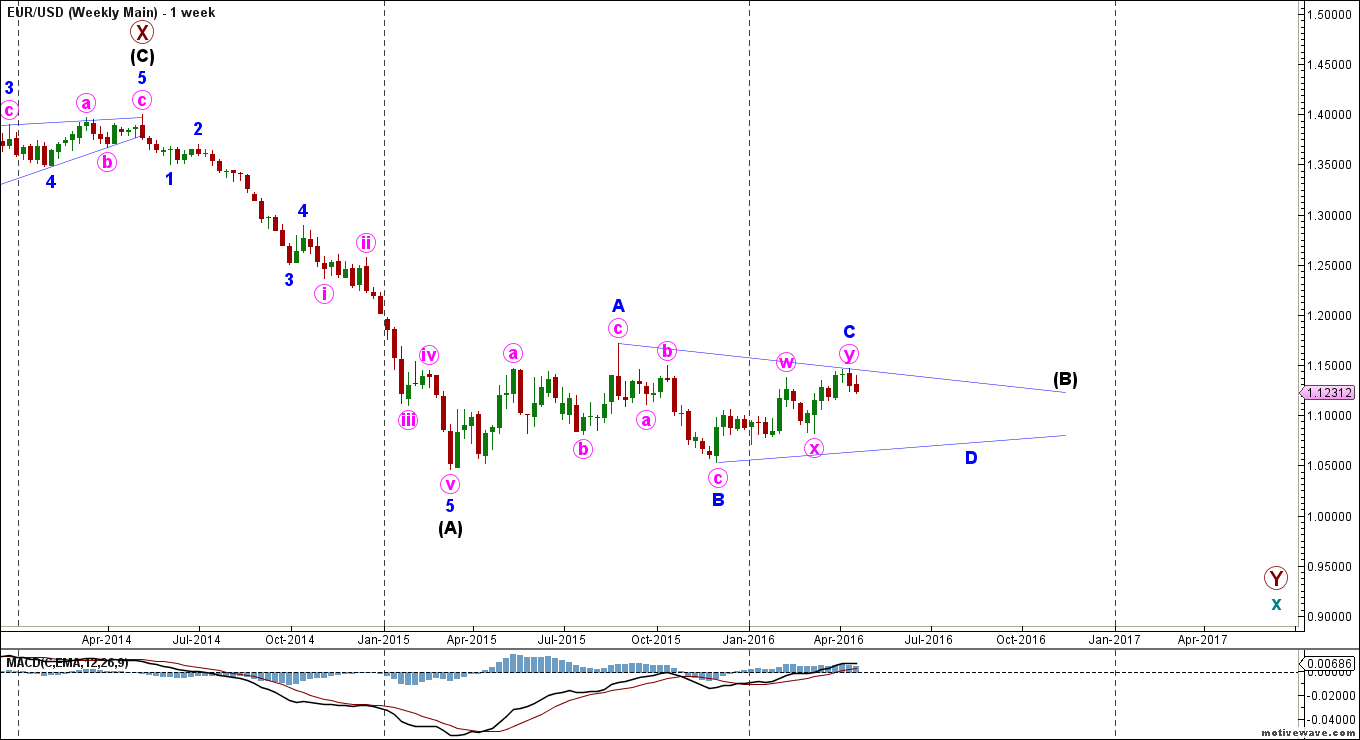

Weekly Main Count

– Invalidation Point: 1.1465 – 1.0525

– Confirmation Point: –

– Downwards Target: 1.0885 – 1.0727

– Wave number: Minor D

– Wave structure: Corrective

– Wave pattern: Zigzag

Weekly Alternate Count

– Invalidation Point: 1.1718 – 1.0821

– Confirmation Point: 1.1465

– Upwards Target: 1.1616 – 1.1673

– Wave number: Minor C

– Wave structure: Corrective

– Wave pattern: Double Zigzag

Big Picture

The bigger picture sees that the euro is moving towards the downside in teal wave x, which is forming a double zigzag labeled maroon waves W, X and Y.

Maroon wave Y is forming a zigzag labeled black waves (A), (B) and (C).

Black wave (A) formed an impulse labeled blue waves 1 through 5.

Black wave (B) is forming a contracting triangle labeled blue waves A through E.

Main Weekly Wave Count

_20160425224435.png)

This main count sees that blue wave C formed a double zigzag labeled pink waves w, x and y. It retraced exactly 78.6% of blue wave B.

Within it, pink wave y formed a zigzag labeled green waves (a), (b) and (c).

This count expects the euro to move towards the downside in blue wave D, which is likely forming a zigzag labeled pink waves a, b and c.

The MACD indicator supports this count by showing a clear bearish divergence between the highs of pink waves w and y, as well as a bearish crossover.

At 1.0886 blue wave D would retrace 61.8% of blue wave C, then at 1.0727 it would reach 61.8% the length of blue wave B.

This wave count is invalidated by movement above 1.1465 as pink wave b of this zigzag may not move beyond the start of pink wave a. It’s also invalidated by movement below 1.0525 as blue wave D may not move beyond the start of blue wave C.

Alternate Weekly Wave Count

_20160425224451.png)

This alternate daily count sees that pink wave y of blue wave C is still unfolding as a zigzag labeled green waves (a), (b) and (c).

Within it, green wave (a) formed a leading diagonal labeled orange waves i through v.

Green wave (b) formed a zigzag labeled orange waves a, b and c, retracing exactly 38.2% of green wave (a) so far. It’s likely complete or near completion.

This count expects the euro to resume move towards the upside in green wave (c), to complete pink y, and therefore blue wave C. This will be confirmed by movement above 1.1465.

At 1.1616 green wave (c) would reach 61.8% the length of green wave (a), then at 1.1673 pink wave y would reach 100% the length of pink wave w.

This wave count is invalidated by movement above 1.1718 as blue wave C of this contracting triangle may not move beyond the start of blue wave B. It’s also invalidated by movement below 1.0821 as green wave (b) of this zigzag may not move beyond the start of green wave (a).

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.