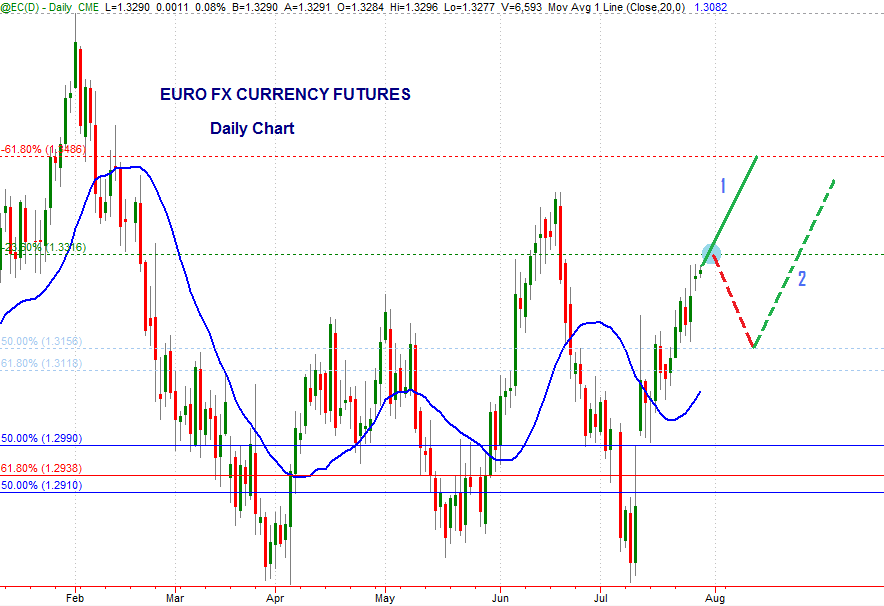

The market moved higher in the daily chart following traditional movements, modeled by our framework. The 1.3310 area is going to be 1st target for the long entry identified last week in the 1.2990 area. The second target of that long setup would be the 1.3480 area.

Picture: "Euro FX currency futures continuous contract daily timeframe, July 28th 2013"

I see two potential scenarios at the moment (refer to above picture):

Scenario 1. price of Euro could just continue higher into the 1.3480 area without pause. This is the preferred and most probable scenario.

Scenario 2. after reaching the 1.3310 area we could witness some profit taking bringing price at the the next support area starting at the 1.3160 area. There it is possible that a bounce could take place followed by a continuation higher.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.