US equities snapped higher after copycat declines in Asia after yesterday’s deep rout following “bear market” references by Gundlach. Sputtering global growth, external pressure on the Fed to halt rate hikes and ongoing trade/tariff concerns have continued to plague investors into year-end.

China’s Xi did not include any olive branches in his keynote speech. However unlikely, it is possible the Fed could relent with a pause into year-end and spark a Santa rally on stocks, but kowtowing to Trump and other critics could be a bitter pill.

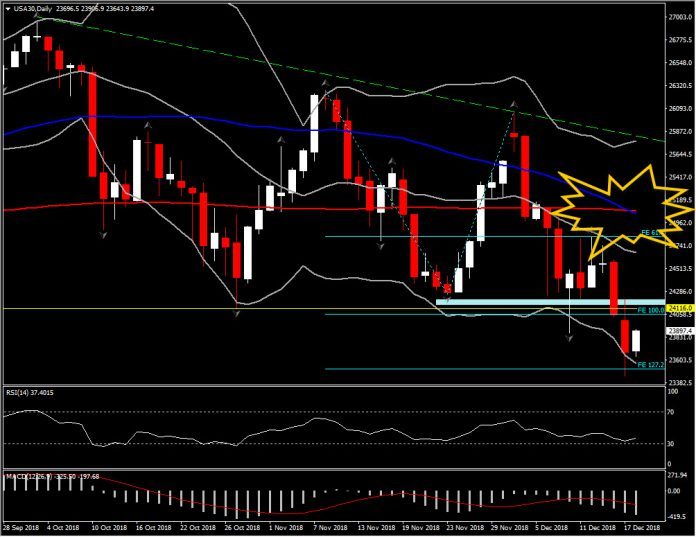

“Death crosses” of 50- and 200-day Moving Averages have been popping on the major US averages, with the USA30, buying a little more space at least in pre-open trade before breaching its 200-day MA of 25,081 vs 50-day m.a. of 25,103 as of yesterday’s close. The USA30 is 134-points higher, USA500 gained 14-points and USA100 is up 36-points after 2.0-2.2% declines Monday.

Despite the gain noticed so far today, the break of 2-month floor at 24,116, along with the formation of a Death Cross keeps the index remains in a bearish outlook. Currently, the asset is traded at 23,908, with immediate Resistance at FE100 from November’s reversal, at 24,050. Support is set to to the confluence of lower Bollinger bands and FE 127.2, at 23,510. Further losses could lead towards February’s lows at 23,200 .

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.