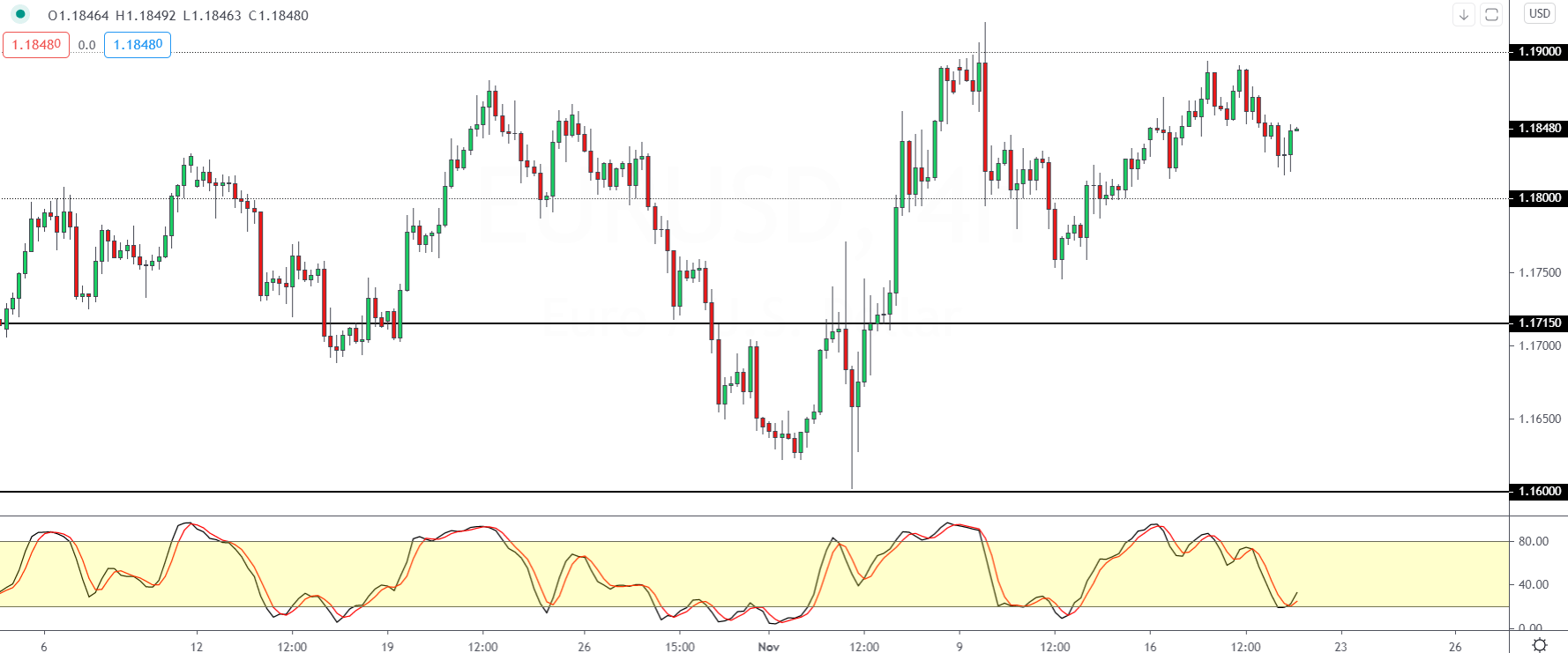

Euro Continues To Drift Lower

The euro currency is trading rather flat although the overall bias is to the downside.

Price fell to a three-day low before recovering from the lows near 1.1816.

On the 4-hour chart, the bullish reversal following the Doji pattern could signal some near term gains.

However, we expect any gains to stall near 1.1850 level in the near term. This could potentially cap the gains while keeping a downside bias in the euro currency.

To the downside, we expect the 1.1800 level to be tested in the near term in such a scenario.

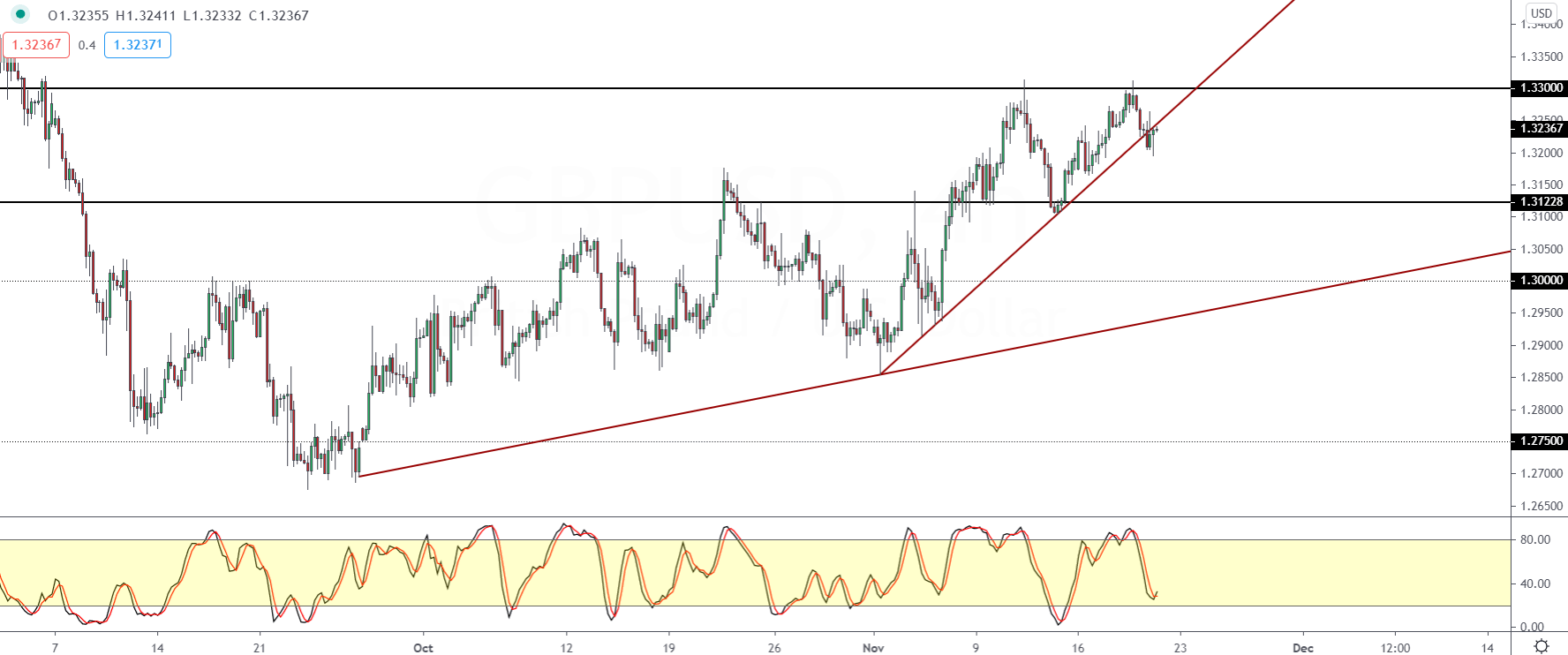

GBP/USD Breaks The Trend Line

The British pound sterling is trading weaker on the day following the break of the rising trend line.

This could now potentially accelerate the declines lower to the 1.3122 level of support.

But the Stochastics oscillator is currently oversold which could signal a rebound in prices.

Any upside gains will be likely stalling near the 1.3300 level of resistance which has held up so far.

Overall, the GBPUSD currency pair continues to remain in a sideways range between the 1.3300 and 1.3122 levels.

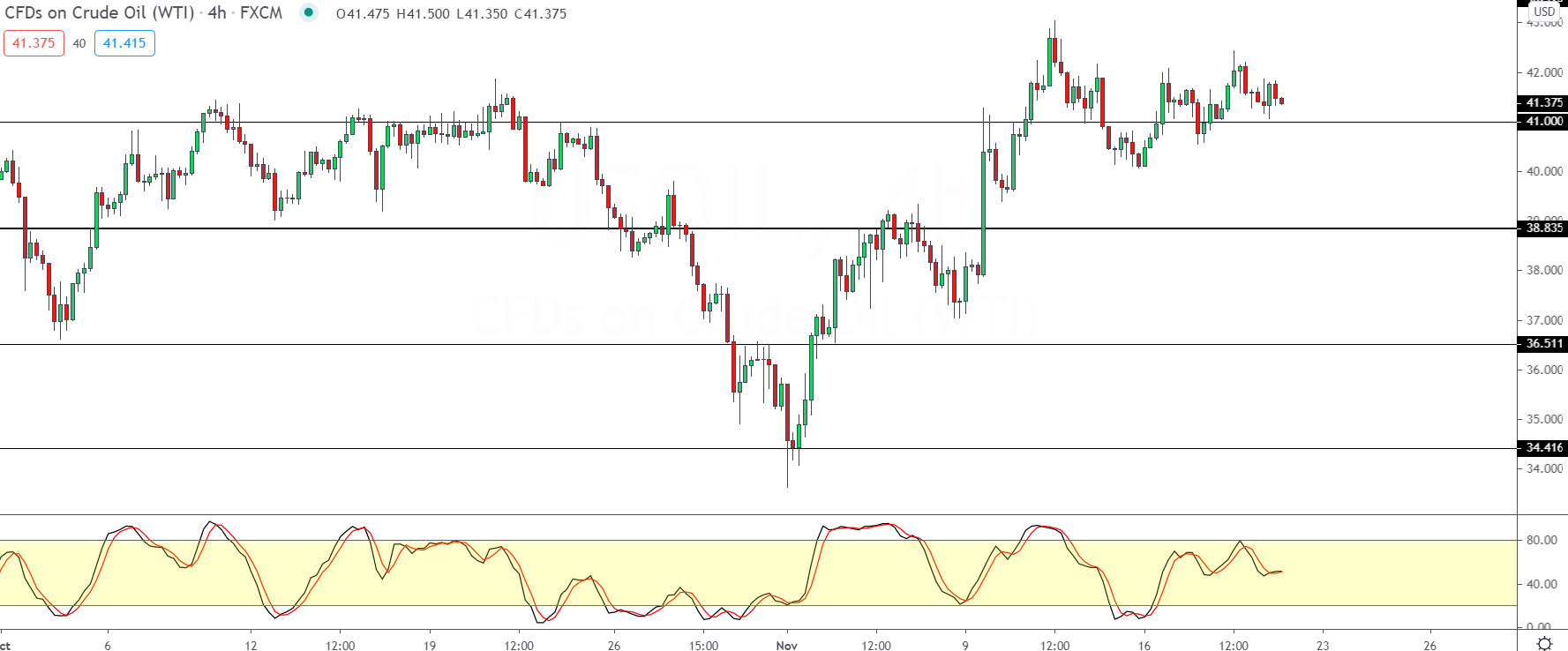

Oil Prices Give Back Gains

WTI Crude oil prices are trading weaker, giving back some of the gains from Wednesday.

Price action remains supported above the 41.00 level for the moment. However, as the momentum continues to point to the downside, we could expect to see declines if the support breaks.

This will potentially open the way for oil prices to slip back to the 38.83 level of support again.

Given that the support level here has not been tested firmly, we could expect a pullback within the larger uptrend since early November.

To the upside, it is likely to see oil prices making gains in the near term.

Gold Prices On Track For A Three-Day Losing Streak

The precious metal is trading lower as price action is on track for a three-day losing streak.

The declines come following the Doji pattern that emerged on the daily chart on Monday.

The continuation lower could see prices testing the 1850 level of support more firmly. This could potentially stall the declines for the moment.

However, if price breaks down below the 1850 handle, then we expect to see room for further correction.

To the upside, any rebound will stall near the 1900 level of resistance.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.