Market Overview

Between February and April the markets were hit by increased geopolitical tensions and concerns over trade wars. Having seemingly been put to bed, these tensions have resurfaced in recent days, leading to markets taking on more of a risk averse position. This has been exacerbated overnight as the US Department of Commerce will investigate automobiles imports into the US on a “national security” basis. On a general level this steps up the protectionist agenda again, but also has hit automobile stocks and indices in Asia overnight, with the automobile companies on the DAX sure to feel the heat today. Primarily this has also driven traders into safe haven assets. With bond yields falling, the US 10 year Treasury yield has dropped quickly below 3% again and in forex, that despite the dollar holding up relatively well as a safe haven, this meant a sharp move into the yen and Swiss franc. However, the dollar has subsequently come under pressure in the wake of the minutes for the May FOMC meeting, released last night. Minutes show that whilst the next rate hike will be “soon”, there is an acceptance on the FOMC for inflation running consistently above the 2% target for a “temporary period” over a 12 month basis. In consistently referencing the word “symmetric” this suggests that they are happy to allow inflation to run a little hot without turning too aggressive on monetary policy. This has gone to clarify to an extent the debate over what “symmetric” means for monetary policy and is a dovish tilt to the minutes which has tempered the dollar gains.

Wall Street was pulled around yesterday with the initial selling over the safe haven bias subsequently supported by the dovish Fed minutes. The S&P 500 closed 0.3% higher at 2733 but the futures are ticking lower today and with the prospect of automobile imports being targeted by Trump’s administration, Asian markets have been hit (Nikkei -1.1%). European markets seem cautious around the open and are mixed in early moves. In forex, the dollar is underperforming this morning, with the yen once more the standout performer. Sterling is also mildly stronger ahead of another key tier one data announcement with retail sales in focus. In commodities the weaker dollar is helping to pull gold higher by $2 whilst it is interesting to see oil is falling back again after yesterday’s decline which was assisted by the surprise EIA crude inventory build.

Key UK data is once more in focus today with UK Retail Sales (ex-fuel) announced at 0930BST which is expected to grow by +0.4% for the month but on a 12 month basis this would be growth of just +0.1% (+1.1% last month). This would be another indicator that reflects the worrying slowdown in the UK economy of Q1 is showing little sign of picking up in April. The ECB monetary policy accounts (i.e. the minutes) are released at 1230BST and as ever, we look for hints at the potential for a move towards withdrawing the asset purchase programme. US Weekly Jobless Claims are at 1330BST and are expected to show again a similar number to last week with 220,000 (222,000 previous), whilst the US Existing Home Sales are due at 1500BST and are forecast to show a slight drop to 5.57m (5.60m last month).

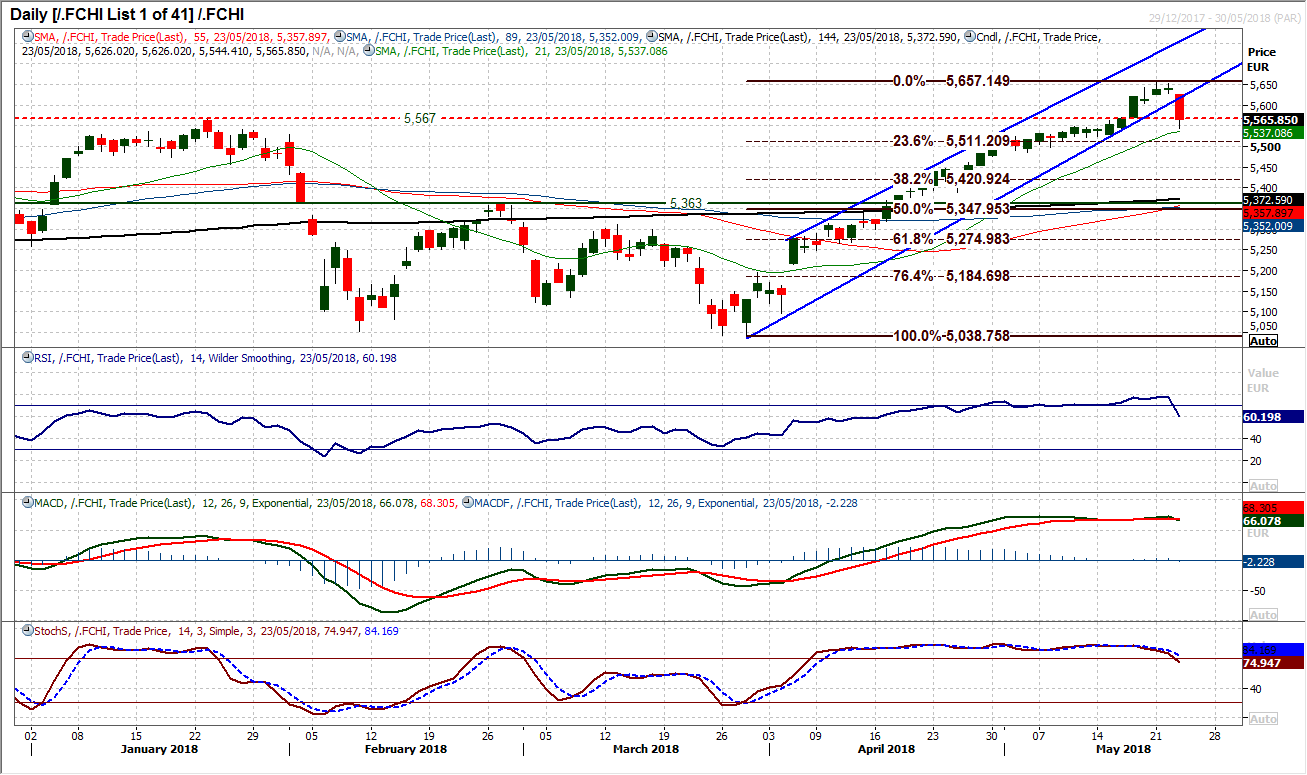

Chart of the Day – French CAC 40

European equity markets had a terrible session yesterday, coming under consistent selling pressure. The most interesting technical move of the major markets was on the French CAC 40. Which posted the biggest down session since the market recovery began back in late March. The move also decisively broke its uptrend channel but also retreated to break below the old breakout level of 5567 which should have been the first basis of support. The move now comes with the RSI dropping to a five week low and posting a basic RSI sell signal (a cross back below 70). However also watch the MACD lines which are crossing lower and the Stochastics which are now close to a confirmed sell signal. The last two sell signals on the Stochastics came after a period of buying pressure ended with sharp moves lower. The correction which has left a key high now at 5657 is now building whilst the 23.6% Fibonacci retracement of 5038/5657 comes in at 5511 and is the initial target. The hourly momentum indicators have become more correctively configured and the bulls may now struggle. There is resistance initially at 5582 and then at 5604.

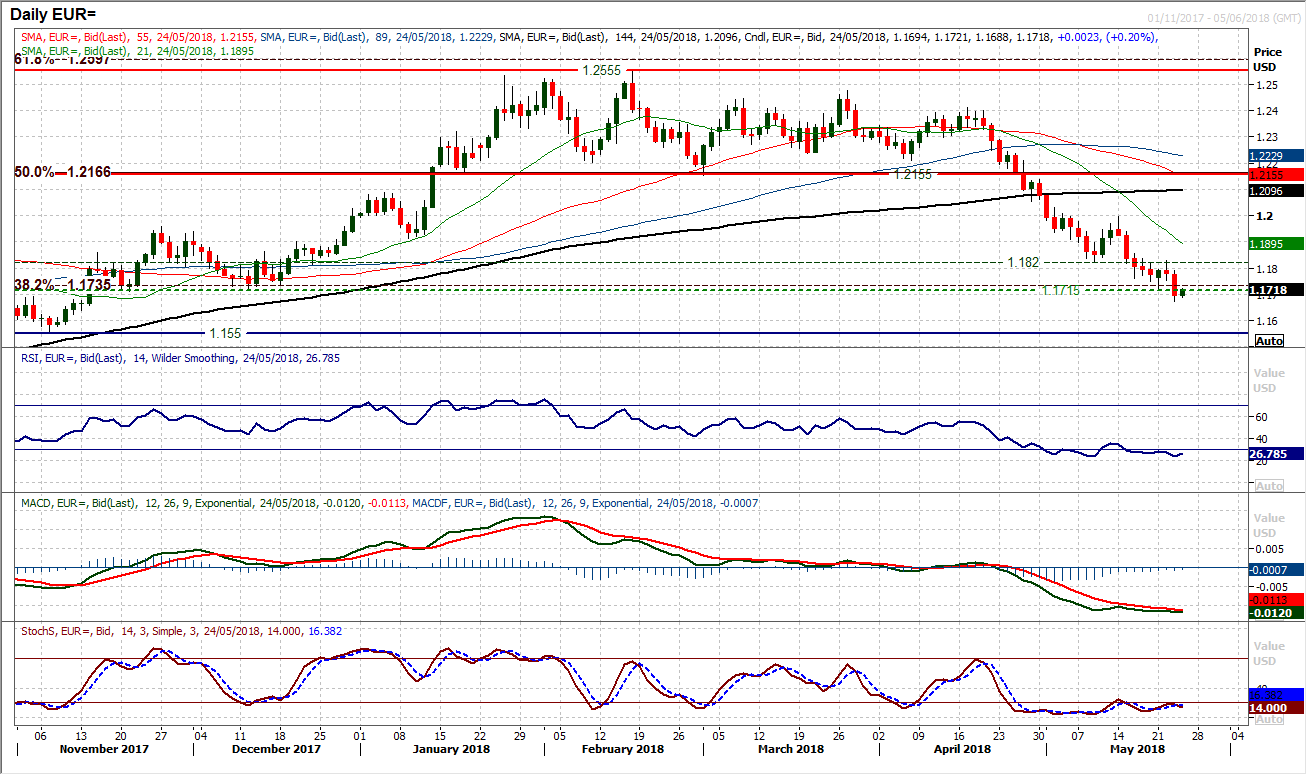

EUR/USD

The euro remains under pressure as the market continues to use rallies as a chance to sell. Another strong bearish candle formed yesterday to breach the support of the December low at $1.1715 and now there is little support of any significance until the key November low at $1.1550. Momentum indicators remain negatively configured with the RSI falling back into the mid-20s, MACD lines still falling and Stochastics still in bearish configuration. The hourly chart shows that intraday rallies are a chance to sell, with resistance $1.1715/$1.1760 as a near term sell zone today. Any rebound that brings the RSI into 50/60 and MACD lines towards neutral also helps to renew downside potential. Key resistance is building between $1.1820/$1.1855.

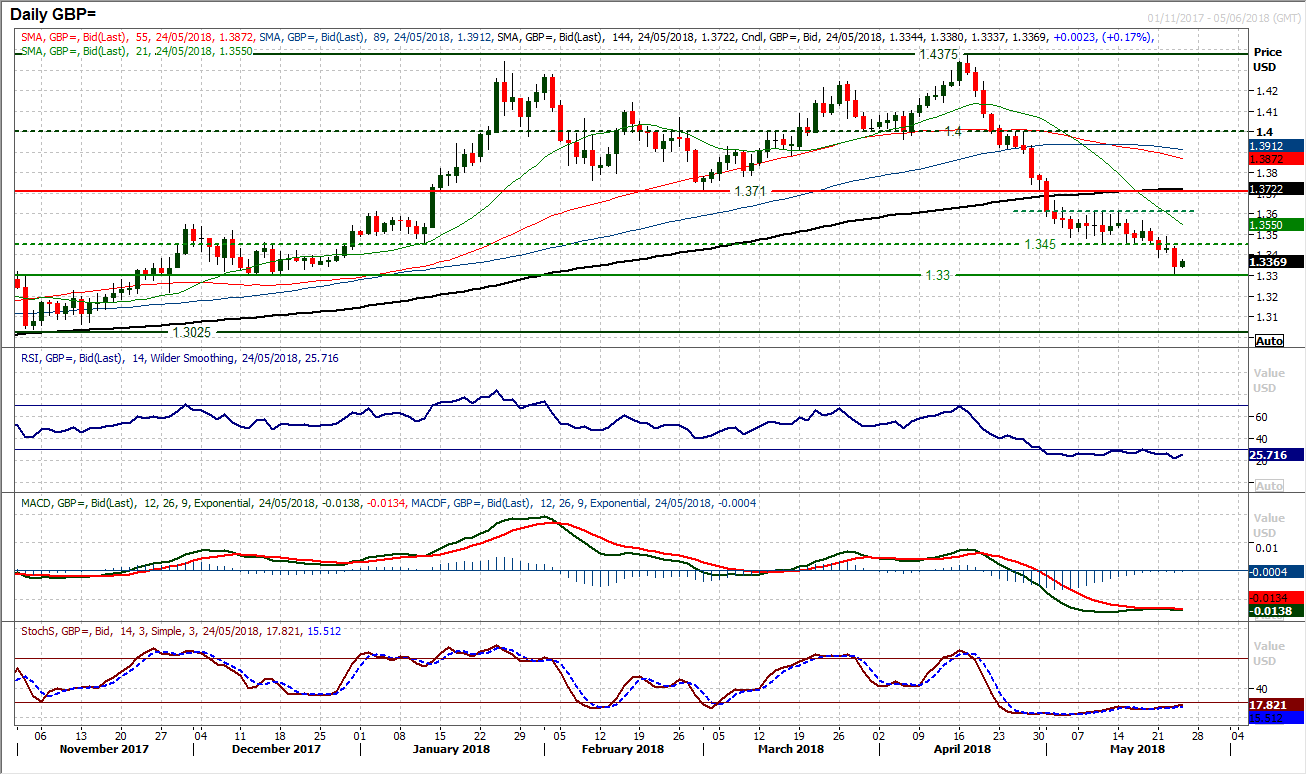

GBP/USD

The key December low at $1.3300 was tested during the latest strong bearish candle on Cable. Whilst the support has so far remained intact, the strength of the selling pressure remains and rallies are being used as a chance to sell. There has been an initial rebound this morning but the weight of overhead supply is likely to restrict any decisive rebound. The previous support of $1.3450 is now the start of a band of resistance. The hourly chart shows this rebound is unwinding hourly momentum indicators to an area where the sellers have tended to resume control, with the RSI into the 50/60 region, whilst the MACD lines have struggled around neutral. There is initial resistance at $1.3390 but there is a more considerable band $1.3450/$1.3490 now. There is little to suggest that the $1.3300 support will not again be tested, and below there the market opens $1.3220 and then the crucial low at $1.3025.

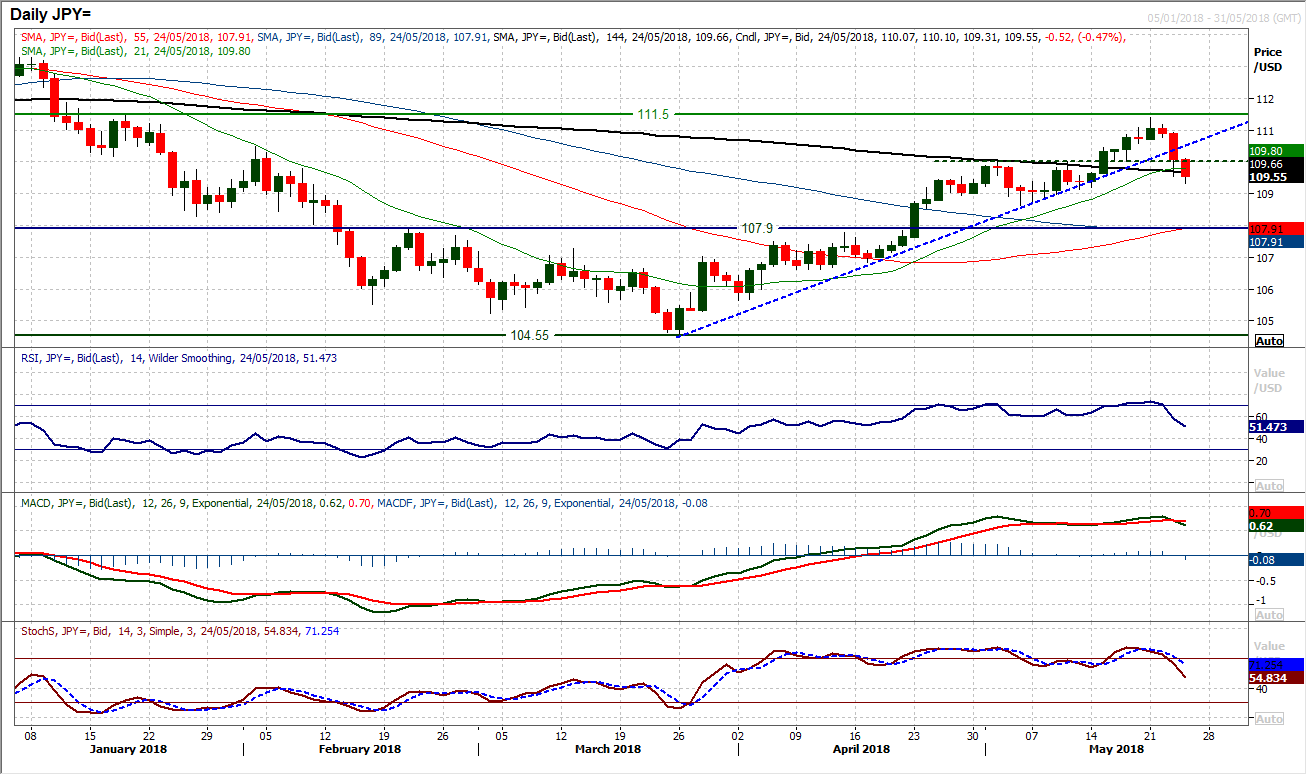

USD/JPY

A dramatic turnaround with a flood into the safe haven of the yen has come to pull Dollar/Yen sharply lower. Yesterday’s sharp bearish candle has continued into today’s session and the bull run is being quickly reversed. The eight week uptrend has been broken, along with the breakout support at 110.00 and the market is trading below the support of the rising 21 day moving average (c. 109.80) for the first time since early April. The momentum indicators have also significantly deteriorated, with the RSI at a six week low, whilst the Stochastics and MACD lines are crossing lower. The market is now posting lower highs and lower lows to begin the build of a new downtrend. Yesterday’s intraday rebound failed at 110.30 and with the hourly chart in negative configuration there is a sense that at least for the near term, rallies are now a chance to sell. The next support to test is 109.15 with the 108.60/108.80 support band now a key gauge for how strong this selling pressure will become. Resistance near term at 110.00/110.30.

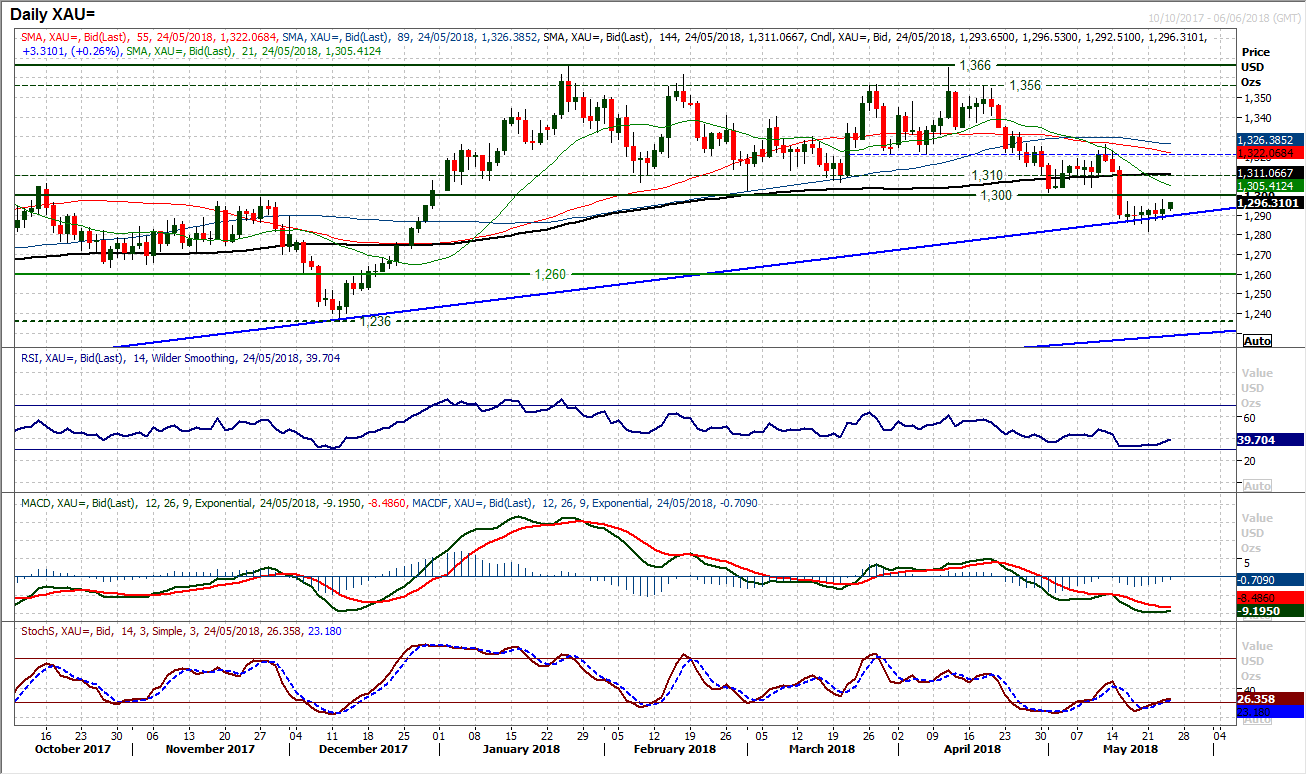

Gold

With a safe haven bias back in the market there has been a creep higher on gold, however it is interesting that gold has been unable to really gain traction in a recovery. The overhead supply with the long term pivot band $1300/$1310 is a key barrier that needs to be breached for any rebound to be deemed as gaining any momentum. However, yet another small bodied candle completed yesterday with the upper tail suggesting that the bulls are still struggling to get a decisive control of the market. The momentum indicators are mildly ticking higher and suggest more of a drift recovery that lacks conviction. The hourly chart shows initial support at $1287/1288 protects the recent low at $1281.80.

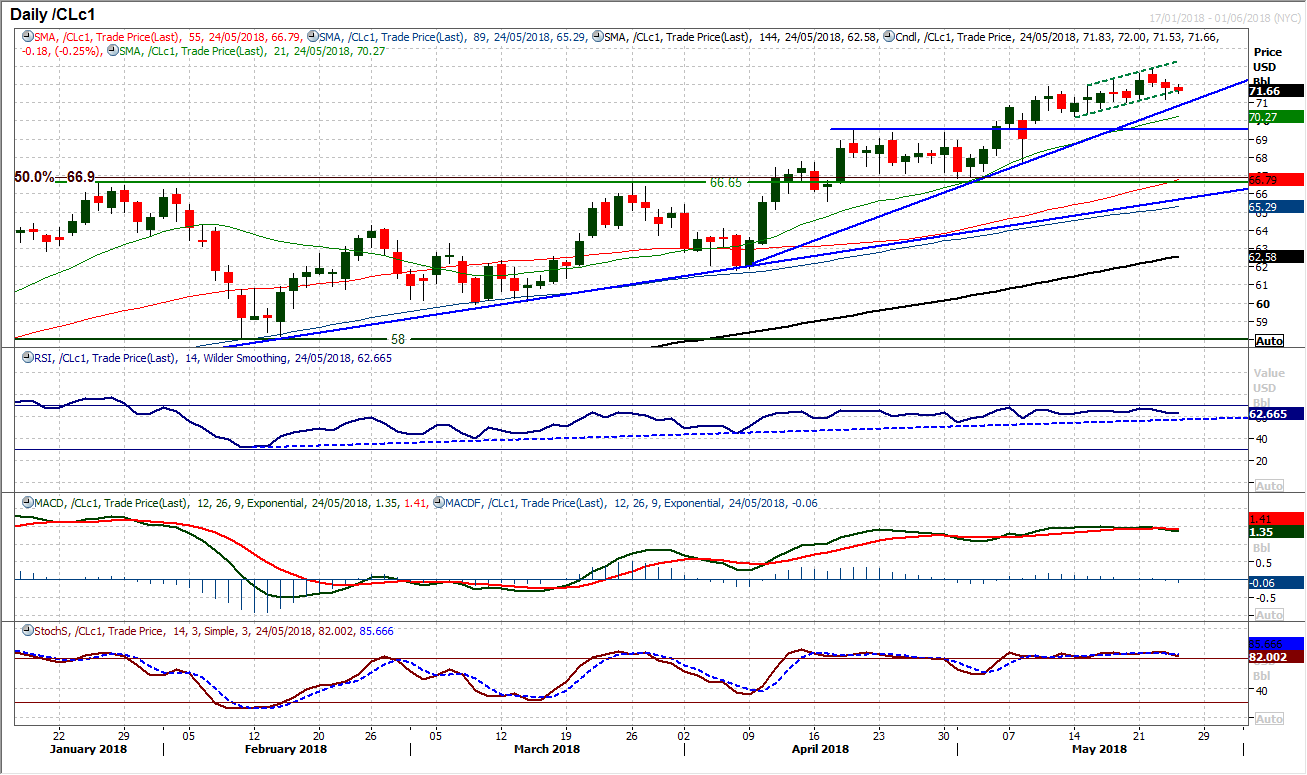

WTI Oil

With oil under pressure anyway during yesterday’s session, a significant surprise build in the weekly crude inventories adds into a more corrective near term move just forming. In the past week the market has been drifting quietly higher in a small uptrend but a second negative candle now increases the near term pressure on oil. The next key test today will be not only whether a third consecutive negative candle is seen (not happened since early April) but also whether the market retreats further to test the support of the six week uptrend (comes in today at $70.85). For now the momentum indicators remain positively configured with the uptrend of the past three and a half months on the RSI still intact, however the MACD lines are beginning to deteriorate again and this is becoming a market under pressure. There is a clutch of support starting at $70.25 with the psychological $70 level and the old key breakout at $69.55.

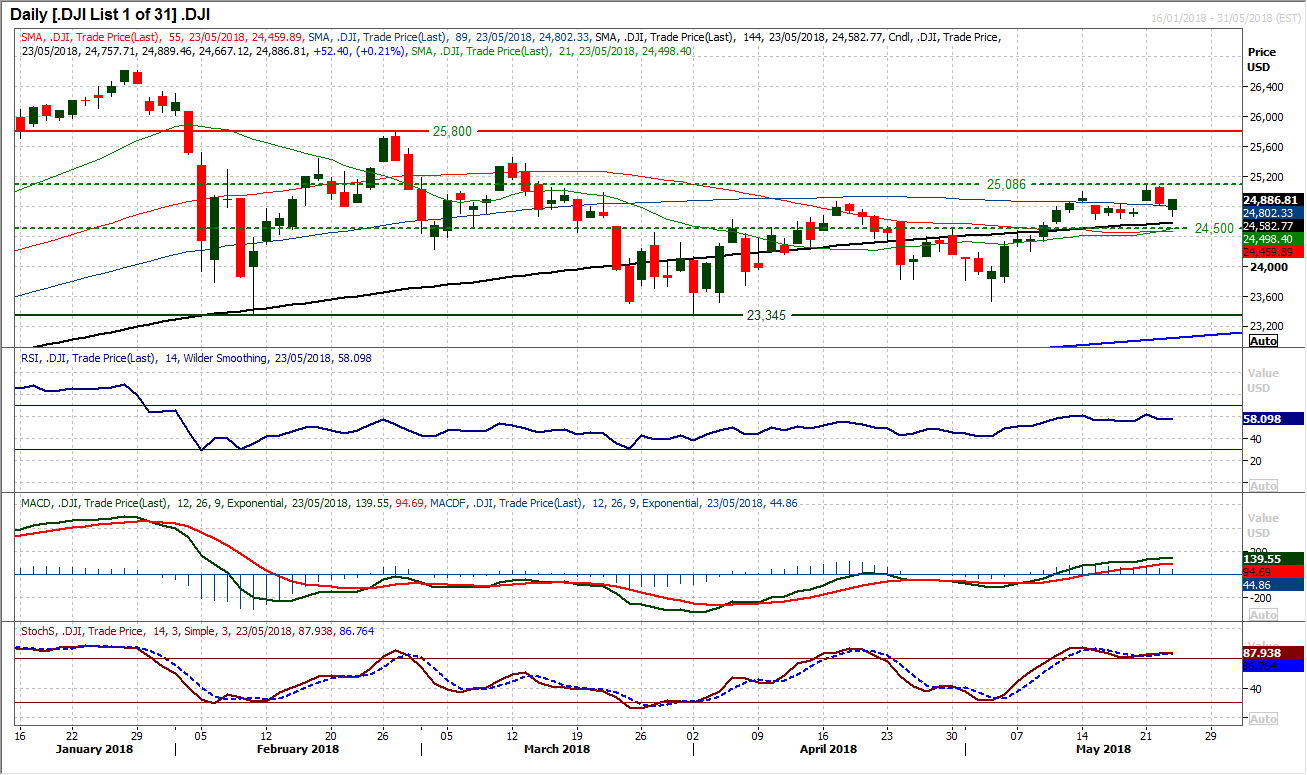

Dow Jones Industrial Average

With yesterday’s late rally into the close, the market has now filled the gap at 24,775 and the bulls will be relieved by the rebound that has kept the bears at bay, at least for now. Whilst the 24,629 reaction low from last week remains intact there is little cause for the bulls to get too alarmed, and yesterday’s low at 24,667 certainly helps now to prevent a move back to test the 24,500 pivot a breach of which would bring in a far more negative bias once more. The hourly chart is worth watching as if the hourly RSI begins to trade more negatively (below 30) and MACD lines move decisively below neutral then the selling pressure will be mounting once more. A move above 25,086 opens the recovery once more.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.