Highlights:

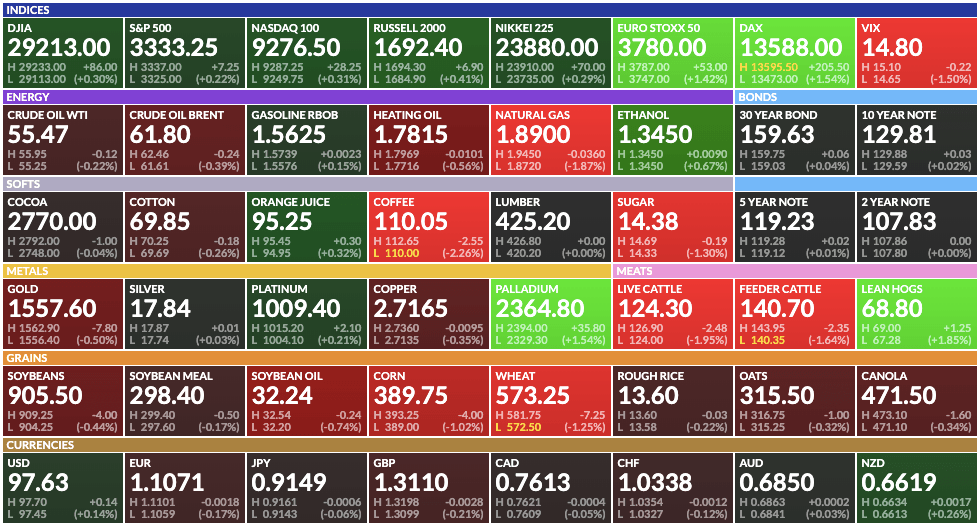

Market Summary: Stocks finished the day higher yesterday as the S&P 500 finished up 0.11%. Transports were the top performing broad market, up 1.31%. Emerging markets closed lower by -0.99%. West Texas Intermediate crude oil fell -2.03% and the CRB commodity index dropped -0.83%.

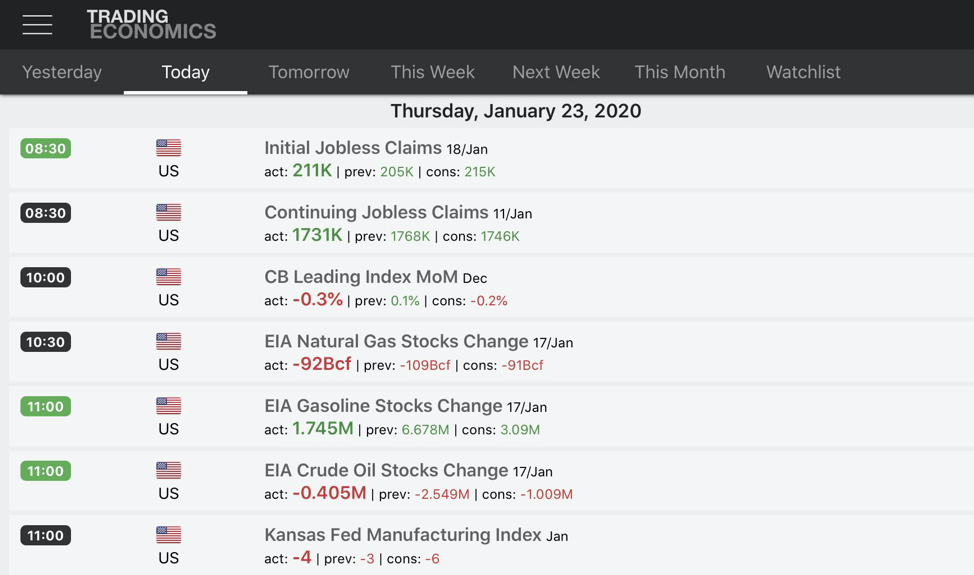

Economic Data: Initial claims were up from the previous week, but less than consensus expectations. The Kansas Fed Manufacturing Index was reported at -4, down from -3 previously. This points to continued weakness in the manufacturing sector of the overall economy. We wonder how long before employment starts to show the effects of a prolonged slowdown.

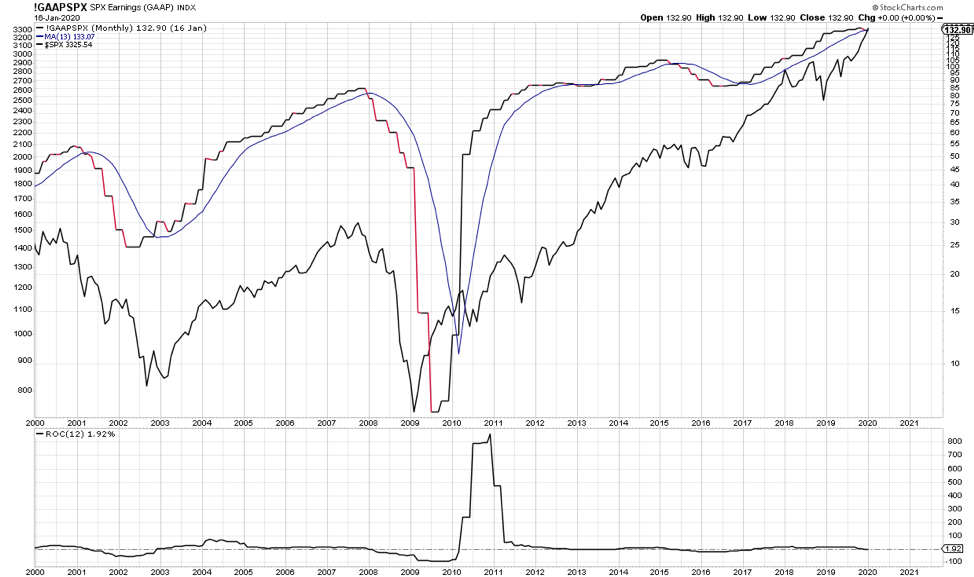

Do Earnings Matter? GAAP earnings for the S&P 500 are now below their 13-month moving average. Historically, this type of breakdown has preceded market corrections. The trend in earnings is negative when looking at this measure.

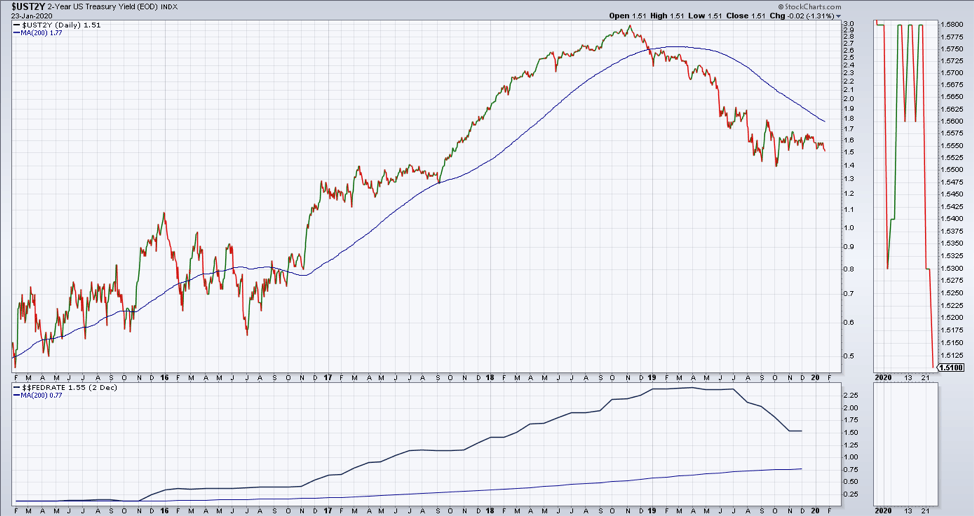

Fed Funds Rate: The Fed Funds rate is back below the 2-year Treasury note yield. If this condition remains, it is our opinion that the Fed will have to cut interest rates and remain accommodative. The Fed funds rate is at 1.55 and the 2 Year Treasury note yield is at 1.51%.

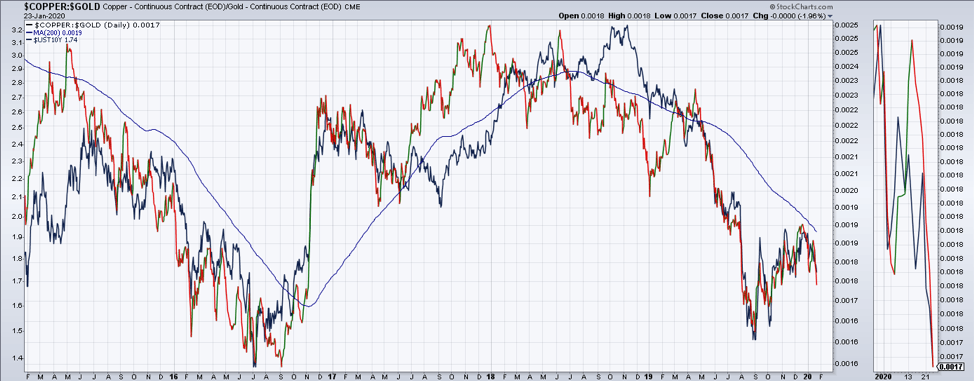

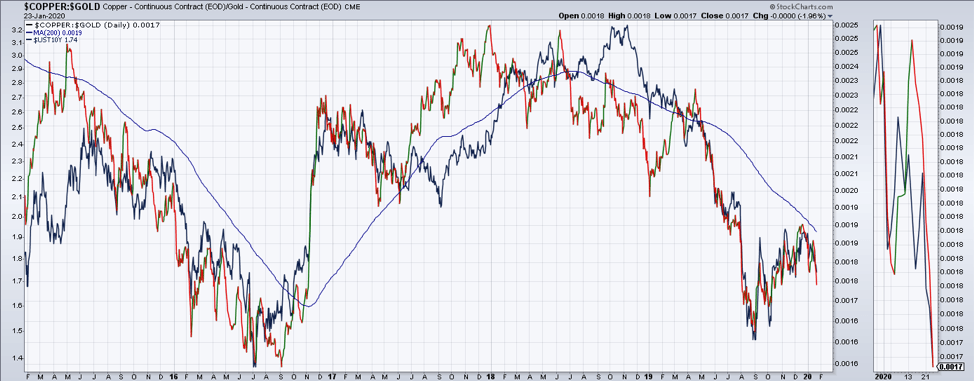

Copper vs. Gold: Copper is dropping against gold. Yesterday, copper dropped over -1% again and gold moved higher by over 0.50%. The ratio is below the 200-day moving average and continues to correlate strongly with the bond market (yields). Is this ratio telling us that economic growth is still slowing and that the reflation hopes are soon to evaporate? Or is this just a flight to safety caused by the coronavirus outbreak?

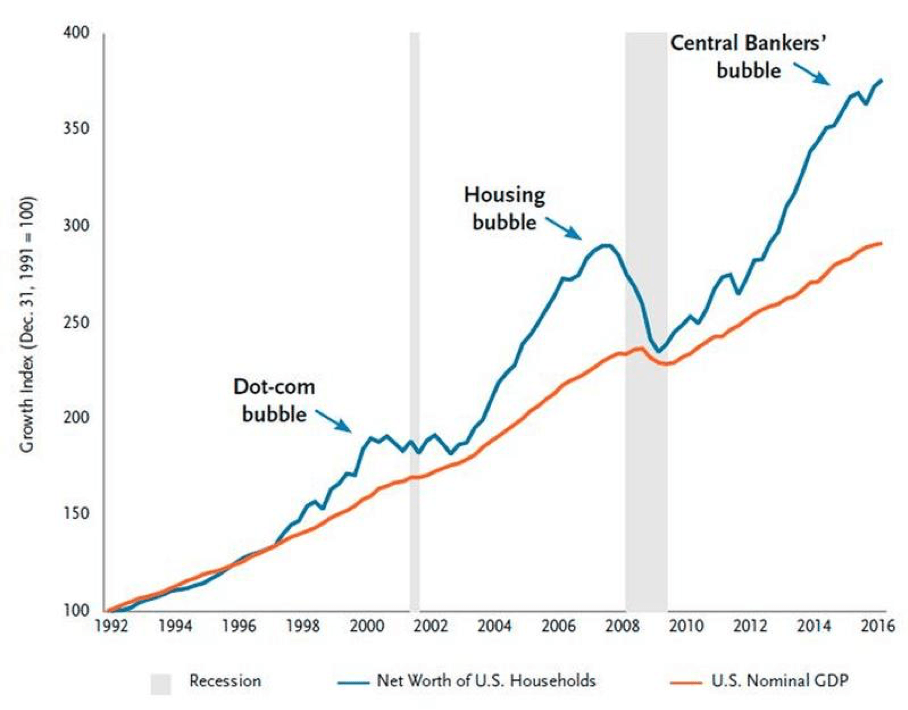

Chart of the Day: Wow. Nothing to see here. Move along. This time is different.

Futures Summary:

News from Bloomberg:

China struggled to stem public anger as it took unprecedented steps to try to slow the spread of the coronavirus. The death toll jumped to 25. Citizens are increasingly critical and anxious as travel restrictions now encompass at least 40 million people as the Lunar New Year holiday kicks off. Here's a look at how a lack of fever may make containing the virus more difficult, and a map of the outbreak.

Banks have started allowing U.S. clients to buy research without paying a steep tab for trading services. The shift may be the biggest U.S. fallout yet from sweeping European rules that force firms to charge separately for analysis. Goldman, UBS, Credit Suisse and Barclays are among banks that have recently softened their positions, people familiar said. Check out our MiFID QuickTake.

Jamie Dimon got $31.5 million for 2019, a 1.6% increase, after JPMorgan posted record profit for the second year. His package includes a base salary of $1.5 million, a $5 million cash bonus and $25 million of restricted stock tied to performance. Dimon has been the best paid big bank CEO since 2016. Morgan Stanley said last week it cut James Gorman's compensation 7% to $27 million.

Impeachment latest: House Democrats will wrap up their case today. Democrats need at minimum to convince Susan Collins, Lisa Murkowski, Mitt Romney and a fourth senator—perhaps retiring Senator Lamar Alexander or a Collins ally like Ohio's Rob Portman—to back subpoenas. President Trump's legal team will start their defense tomorrow. Follow the developments with our Impeachment Update.

U.S. stock futures rose with European shares as investors digested the latest corporate news and promising economic data out of Germany, setting aside for now fears over the deadly virus spreading from China. Markets in mainland China and South Korea were shut for the Lunar New Year holidays. The dollar gained and Treasuries were steady. Oil and gold fell.

WealthShield is a division of Emerald Investment Partners, an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where WealthShield and it’s representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by WealthShield unless a client service agreement is in place. Before investing, consider your investment objectives and WealthShield’s charges and expenses.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.