Australian dividend investors are likely to have a struggle in this upcoming earnings and dividend season in September. Forecasts suggest that this will likely be the worst cut in at least a decade with a number of entities planning to cut, postpone or simply cancel dividend payments, including the big fan favourites within the S&P/ASX200.

With more than a third of the top 100 cutting, postponing, or cancelling payments in the earlier earnings season of 2020, a similar outcome is expected this time around. It is a depressing reminder for many investors that there is still a level of risk, even in revered markets known for having outstanding returns historically. It is worth noting that while some equity markets do hint at a V-shaped recovery, the wider economy does not share those same results and dividends will lag behind earnings, so don’t expect a phenomenal pay day any time soon.

The data so far suggests a fall between 30-40% in dividend payments on the previous financial year, meaning the figure is between $24B and $32B as a current estimate. With the new lockdown imposed in Victoria, there are likely to be further revisions before the ex-dates as a defence of cashflow.

Still there are some outliers, some mining entities have been well placed to weather the pandemic, due to support from above average commodity prices.

Iron ore producers should have a better than expected outcome, with the greater than normal demand for steel in China with outputs up 4%. The demand argument aside, iron ore prices have risen 30% in the last few months with prices resting in the $107/t range and considering the cost of production is in the $13/t range, then profits should be substantial.

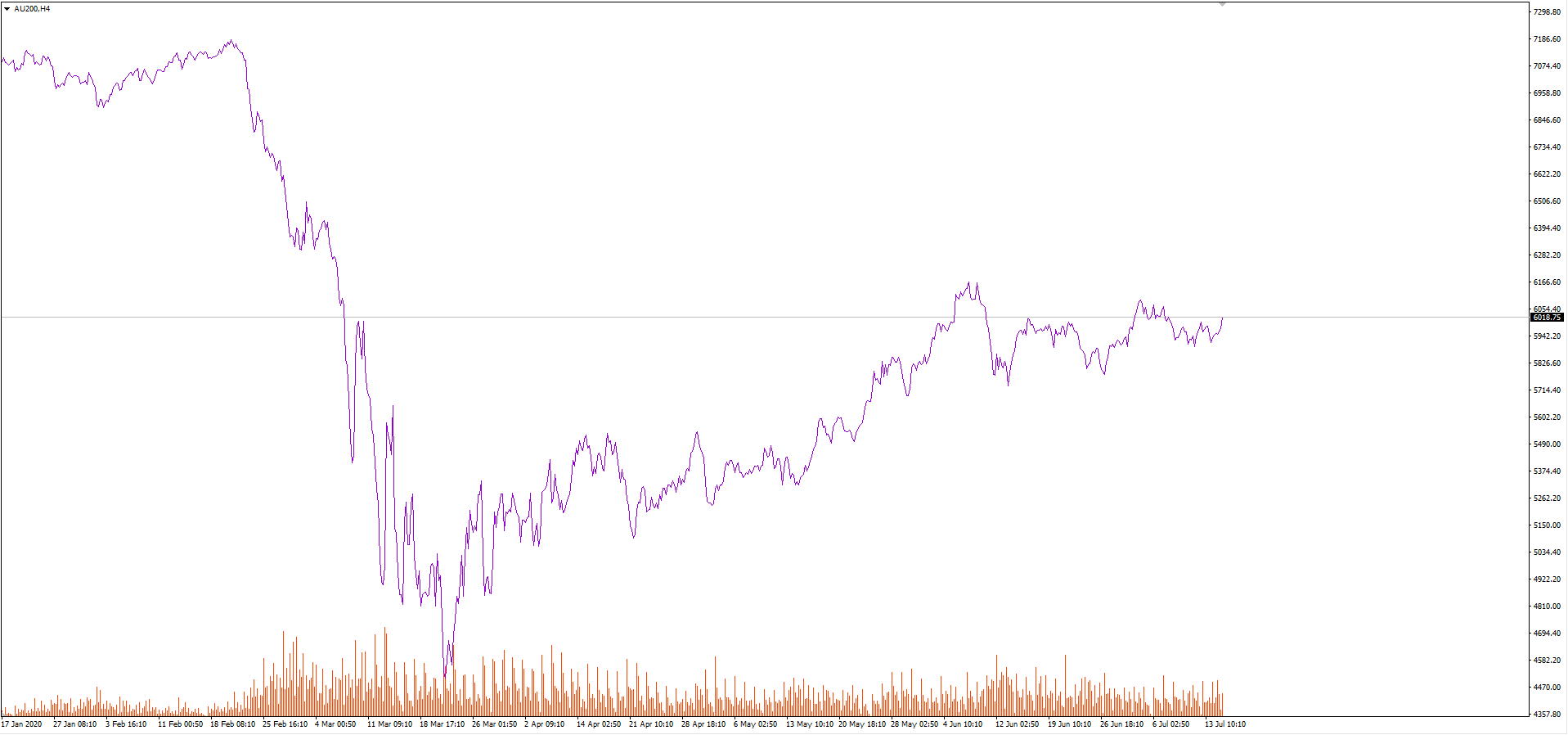

Considering the current economic landscape for ASX listed entities, I would not be surprised if we are to see a decline in the ASX200, in the near-term. Having this many listed companies either not providing or offering limited advice does not speak well for the likely hood of dividend payments. The current price in the ASX200 reflects on this as well with price struggling to get past the pain point of $6,200.

S&P/ASX200 – 15/07/2020

Regardless of this my eyes are going to be firmly focused on iron ore producers such as Fortescue Metals, BHP and Rio Tinto, with the occasional glance hovering on Big 4 offerings.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.