Key Points:

-

Fed Chair Yellen takes a dovish tone before congress.

-

Central bank likely to rely mainly upon QE taper rather than multiple rate hikes.

-

Equity and bond markets likely to be strongly impacted by any QE taper.

The markets have been relatively consigned to the fact of a cycle of interest rate tightening from the U.S. Federal Reserve in the coming year given the historic expectation setting that has occurred of late. However, the venerable Fed Chair, Janet Yellen, has tendered some testimony to congress which appears to take a significantly more dovish tone and has caused sentiment to swing sharply away from the greenback. Subsequently, markets have been left wondering just which direction the central bank will head in the coming months.

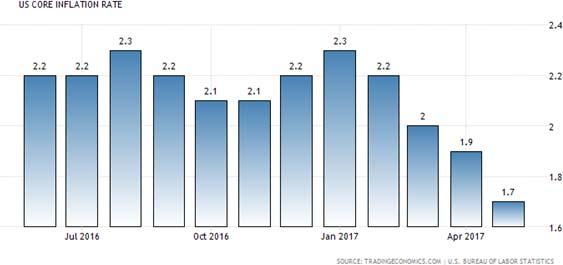

However, it wasn’t really a surprise that there are many within the FOMC that are now backing away from an ever delayed cycle of significant tightening. The central bank’s main problem is the abject lack of price inflation within the U.S. economy despite a strengthening labour market. Subsequently, given that inflation is running at around 1.4% (if you believe the official measure), it isn’t a surprise that Yellen’s comments indicate that the Fed is near to a neutral interest rate. Presently, the FFR sits at around 0.75% with a target rate of between 1.00% and 1.25%. So the central bank’s contention is that an additional hike would take interest rates to a neutral level for the economy.

However, the real reason that the Fed is moving away from the rhetoric of a multiple rate hike tightening cycle is their balance sheet. The central bank has signalled their intention to start a balance sheet taper sometime in 2017 and this is likely to have a relatively strong impact on equity and bond markets. The current view is that the Fed will be looking to gradually offload around $4.5 trillion in bonds from their balance sheet and this is likely to have the same impact as further tightening in interest rates. Subsequently, equity markets could be in for a fairly rough ride once the QE removal process starts and some fairly rapid capital flows occur.

Additionally, if there are any further ripples in the global economy the Fed also faces the prospect of little in the way of macroeconomic tools to respond to recessionary pressures. Interest rates have a limited distance from the zero lower bound and the Fed is likely to still be carrying significant amounts on their balance sheet as any taper will likely not be rapid.

Regardless, the central bank has a job to do and they might have finally realised that the low inflation recovery has largely hampered their ability to respond to any form of crisis and, as such, are now looking at ways to normalise within relying upon strong rate hike cycles. Subsequently, we are left with the view that the Fed will likely hike 25bps in the remaining part of 2017 whilst slowly unwinding some of the bonds on their balance sheet. Ultimately, this means we are not likely to see the rampantly bullish U.S. Dollar that was largely expected with the planned multiple hikes.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.