Market Overview

Geopolitical tensions between the US and Iran in the Middle East may remain elevated, but they have also not escalated further early this week. The threat of some sort of reprisal attack by Iran (either direct or indirect) is still likely, but with nothing immediately coming, markets are beginning to find the dust settling. Whilst some kay markets have become stretched (such as oil and gold), leading to the potential for retracements, for now, the added risk premium that has taken flow into safe havens, is still required. It will remain so whilst uncertainty remains of how a response by Iran will take shape. Despite this though, there is a degree of bounce back today. Treasury yields rebounded into the close last night, whilst equity markets are taking a lead on this to drive a recover today. However, there is still a questioning of the rebound this morning, as forex majors reflect a risk retreat again and Treasury yields slip back. Can this apparent contradiction continue? Something will need to give. Attention will also turn back to the PMIs once more, with the US ISM Non-Manufacturing in focus today.

Wall Street rebounded into the close last night with the S&P 500 +0.4% higher at 3246. With US futures also higher today +0.1% this has helped a broad bounce in Asia (Nikkei +1.6%, Shanghai Composite +0.7%). Markets in Europe are set to follow this rebound, with the FTSE futures +0.5% and DAX futures +0.6% higher in early moves. However, in forex there is a move back into safety, with JPY performing well, along with USD. On the flipside, AUD and NZD are suffering, whilst EUR is also dropping back slightly. In commodities, as the European session has got going, there has been a move back into gold again after yesterday’s late slip, however, oil is over -0.5% lower today.

The outlook of the US services sector will be key on the economic calendar today, along with the first look at Eurozone inflation. Flash Eurozone HICP for December is at 1000GMT with headline inflation expected to increase to +1.3% (from +1.0% in November) and core inflation staying at +1.3% (+1.3% in November). US Trade Balance for November is at 1330GMT with an improvement in the deficit to -$43.8bn (from -$47.2bn in October). The US ISM Non-Manufacturing is at 1500GMT and is expected to improve to 54.5 (from 53.9 in November) and will be particularly watched after the manufacturing disappointment last week. US Factory Orders for November are at 1500GMT with the notoriously volatile data expected to fall by -0.8% on the month (+0.3% in October).

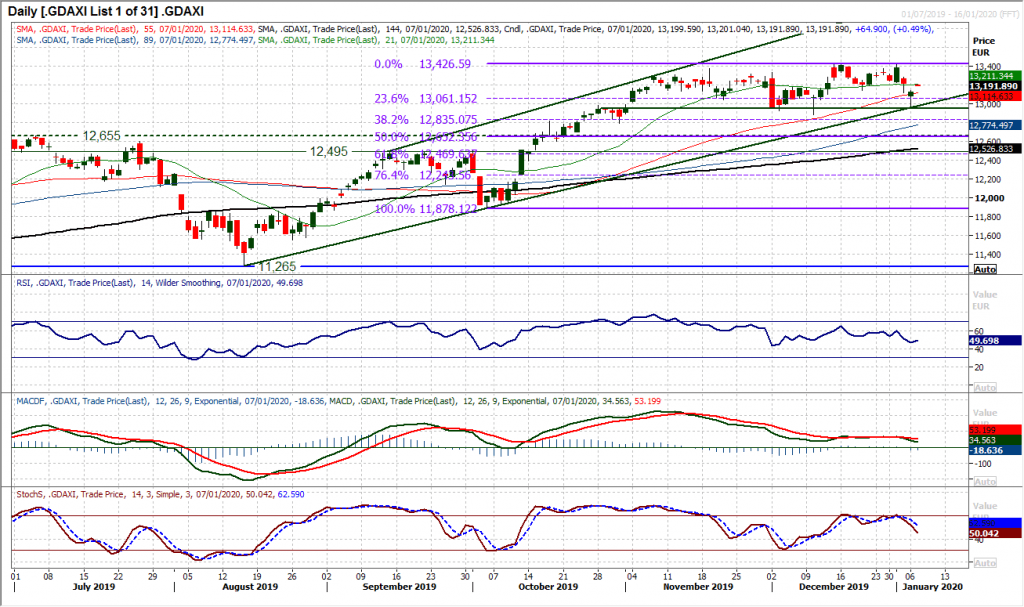

Chart of the Day – German DAX

The bullish outlook for the DAX has been rocked in recent sessions as risk appetite has been hit from a rise in geopolitical risk. However it interesting to see yesterday’s rebound off 12,948 as a near five month uptrend provided the basis of support. This rebound also came effectively off the bottom of what seems to be a two month trading range broadly between 12,950/13,425. The bulls will certainly point to the fact that the opening gap below 13,120 has been bull closed. This closing of the gap also meant that the market formed a bull hammer candlestick yesterday. This was a hugely positive reaction meaning that the market closed +178 ticks from the low. Momentum indicators have reacted in the past couple of days but are still positive within their medium term configuration. The RSI has been above 40 throughout the five month channel, whilst MACD lines remain above neutral and Stochastics have only marginally slipped. Once more holding above the 23.6% Fib retracement (of 11,878/13,425) at 13,060 leaves the bulls in the box seat still. Weakness remains a chance to buy whilst these positive indicators continue. The hourly chart shows resistance at 13,140 and then 13,245.

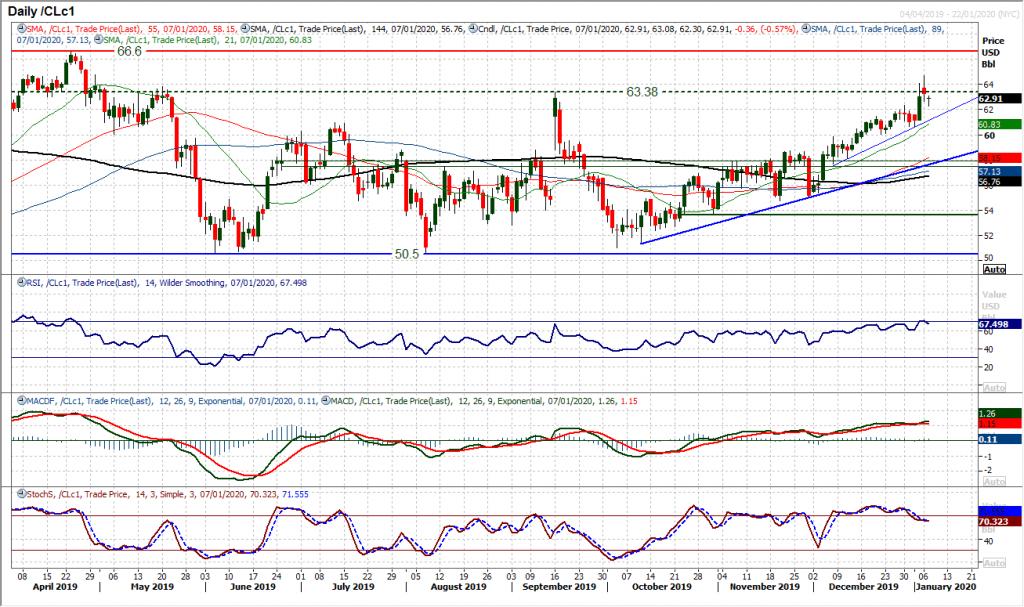

WTI Oil

Volatility on oil is still elevated, however, with no immediate escalation in geopolitical tensions in the Middle East, the immediate upside on oil has just moderated slightly. Yesterday’s close was higher (following an initial gap higher) but a negative candle formed on a close below the open. This has been followed by an opening gap lower today (opening the prospect of an “evening star” candlestick formation, which would need a strong bear candle today to complete). The RSI pulling back from 70 and near term slip in Stochastics adds to the potential for a near term retracement in the December bull run. Focus comes with the initial support at $62.35 with the more considerable $60/$60.65 support area underneath. However, what could underpin the market at elevated levels could be the uncertain geopolitical climate and markets maintaining that degree of risk premium. Closing above $63.40 would be a positive signal now.

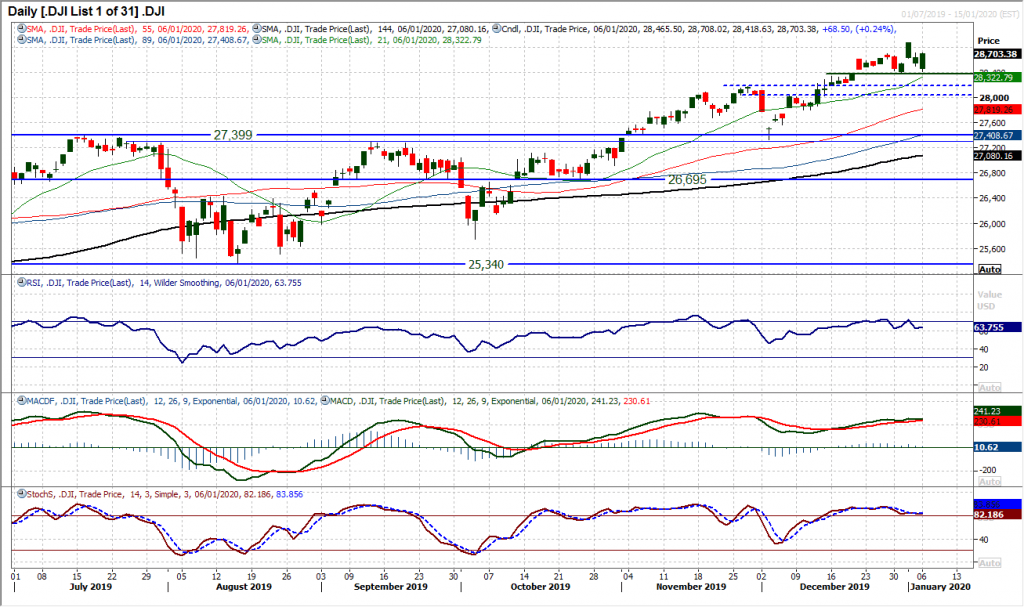

Dow Jones Industrial Average

Concern for bull markets increases when good news is sold into. When bad news is bought into, then it shows that the bulls are still in a strong position. In both sessions since the geopolitical tensions hotted up on Friday, we have seen a positive reaction from the bulls. Yesterday’s initial decline was bought solidly throughout the session to leave a strong positive candlestick and the bulls still very much in control. The first reaction low at 28,376 is still intact as support and will now take on added importance. The way the market is shaping over the past couple of weeks, should 28,376 support fail, it would complete a top pattern. However, with futures pointing to a marginally positive open, the bulls are looking higher. Momentum indicators remain positively configured, with RSI still above 60 (below 60 would hint at completion of the small top), whilst MACD and Stochastics are also positively configured. The all-time high of 28,873 is once more in focus.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.