A handful of chart by Albert Edwards at Society General suggests a recession is long overdue.

The following snips are courtesy of Albert Edwards at Society General

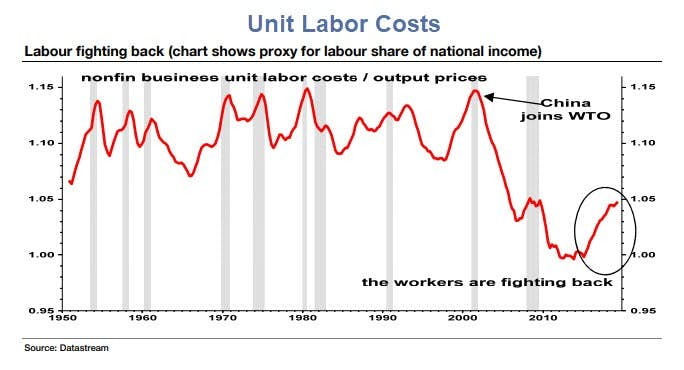

Unit Business Costs and a Profit Squeeze

Aside from payrolls, the economic data has certainly been lukewarm. So that rapid payroll growth spells dire productivity growth. In short, the sharp 3% jump in unit labour costs in Q3 is crushing corporate margins (chart shows inverse).

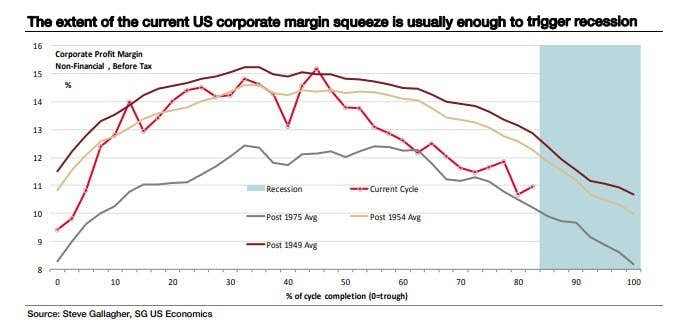

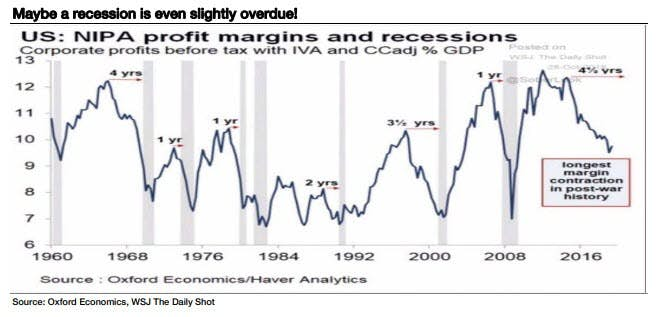

Our US economist Steve Gallagher shows below that, if history is any guide, a recession is due just about now. Yet investors fear of recession has all but evaporated.

Extent of the Margin Squeeze

Recession Overdue

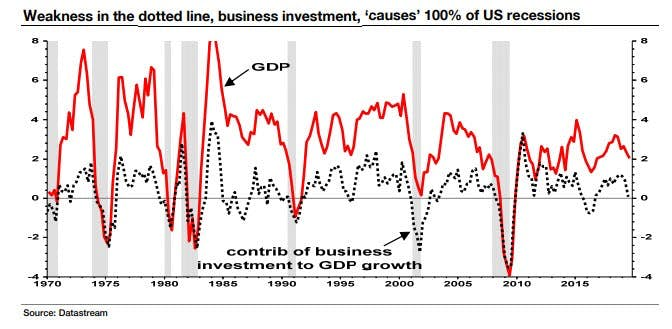

Regular readers will know that we have long believed that it is the business investment cycle that ‘causes’ recessions, in an accounting sense. The chart below shows the contribution of business investment to GDP growth. Although in an economic recovery business investment contributes a fraction of GDP growth, in a recession the dotted line totally overlays the red line – business investment ‘causes’ recessions.

Recent weak core durable goods orders confirmed what the latest Q3 GDP data also suggest: business investment has begun falling. Together with the margin cycle, this is a loud warning signal of recession (the false signal in 2015 was due to the collapse in shale oil and confined to only one sector).

Rise in Employment Costs

I discussed the rise in employment costs yesterday in Labor Productivity Dives as Unit Labor Costs Soar

10 Reasons for Declining Productivity

Earlier today I gave 10 Reasons for Declining Productivity

Fed-sponsored Zombie corporations, debt, government spending and demographics are among my reasons.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.