Welcome to December! As my colleague Ken Odeluga wrote in our Market Brief, the day had started off pretty well with both the official Chinese PMI (released Saturday) and China’s unofficial measure of manufacturing, the Caixin PMI, both beat expectations. With that, stock indices, the Australian Dollar, and the New Zealand Dollar were all trading higher on the day. Then early in the US session, Trump tweeted that tariffs would be restored on steel and aluminum shipped from Brazil and Argentina to the US. Stocks and the US Dollar both began to sell off. However, the selling did not start in earnest until the US ISM Manufacturing PMI for November was released at 48.1 vs 49.2 expected and 48.3 last. A reading above 50 indicates economic expansion and a reading under 50 indicates economic contraction. November is now the fourth straight month of a reading under 50, and therefore, economic contraction.

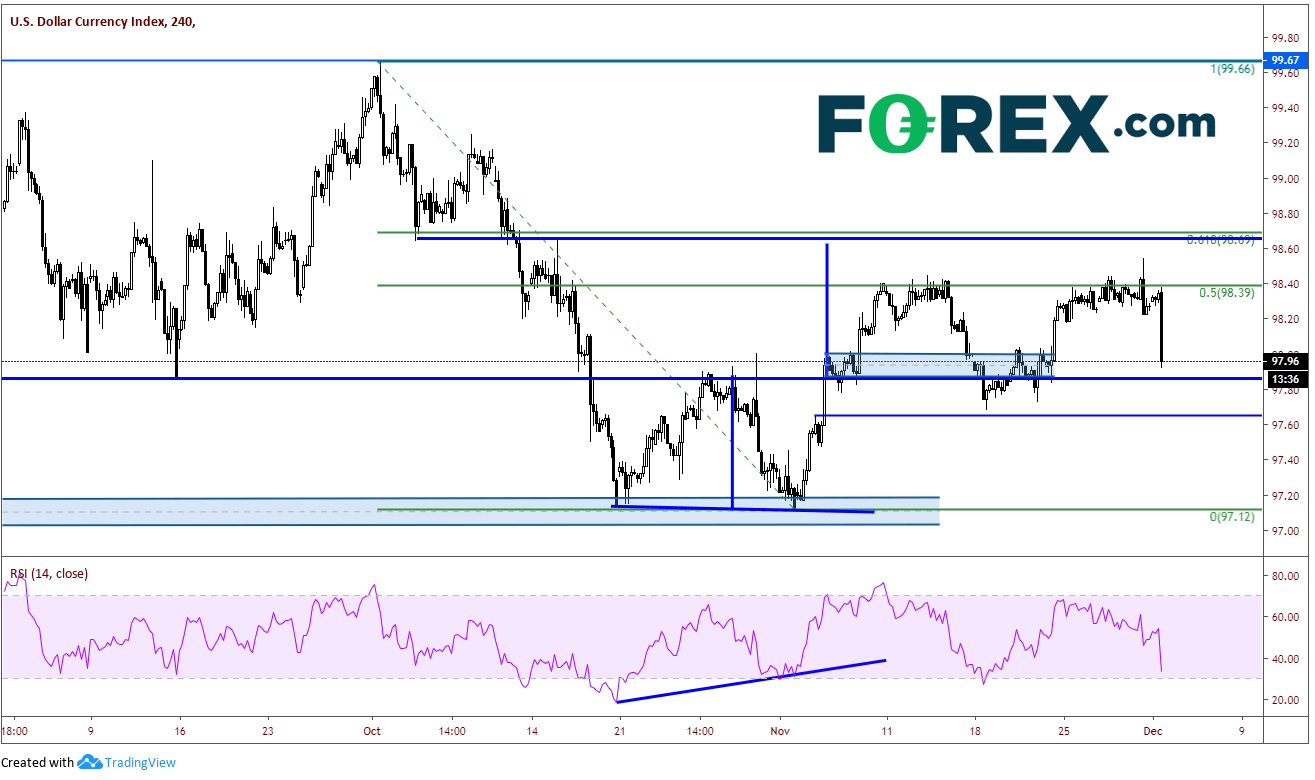

The US Dollar Index has had a difficult time trading about the 50% retracement level from the highs on October 1st to the lows on November 1st. The DXY has been trading near the 98.40 level for a week and could not get a significant move above it. With today’s price action, price moved aggressively lower and is now trading back at support between the 97.85/98.00 area. If price breaks lower through this level, 97.65 may be the next level of support.

Source: Tradingview, FOREX.com

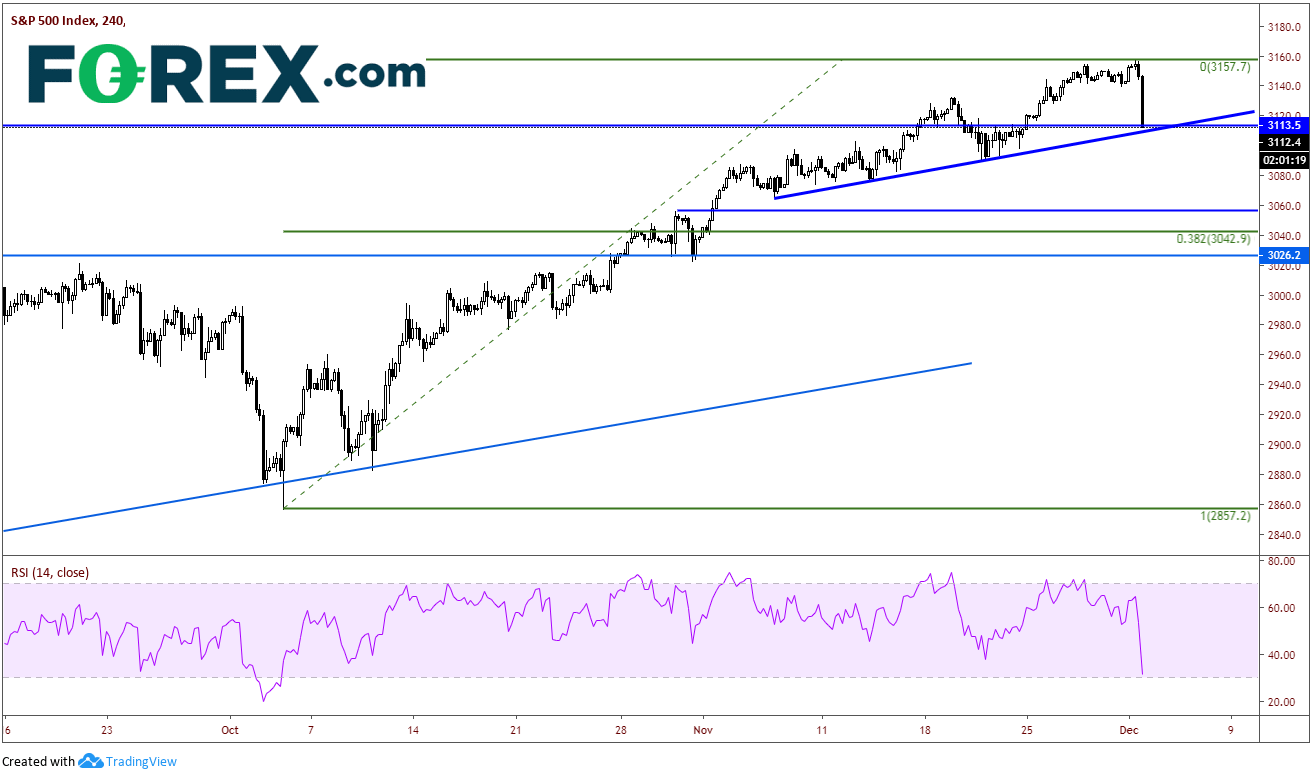

In addition, the S&P 500 Index is down 30 handles as the markets got smashed by the tweets and ISM data. After putting in new all-time highs last week, the index has pulled back and is currently trading near horizonal and trendline support at 3110/3113.

Source: Tradingview, FOREX.com

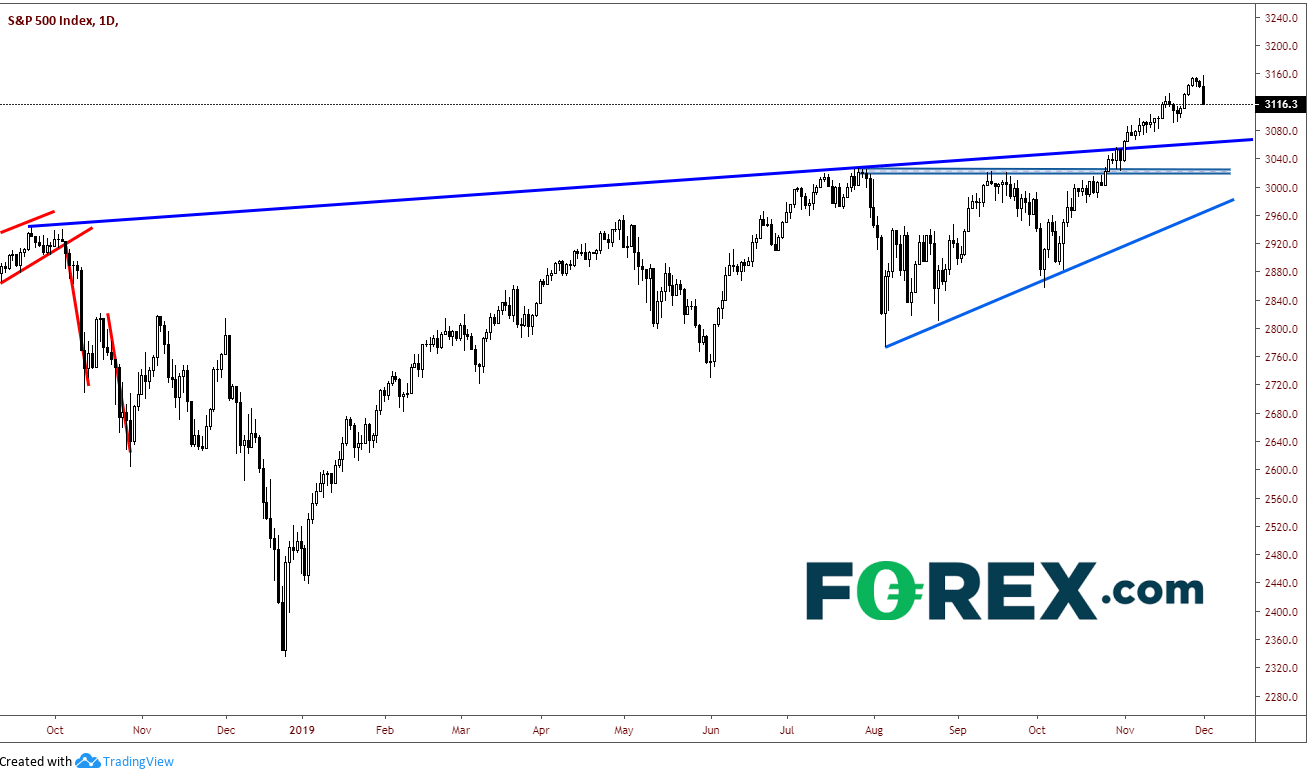

If price breaks below 3110, there is a longer upward sloping trendline dating back to September 2018 which comes across near 3075. Also, if the S&P 500 closes below 3137, a bearish engulfing candle will form and the daily chart.

Source: Tradingview, FOREX.com

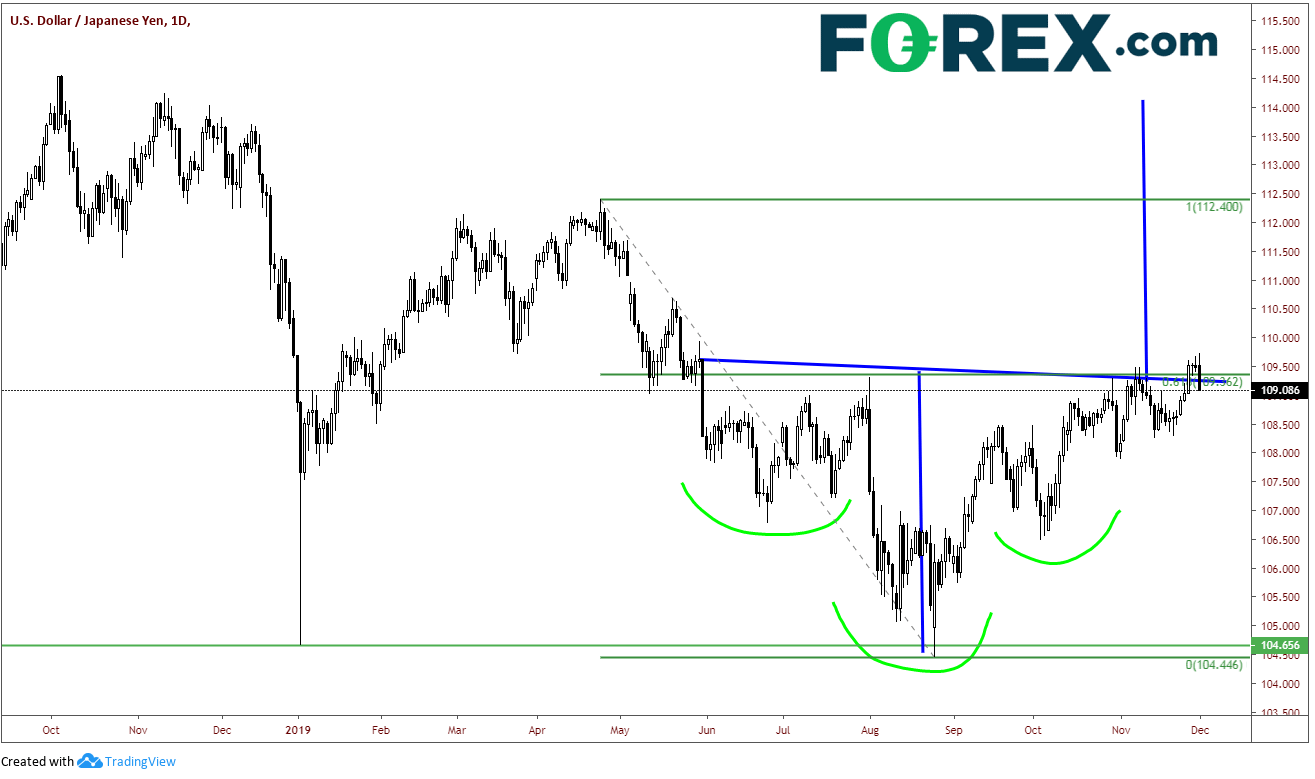

Along with the risk off theme of the US session, it’s no surprise that USD/JPY is trading lower. The pair broke through the neckline of the inverse head and shoulders last week, only to see it collapse today and trade back under it. USD/JPY is currently 70 pips off its highs of the day. As with the S&P 500, if the pair closes below 109.40 today, there will be a bearish outside candle, an indication prices may trade lower in the days to come.

Source: Tradingview, FOREX.com

Watch for more tweets from President Trump throughout the day and the week. He does not seem like a President who tolerates a falling stock market. Perhaps a China-US trade deal is almost done, again? And don’t forget NFP on Friday!

December has just begun!!

Risk Warning Notice Foreign Exchange and CFD trading are high risk and not suitable for everyone. You should carefully consider your investment objectives, level of experience and risk appetite before making a decision to trade with us. Most importantly, do not invest money you cannot afford to lose. There is considerable exposure to risk in any off-exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of the markets that you are trading. Margin and leverage To open a leveraged CFD or forex trade you will need to deposit money with us as margin. Margin is typically a relatively small proportion of the overall contract value. For example a contract trading on leverage of 100:1 will require margin of just 1% of the contract value. This means that a small price movement in the underlying will result in large movement in the value of your trade – this can work in your favour, or result in substantial losses. Your may lose your initial deposit and be required to deposit additional margin in order to maintain your position. If you fail to meet any margin requirement your position will be liquidated and you will be responsible for any resulting losses.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.