We highlighted in an article here on FX Street last week that both the DAX and FTSE 100 were threatening intermediate-term bullish shift. The DAX has already signalled a bull trend, whilst the FTSE 100 is poised to do so also, assisted by the surging rally seen across global equity averages since Wednesday's Fed Meeting.

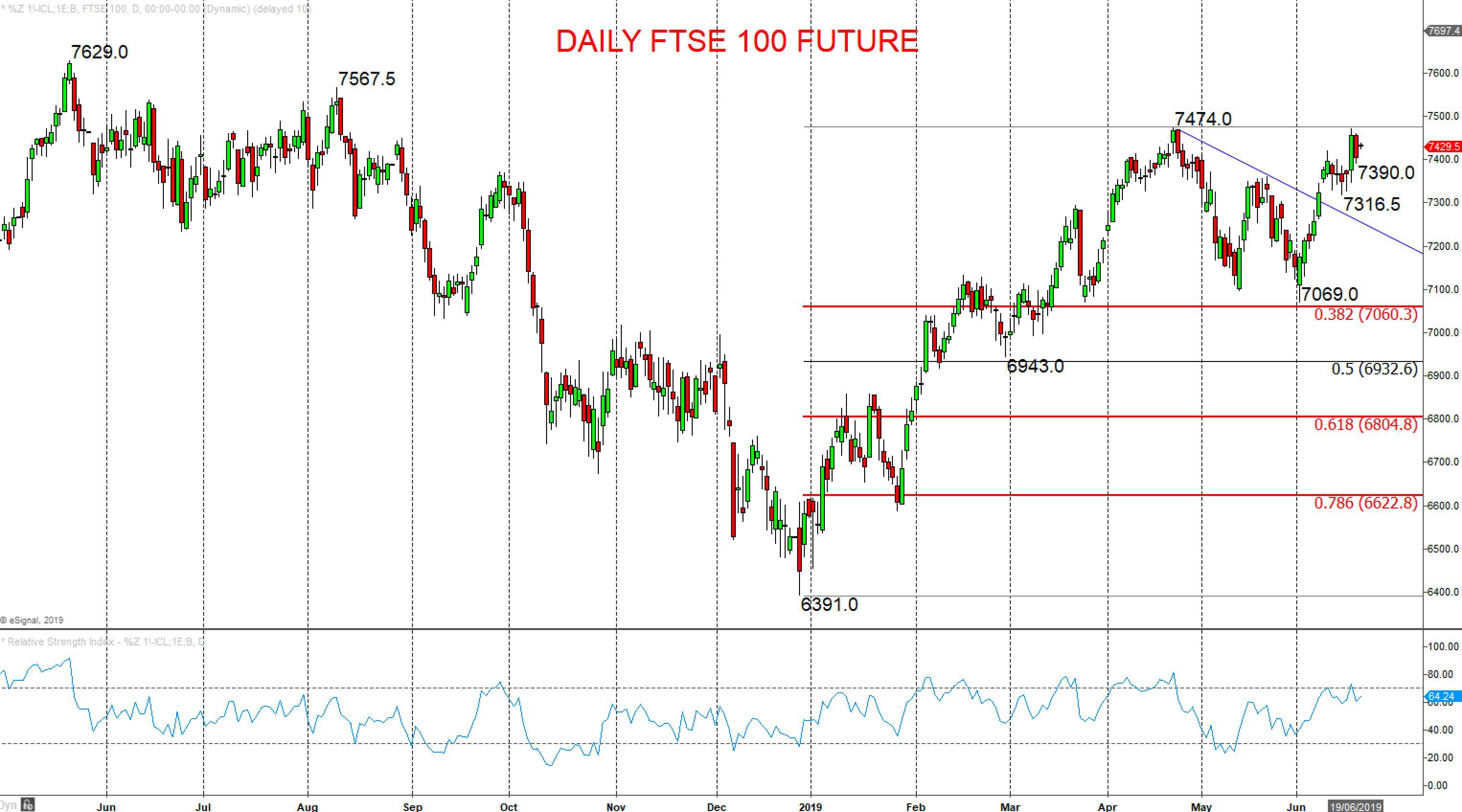

FTSE 100 Future (Jun’ ‘19 contract) upside risks to key 7474

A dip and a rebound Wednesday after Tuesday’s strong advance through the 7420 June peak to another new recovery peak and 7470.5 to just stall below the key cycle high at 7474, to sustain both short- and intermediate-term bull pressures, keeping risks higher for Thursday.

The June push above 7360.5 set an intermediate-term range we see as 7474 to 7069, BUT with risks growing for an intermediate-term bullish shift above 7474.

For Today:

-

We see an upside bias for key 7470.5/74; break here aims for 7500, even 7531.

-

But below 7390 opens risk down to 7374.5, which we would look to try to hold.

Intermediate-term Range Breakout Parameters: Range seen as 7474 to 7069.

-

Upside Risks: Above 7474 sets an intermediate-term bull trend to aim for 7500 and 7625.5.

-

Downside Risks: Below 7069 sees an intermediate-term bear trend to target 6943 and maybe 6587.

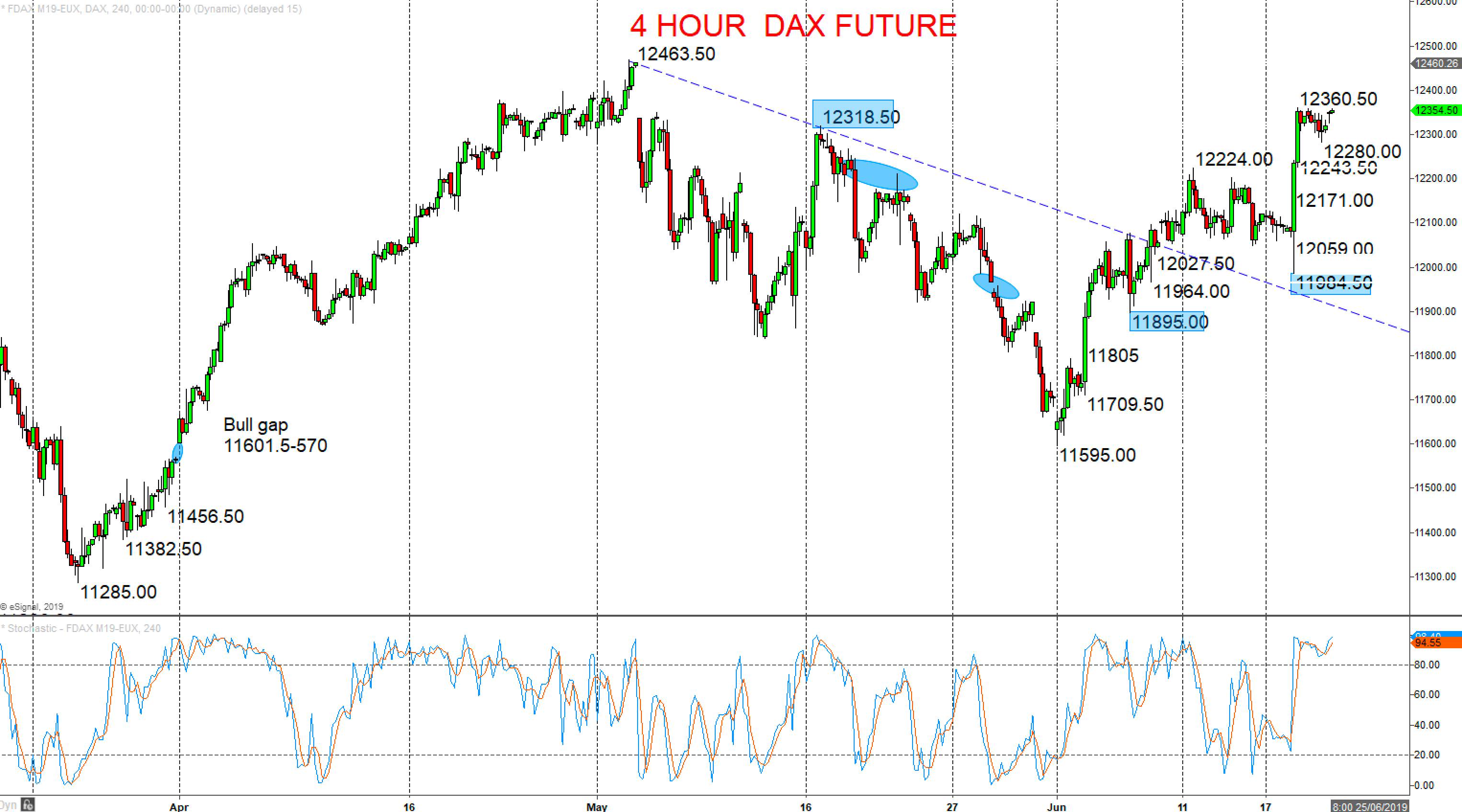

DAX Future (Jun’ ‘19 contract) intermediate-term bullish shift reinforced

A high-level consolidation Wednesday above initial 12243.5 support (holding 12280), to sustain bull forces from Tuesday’s surge up through key 12318.5 resistance (for an intermediate-term bull shift), to keep the bias higher Thursday.

The mid-June surge above key 12318.5 day saw an intermediate-term bull trend established.

For Today:

-

We see an upside bias through 12360.5; break here aims at 12463.5 maybe 12500.

-

But below 12280 quickly targets 12243.5 and maybe opens risk down to 12171.

Intermediate-term Outlook - Upside Risks: We see an upside risk for 12463.5.

- Higher targets would be 12586 and 12873.

- What Changes This? Below 11984.5 shifts the intermediate-term outlook back to neutral; through 11895 is needed for an intermediate-term bear theme.

See more of Steve's Technical Anlysis on equities and Forex here

THERE IS SUBSTANTIAL RISK OF LOSS IN TRADING FUTURES, OPTIONS AND FX PRODUCTS. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.