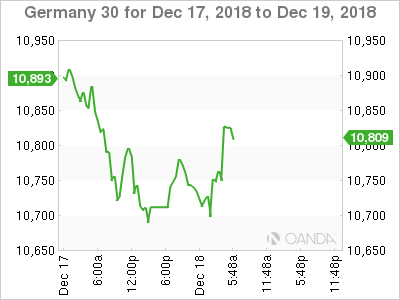

The DAX index has posted considerable gains in the Tuesday, erasing most of the losses seen on Monday. Currently, the index is at 10,818, up 0.70% on the day. In economic news, German Ifo Business Climate dipped to 101.0, down from 1o2.0 and shy of the estimate of 101.8. This is the fourth straight drop for the indicator, as business confidence continues to weaken. On Wednesday, the Federal Reserve is expected to raise the benchmark rate by a quarter-point.

At last week’s policy meeting, the ECB officially terminated its bond-purchasing program (QE), after three years. The program pumped some 2.6 trillion euros into the economy, and played an important role in boosting growth and inflation levels. However, the move comes at a time when the eurozone economy has slowed down, after a strong performance in the first half of 2018. Final CPI dropped to 1.9% in November, down from 2.2% a month earlier. This was below the initial forecast of 2 percent.

The eurozone slowed down in Q3, and all signs point to weak numbers in the fourth quarter as well. Global trade tensions have taken a bite out of eurozone exports, and uncertainty over Brexit and the Italian budget have soured investor confidence and raised risk apprehension.

All eyes will be on the Federal Reserve on Wednesday, which winds up its rate policy meeting. The Fed is expected to raise interest rates on Wednesday, which would mark the fourth rate hike in 2018. The CME has pegged the odds of a rate hike at 69%, down from 80% just one week ago. A key factor in the drop is the latest sell-off in global equity numbers. The week started poorly, as the S&P fell on Monday to its lowest level since October 2017. Rate hikes are unusual when stock markets are swooning, so traders should be prepared for the Fed to send a dovish message to the markets, along with a quarter-point rate hike.

Stocks resume December swoon; Russell 2000 enters bear market territory

A not so “Silent Night” in the markets

Economic Calendar

-

4:00 German Ifo Business Climate. Estimate 101.8

-

2:00 German PPI. Estimate -0.1%

-

14:00 US FOMC Economic Projections

-

14:00 US FOMC Statement

-

14:00 US Federal Funds Rate. Estimate <2.50%

-

14:30 US FOMC Press Conference

Open: 10,744 Low: 10831 High: 10,715 Close: 10,818

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.