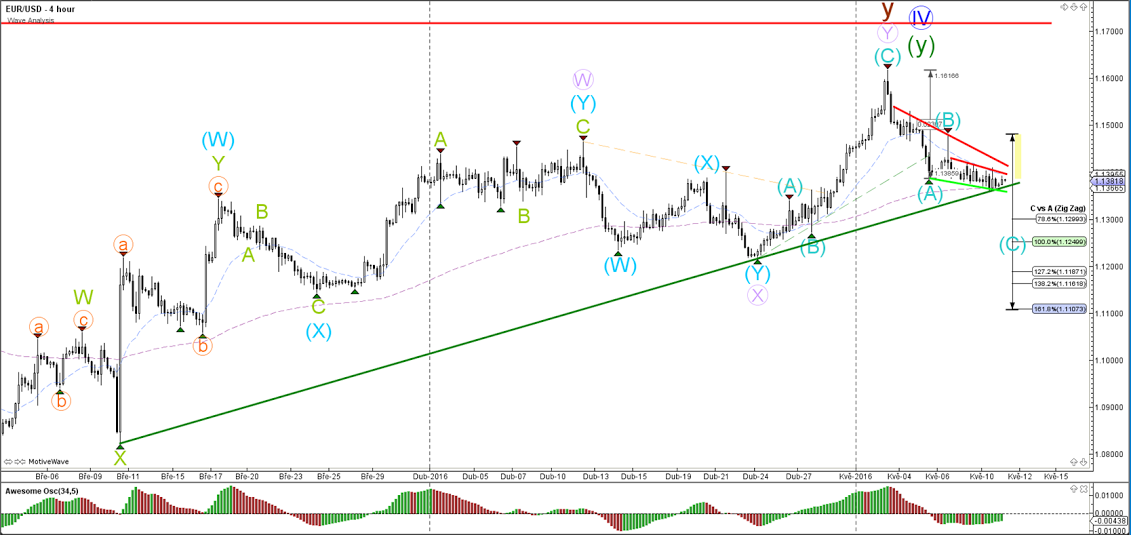

EUR/USD

4 hour

The EUR/USD is entrapped between support trend lines (green) and resistance (red). Price has reached a long-term support trend line (dark green), which is a bounce or break spot. A bullish breakout could indicate a completion of the ABC (blue), whereas a bearish breakout could indicate a continuation of the C wave (blue).

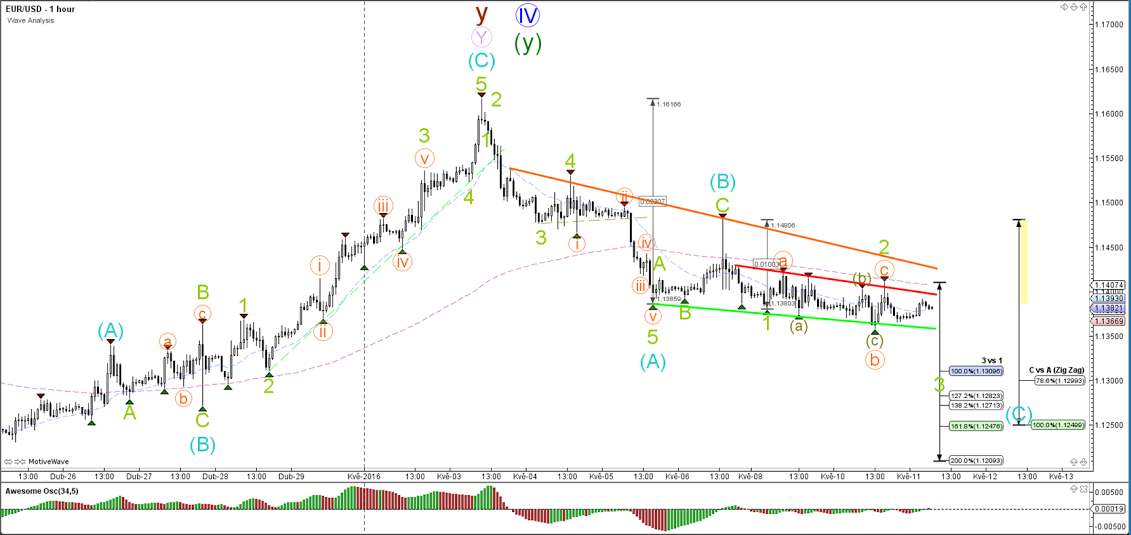

1 hour

The EUR/USD remains in a choppy trend channel. Price keeps respecting the support (green) and resistance (red) levels. A bearish breakout would most likely see price move towards the Fibonacci targets of wave 3 (green) and wave C (blue).

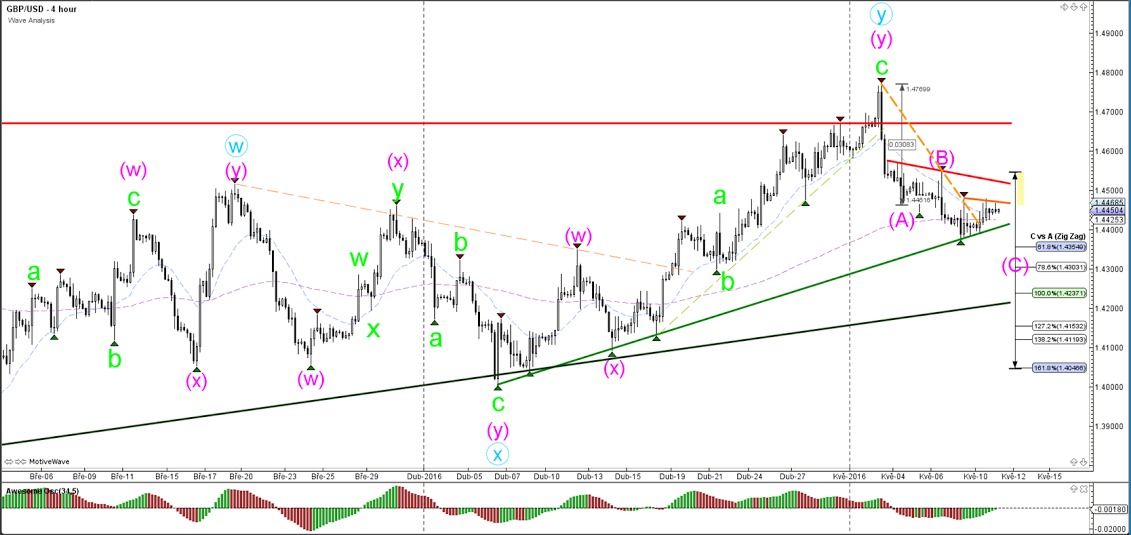

GBP/USD

4 hour

The GBP/USD has also reached a long-term key support trend line (green). A break of the support trend line would confirm the downtrend on the GBP/USD whereas a break of the 2 resistance trend lines (orange-red) could indicate the completion of the ABC (pink) and an expansion of the uptrend.

1 hour

The GBP/USD is still respecting the 61.8% Fibonacci level of wave 2 vs 1. A bearish break below the support trend lines (green) could see price expand wave A (pink) lower via a potential wave 3 (green). A bullish break above resistance (red) invalidates 123 (green) and indicates a bullish breakout.

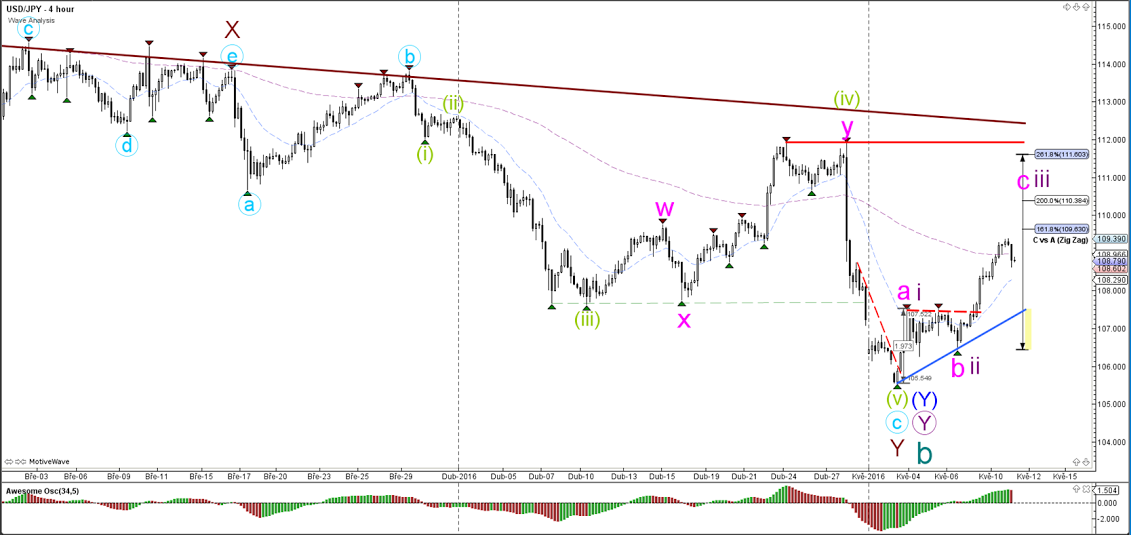

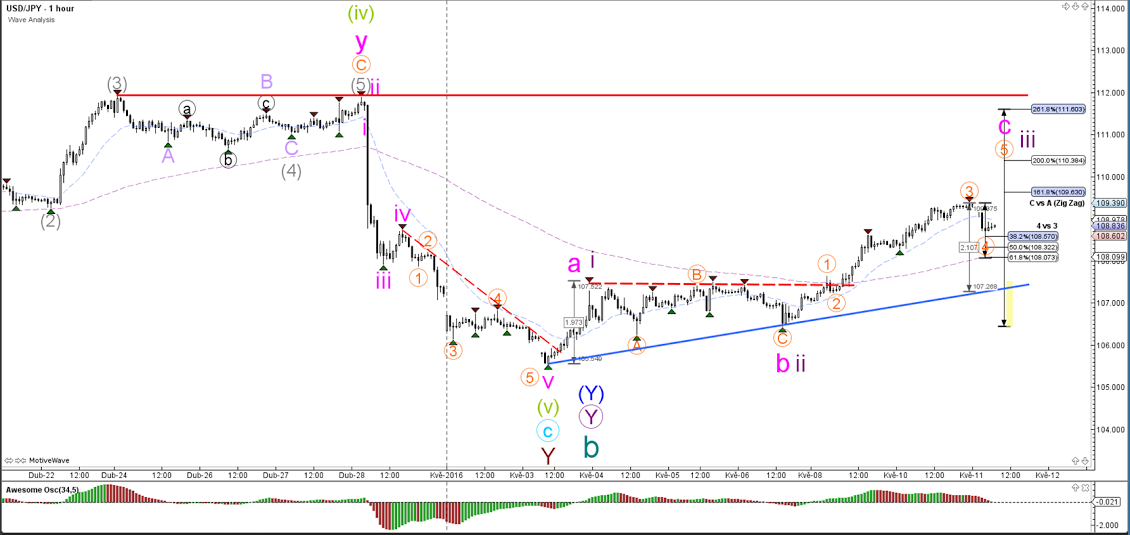

USD/JPY

4 hour

The USD/JPY has reached the 161.8% Fibonacci target. A break above this target favors a wave 3 (purple) whereas a bearish turn makes a wave C (pink) more likely.

1 hour

Whether the USD/JPY will build a wave C (pink) or wave 3 (purple) depends on its price reaction at the Fibonacci levels of wave 4 (orange). Price should typically stop at the 38.2% Fibonacci level and not break below the support trend line (blue) if a wave 4 indeed unfolds.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.