Technical Bias: Bullish

Key Takeaways

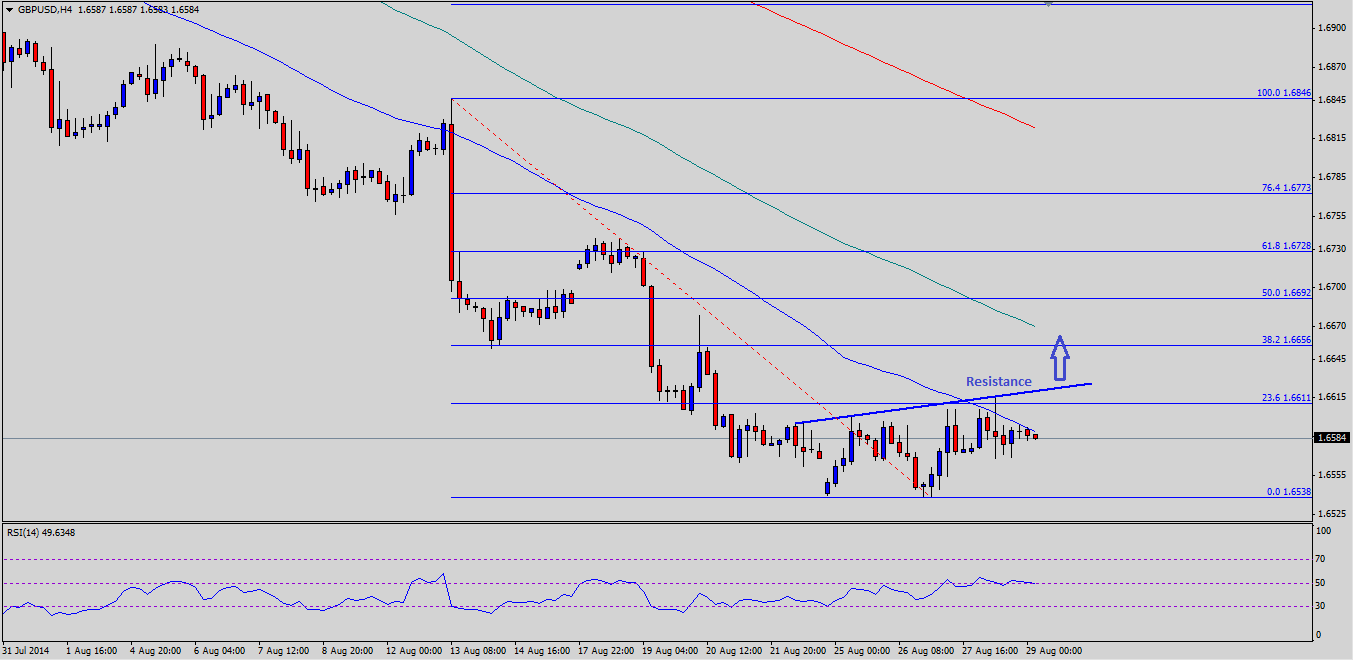

- British pound likely to trade higher against the US dollar as the GBPUSD pair formed a double bottom pattern.

- As long as the pair is trading above the 1.6538 level gains are favored.

- GBPUSD support seen at 1.6538 and resistance ahead at 1.6618.

The British pound weakness might take a pause against the US dollar, as there is a strong chance of a break higher if the GBPUSD pair manages to settle above the 1.6620 level.

UK Gfk Consumer Confidence

The UK Gfk Consumer Confidence was released by the GfK Group earlier during the Asian session. The forecast was of a small rise from -2 to -1. However, the outcome was better than expected, as the UK Gfk Consumer Confidence came in at 1.

Technical Analysis

The GBPUSD pair recently fell towards the 1.6540 support area and failed twice to break the same, which has raised the possibility of a double bottom pattern. There is a major bearish trend line formed on the 4 hour timeframe for the GBPUSD pair. Moreover, the 23.6% Fibonacci retracement level of the last drop from the 1.6846 high to 1.6538 low is also around the highlighted trend line at 1.6620. So, if the pair trades higher, and manages to close above the mentioned resistance level, then there might be a chance of the pair heading towards the 100 simple moving average (SMA) – 4H. The 50% fib retracement level also sits around the 100 SMA (4H). So, the British pound sellers could appear around the 1.6692 level.

On the other hand, if the GBPUSD pair fails to break higher, then a retest of the previous low of 1.6538 is possible. If sellers take control, then a break below the last low might call for more losses in the pair moving ahead.

Overall, as long as the pair is trading above the 1.6540 level buying dips might not be a bad option in the near term.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.