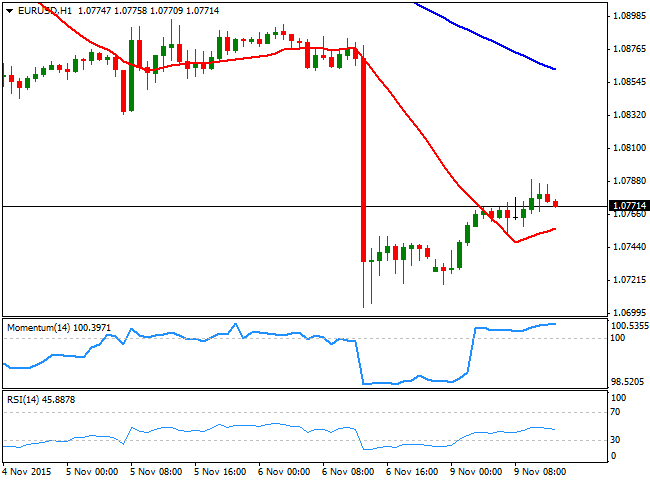

EUR/USD Current price: 1.0763

View Live Chart for the EUR/USD

The American dollar is giving back some of its recent gains this Monday, albeit the decline is barely corrective, given that the greenback has reached overbought levels against most of its rivals last Friday. The EUR/USD pair has reached a daily high of 1.0789 as local share markets retreated some, but the upside remains limited. Early data showed that German trade balance reached a surplus of €22.9 billion in September 2015, whilst exports and imports jumped well above expected in September, reversing the declines from previous months. With only some minor reports scheduled for the American session, the pair remains below the 1.0800 level, with limited upward potential in the short term, as the 1 hour chart shows that the Momentum indicator has host its upward strength after recovering above its 100 level, whilst the RSI indicator is resuming its decline around 45, having corrected the extreme oversold readings reached last Friday. In the 4 hours chart, the 20 SMA maintains a strong bearish slope above the current price, offering an immediate resistance around 1.0820, whilst the technical indicators have turned south well below their mid-lines and after correcting extreme oversold readings, supporting further declines particularly on a break below 1.0700.Support levels: 1.0745 1.0700 1.0660

Resistance levels: 1.0800 1.0845 1.0890

GBP/USD Current price: 1.5090

View Live Chart for the GPB/USD

The GBP/USD pair posted a daily high of 1.5114, but struggles to hold above the 1.5400 level ahead of the US opening. There were no fundamental releases in the UK this Monday, and with little ahead in the US, the pair may well remain directionless during the American session. Technically, the 1 hour chart shows that the price is now above a flat 20 SMA, whilst the technical indicators have extended from extreme oversold readings into positive territory, lacking upward momentum at the time being. In the 4 hours chart, the price remains well below a sharply bearish 20 SMA, whilst the technical indicators have corrected the extreme readings, but are regaining the downside in oversold territory, maintaining the risk towards the downside.

Support levels: 1.5080 1.5035 1.5000

Resistance levels: 1.5095 1.5130 1.5160

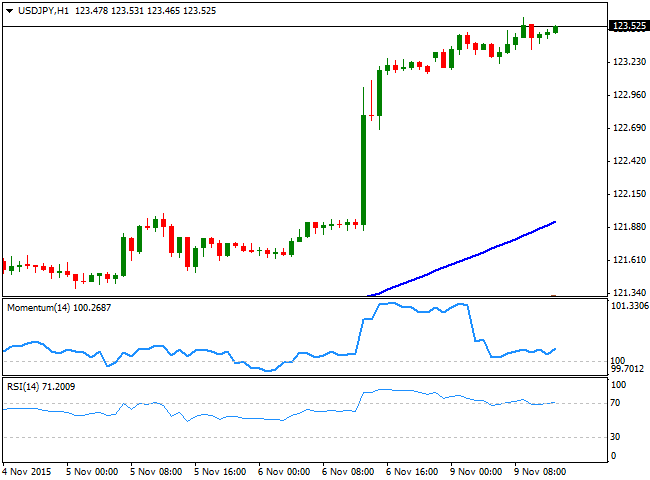

USD/JPY Current price: 123.51

View Live Chart for the USD/JPY

Overbought, but no signs of reversing. The USD/JPY pair advanced up to 123.59 and remains nearby, holding to its latest gains and pointing to extend its advance during the upcoming sessions, given that the 1 hour chart shows that the Momentum indicator has erased all of its overbought readings down to its mid-line, from where it is now bouncing, while the RSI indicator stands flat around 70. In the same chart, the 100 SMA has advanced far above the 200 SMA, but both remain well below the current level. In the 4 hours chart the price is holding near its highs whilst the technical indicators look slightly exhausted towards the upside. Nevertheless, the upside remains favored, with a break above 123.80 opening doors for an advance towards the year high at 125.80.

Support levels: 122.80 122.50 122.20

Resistance levels: 123.35 123.80 124.25

AUD/USD Current price: 0.7057

View Live Chart for the AUD/USD

The Australian dollar opened with a downward gap against its American rival, following poor Chinese trade balance data released over the weekend. The AUD/USD however, held above Friday's low of 0.7031 and advanced up to 0.7069 before retreating some. Confined in a tight range, the 1 hour chart shows that the price is above a mid bullish 20 SMA, whilst the Momentum indicator turns lower above its 100 level and the RSI indicator also turns lower but at 42, increasing the risk of a downward continuation. In the 4 hours chart, the price is well above a bearish 20 SMA, whilst the technical indicators are gaining bearish slopes below their mid-lines and after correcting oversold readings, supporting the shorter term view.

Support levels: 0.7030 0.6980 0.6940

Resistance levels: 0.7070 0.7110 0.7150

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.