EUR/USD Current price: 1.1111

View Live Chart for the EUR/USD

ECB's President, Mario Draghi, surprised the markets with his announcement this Thursday, which lead to one of the largest EUR/USD intraday declines in almost two months. The Central Bank statement signaled that the ECB may add additional stimulus in December, either by expanding its assets purchases, or lowering the deposit rate further below zero, something that officials even discussed this month. The pair plunged also on the back of positive US data, which fueled dollar's demand. Weekly unemployment claims, in the North American country fell to 259 against expectations of 266K, sending the four-week average to its lowest since 1973. Additionally, US Existing Home sales rebounded strongly in September, increasing by 4.7% to a seasonally adjusted annual rate of 5.55M. European stocks soared after the news, and the US indexes followed, closing at their highest since mid August.

The EUR/USD pair approached 1.1100 by the end of the US session, and consolidates near the mentioned low, with no signs of changing bias any time soon. Nevertheless, the pair has reached a major long term support area, and given that the pair lost over 200 pips pretty much straight, it may attempt an upward corrective movement before resuming its decline. Short term, the 1 hour chart shows that the technical indicators have lost their bearish strength, but hold in extreme oversold levels, while in the 4 hours chart, the Momentum indicator maintains a sharp bearish slope near oversold territory and the RSI indicator stands at 19. The next strong support comes at 1.1080, a long term ascendant trend line coming from 1.0591, April monthly low, which if broken, should lead to a test of the 1.1000 critical figure in the near term.

Support levels: 1.1080 1.1040 1.1000

Resistance levels: 1.1160 1.1200 1.1245

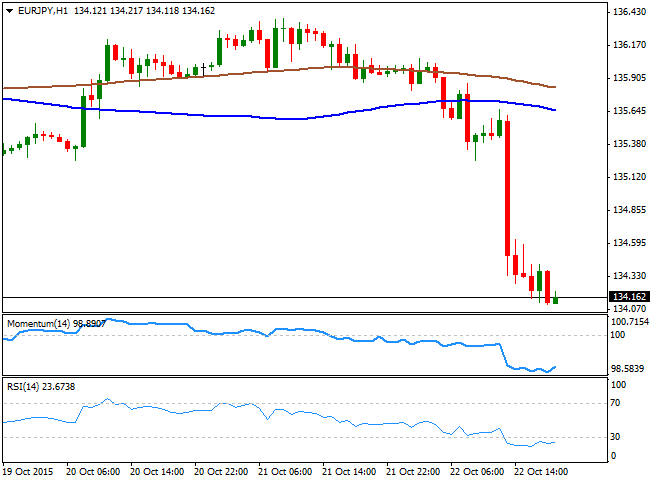

EUR/JPY Current price: 134.16

View Live Chart for the EUR/JPY

The EUR/JPY pair followed suit, dropping down to 134.11, a fresh 3-week low, as investors dropped the common currency on the back of an ultra-dovish stance from the ECB. The pair fell through its 100 DMA and is now pointing to close the day below the 200 DMA, at 134.50, which points for a continued decline over the upcoming sessions. Short term, the 1 hour chart shows that the price has declined far below its moving averages, whilst the technical indicators have lost their bearish strength and turned slightly higher, still in oversold territory. In the 4 hours chart, the Momentum indicator maintains its strong bearish slope, whilst the RSI heads lower around 28, all of which supports additional declines on a break below 134.00, the immediate support.

Support levels: 134.00 133.65 133.30

Resistance levels: 134.50 134.90 135.40

GBP/USD Current price: 1.5391

View Live Chart for the GPB/USD

The British Pound enjoyed of some temporal strength, at the beginning of the European session, advancing up to 1.5507 following the release of the UK Retail Sales figures for September. Sales in the UK grew by 1.9% monthly basis, against expectations of a 0.4% advance, whilst compared to a year before, sales jumped by 6.5% against the 4.8% expected. The pair however, was unable to sustain gains beyond the 1.5500 level, quickly pulling back down, and accelerating its decline on broad dollar's demand triggered by the ECB. The slide was moderate, with the pair setting a daily low of 1.5368 and consolidating below the 1.5400 level in the American afternoon. Technically, the 1 hour chart shows that the price is now below a mild bearish 20 SMA, whilst the technical indicators have turned slightly higher below their mid-lines, limiting chances of a continued decline. Also, the price is holding above the 50% retracement of its latest bearish at 1.5380, the immediate support. In the 4 hours chart, the 20 SMA is slowly turning lower around 1.5445, whilst the technical indicators present bearish slopes below their mid-lines, in line with further declines as long as 1.5415, attracts selling interest.

Support levels: 1.5380 1.5350 1.5320

Resistance levels: 1.5415 1.5450 1.5495

USD/JPY Current price: 120.64

View Live Chart for the USD/JPY

The USD/JPY surged to 120.74, an almost one month high, boosted by a strong advance in European and American stocks, after the ECB's President, Mario Draghi, announced the Central Banks is ready to throw more money into the economy. The pair has been advancing on speculation the Bank of Japan will increase its stimulus in its upcoming economic policy meeting by the ends of October, but with no momentum, until today. The pair broke above the 120.35 level, now an immediate support, as per being the 50% retracement of the latest weekly decline. Short term, the 1 hour chart shows that the price has advanced above a now bullish 100 SMA, whilst the technical indicators present strong upward slopes, despite being in overbought territory. In the 4 hours chart, the technical indicators also head higher in overbought territory, with no aims of changing bias any time soon. Renewed advances should lead to the test of a critical resistance and the top of the latest range at 121.35 the level that capped the upside since late August.

Support levels: 120.35 120.00 119.70

Resistance levels: 120.90 121.35 121.80

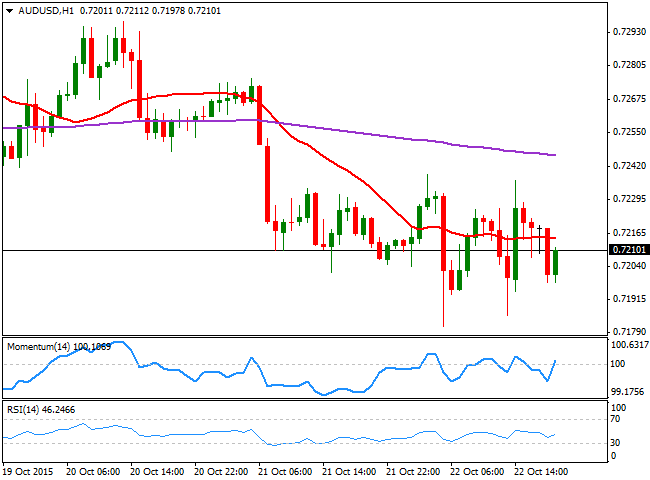

AUD/USD Current price: 0.7208

View Live Chart for the AUD/USD

The AUD/USD pair closed the day with limited losses, but not before setting a fresh weekly low of 0.7181 during the previous Asian session, following a sharp decline in Chinese stocks. The pair hovered between gains and losses afterwards, finally ending the day a few pips above the 0.7200 level, helped by the sharp advance in stocks. During the upcoming hours, China will release some minor housing data, alongside with the September CB Leading Economic index, and while none of them is usually a big market mover, disappointing results may put the Aussie under pressure. Short term, the 1 hour chart presents a neutral stance, with the price developing a few pips below a horizontal 20 SMA and the technical indicators hovering around their mid-lines with no actual directional strength. In the 4 hours chart however, the bearish tone prevails, as the 20 SMA maintains a strong bearish slope above the current level, whilst the technical indicators turned south in negative territory, after failing to extend beyond their mid-lines.

Support levels: 0.7180 0.7135 0.7100

Resistance levels: 0.7240 0.7290 0.7335

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.