EUR/USD Current price: 1.1337

View Live Chart for the EUR/USD

Majors were trading in their weekly dull ranges at the beginning of this Wednesday, but a sudden decline in gold prices following Wall Street's opening, was the kickoff signal for the greenback to rally. Ending the day with uneven gains, the American currency is higher against all of its majors rivals, with the EUR/USD pair being the most reluctant to move far away, as investors are waiting for the ECB policy meeting outcome this Thursday. The European Central Bank is largely expect to maintain its ongoing stimulus unchanged, with Draghi offering a dovish tone, and aiming to down talk the EUR, as the currency has returned to the levels it was in January, when the ECB launched its QE program.

The pair remained confined to a 50 pips range ever since the day started, and trades a handful of pips below the daily opening by the US close. The technical picture is neutral-to-bearish in the short term, as in the 1 hour chart, the technical indicators present mild bearish slopes below their mid-lines, whilst the price is below its moving averages that anyway lack clear directional strength. In the 4 hours chart, the price is hovering around a mild bearish 20 SMA, whilst the technical indicators remain stuck around their mid-lines. The upcoming moves will be determinate by the ECB's decision, with the main support being at 1.1280, and the main resistance at 1.1400, where selling interest has contained advances ever since the week started.

Support levels: 1.1310 1.1280 1.1240

Resistance levels: 1.1385 1.1420 1.1460

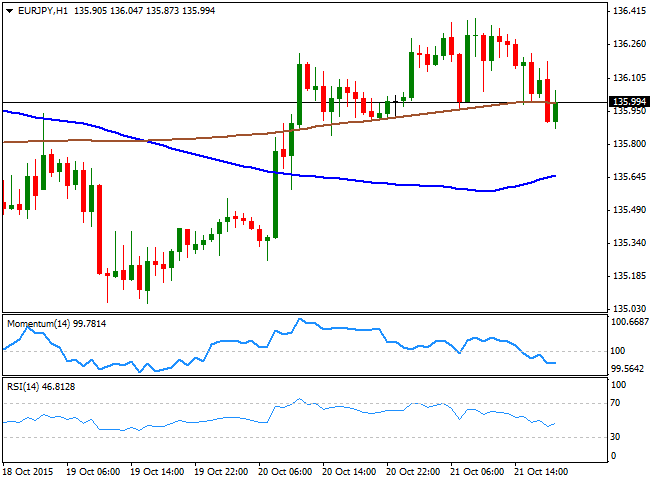

EUR/JPY Current price: 135.99

View Live Chart for the EUR/JPY

The EUR/JPY closed the day unchanged around the 136.00 level, after advancing up to 136.38 intraday. The Japanese yen came under selling pressure after the release of worse-than-expected local trade balance figure during the previous Asian session, posting a sixth consecutive deficit monthly basis, against expectations of a ¥84.4B surplus. Nevertheless, the lack of interest in the EUR kept the pair within a limited range and its currently turning short term bearish, given that the 1 hour chart shows that the price is struggling to hold above its 200 SMA and that the technical indicators have entered negative territory, presenting a limited bearish potential at the time being. In the 4 hours chart, the price holds above its 100 and 200 SMAs that present a mild positive tone, whilst the Momentum indicator aims higher above the 100 level, but the RSI indicator turned lower around 53.

Support levels: 135.85 135.50 135.10

Resistance levels: 136.20 136.65 137.10

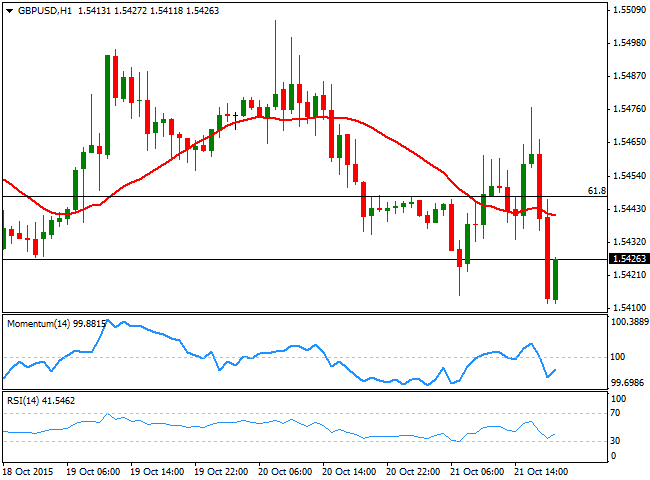

GBP/USD Current price: 1.5426

View Live Chart for the GPB/USD

The GBP/USD pair fell as low as 1.5411 during the American afternoon, following BOE's Governor Mark Carney speech on the economic impact of a possible 'Brexit.' Despite he made no references to economic policies in the UK, Carney highlighted the positive effects of belonging to the EU, and said that the Bank may need to adjust its monetary policy accordingly to the result of the referendum. The UK will release its September Retail Sales figures for September this Thursday, expected to have risen by 0.4% from a previous monthly reading of 0.2%. The Pound may get a boost from better-than-expected readings, but the latest decline, with the pair now pressuring the lows of its latest range, increases chances of a downward continuation for this Thursday. The 1 hour chart presents a mild negative tone, with the price now extending below its 20 SMA and the technical indicators in negative territory, albeit lacking directional strength. In the 4 hours chart, the price failed to sustain gains on an early advance spike above its 20 SMA, whilst the technical indicators turned south and maintain strong bearish slopes in negative territory, in line with further declines.

Support levels: 1.5415 1.5380 1.5350

Resistance levels: 1.5450 1.5495 1.5530

USD/JPY Current price: 119.91

View Live Chart for the USD/JPY

The USD/JPY pair advanced up to 120.08, ending the day around the 120.00 level, extending its tepid rally for a fifth day in-a-row. Ever since bottoming at 118.05 last week, the pair has been advancing slowly, but steadily, mostly as latest disappointing Japanese data suggest the BOJ will extend its stimulus in its upcoming meeting by then ends of October. Wednesday's rally came after the Japanese September trade balance posted a deficit of ¥114.5B against market's expectations of a ¥84.4B surplus. Imports resulted better than expected, falling by 11.1% against market's forecast of an 11.7% decline, while exports grew by 0.6%. The 1 hour chart shows that the price has advanced further above its moving averages whilst the 100 SMA accelerated its advance, but remains below the 200 SMA. In the same chart however, the technical indicators have lost their early strength and turned flat around their mid-lines. In the 4 hours chart, the price stalled its advance around the 200 SMA, whilst the technical indicators are also losing their upward strength but holding well above their mid-lines.

Support levels: 119.70 119.35 118.90

Resistance levels: 120.35 120.70 121.10

AUD/USD Current price: 0.7222

View Live Chart for the AUD/USD

The AUD/USD pair plunged at the beginning of the day, weighed by a sharp decline in Chinese stocks and weaker commodity prices. The Aussie traded as low as 0.7201 during the American afternoon following the sharp decline in gold prices, with intraday bounces now finding selling interest around the 0.7240 level. Technically, the pair is poised to extend its decline in the short term, as the 1 hour chart shows that the price remains well below a strongly bearish 20 SMA, whilst the technical indicators consolidate in negative territory, rather reflecting the lack of downward momentum than suggesting downside exhaustion. In the 4 hours chart, the 20 SMA accelerated its decline above the current level, whilst the RSI indicator remains flat around 38, and the Momentum indicator aims higher, but remains below its 100 level. Should the price extend its decline below the 0.7200 figure, the bearish potential will increase, with the market then targeting 0.7130.

Support levels: 0.7205 0.7170 0.7130

Resistance levels: 0.7240 0.7290 0.7335

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.