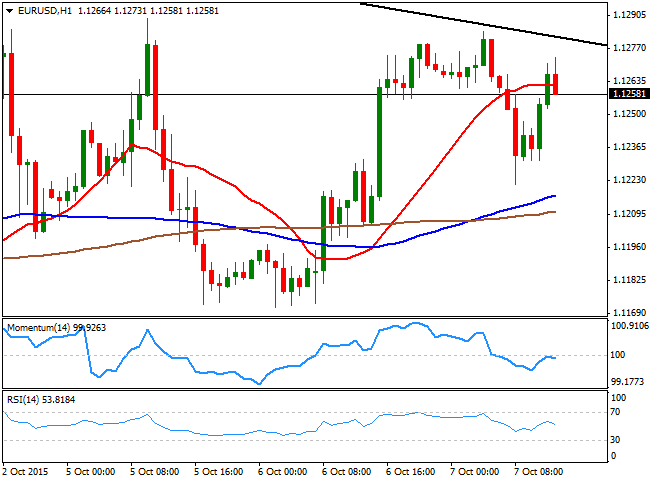

EUR/USD Current price: 1.1252

View Live Chart for the EUR/USD

The American dollar is in trouble this Wednesday, down against all of its major rivals. The common currency however, has been reluctant to extend its rally, with the EUR/USD pair having retreated from a daily high of 1.1283 amid poor German Industrial Production reading for August, down 1.2% monthly basis. The pair has bounced however from a daily low of 1.1221, but is still limited by selling interest around the daily descendant trend line coming from 1.1713. Technically, the 1 hour chart shows that the price is also unable to settle above a flat 20 SMA, whilst the technical indicators are turning south after failing to overcome their mid-lines. In the 4 hours chart, the technical indicators maintain the neutral stance seen on previous updates, although the price is above a now bullish 20 SMA that should keep the downside limited during the upcoming hours.

Support levels: 1.1245 1.1200 1.1160

Resistance levels: 1.1285 1.1335 1.1370

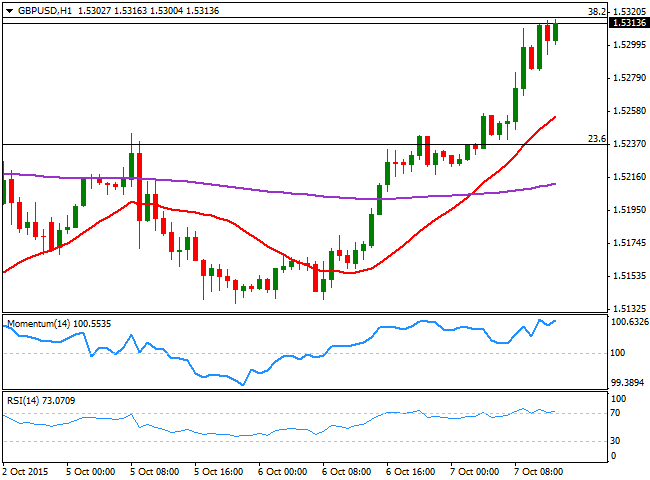

GBP/USD Current price: 1.5315

View Live Chart for the GPB/USD

The British Pound surged to a fresh 2-week high against its American rival during the European session, boosted by strong manufacturing and industrial production figures, which reversed the previous negative tone in August. The pair's advance reached 1.5315, the 38.2% retracement of its latest daily decline, before the US opening, and consolidates a bunch of pips below it, presenting a strong upward tone in the 1 hour chart, as the technical indicators maintain their bullish slopes, despite being in overbought territory. In the 4 hours chart, the RSI indicator has lost its upward strength in overbought territory, whilst the Momentum indicator also lacks directional strength well above its mid-lines. Should the price accelerate above the mentioned Fibonacci resistance, the advance can extend up to 1.5360, en route to the 1.5400 figure.

Support levels: 1.5260 1.5220 1.5170

Resistance levels: 1.5315 1.5360 1.5400

USD/JPY Current price: 120.09

View Live Chart for the USD/JPY

Lower on BOJ's on-hold stance. Pretty much as expected, the Bank of Japan economic policy meeting of this October 7th passed with no changes, and the Japanese yen appreciated afterwards, despite risk appetite prevailed among stocks' traders. The USD/JPY pair fell down to 119.75 intraday, but recovered back above the 120.00 level, where is now consolidating with a pretty neutral technical stance, both short and long term. The 1 hour chart shows that the technical indicators recovered from oversold levels, but turned flat below their mid-lines, whilst the price is stuck around the 100 and 200 SMAs, both converging with the current price. In the 4 hours chart, the price is a handful of pips below its moving averages, while the technical indicators are also flat around their mid-lines. Given that stocks in Europe and America present a positive tone, the downside in the pair seems limited, with the immediate resistance now at 120.35, followed later by the 120.70 price zone.

Support levels: 119.70 119.35 118.90

Resistance levels: 120.35 120.70 121.00

AUD/USD Current price: 0.7227

View Live Chart for the AUD/USD

The AUD/USD pair surged to a fresh 3-week high where its stands, well above the 0.7200 level, with the Aussie finding support in the continued advance in commodities' prices. The pair seems overbought short term, although there is no technical signal of exhaustion, as the 1 hour chart shows that the price continues advancing above a bullish 20 SMA, whilst the technical indicators maintain their bullish slopes, despite being in overbought territory. In the 4 hours chart, the 20 SMA accelerated its advance and it's about to cross above the 200 EMA around 0.7110, while the technical indicators maintain their strong bullish slopes in extreme overbought territory.

Support levels: 0.7185 0.7145 0.7110

Resistance levels: 0.7230 0.7280 0.7330

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.