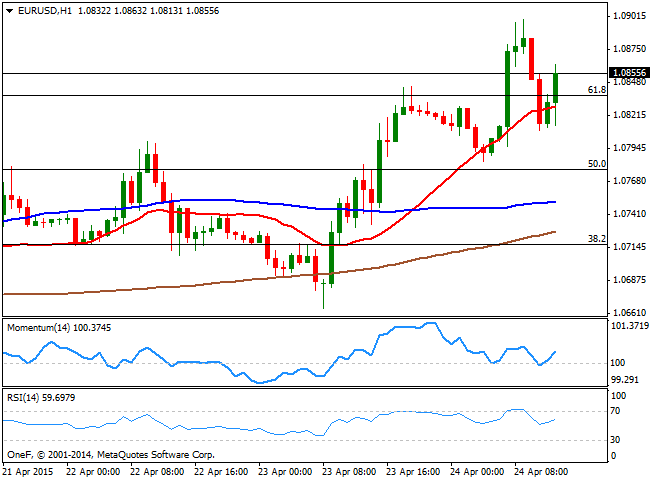

EUR/USD Current price: 1.0855

View Live Chart for the EUR/USD

The EUR/USD surged to a daily high of 1.0899 on hopes Greece was about to reach a deal with its creditors, only to sunk down to 1.0809 on the back of EU officers reviling Greek Finance Minister Yanis Varoufakis. European ministers seem to be outraged by Varoufakis having failed to deliver once again, a serious list of economic reforms, and was accused to be an amateur, according with "a person familiar to the conversations." Spain minister De Guindos claimed that no substantial progress was made on Greece, and that was the only official comment I was able to find so far. Anyway, earlier in the day, German IFO survey showed local confidence improved more than expected in April, with the Business Climate up to 108.60. In the US, Durable Goods Orders in March surged 4.0%, reversing previous month decline, albeit the core reading disappointed, down -0.2%. Worse than expected US data helped the EUR/USD pair recover above 1.0840, the 61.8% retracement of its latest daily decline.

Technically, the 1 hour chart shows that the price stands above its 20 SMA whilst the technical indicators bounced from their mid-lines and maintain a bullish slope. In the 4 hours chart the technical indicators hold above their mid-lines albeit lack directional strength, whilst the price stands well above its moving averages in the 1.0740/60 region. If the pair manages to hold above 1.0845, chances are of an advance towards the 1.0900 figure, whilst a break below 1.0800 exposes it to a continued decline towards the 1.0740/60 price zone.

Support levels: 1.0840 1.0800 1.0760

Resistance levels: 1.0900 1.0950 1.1000

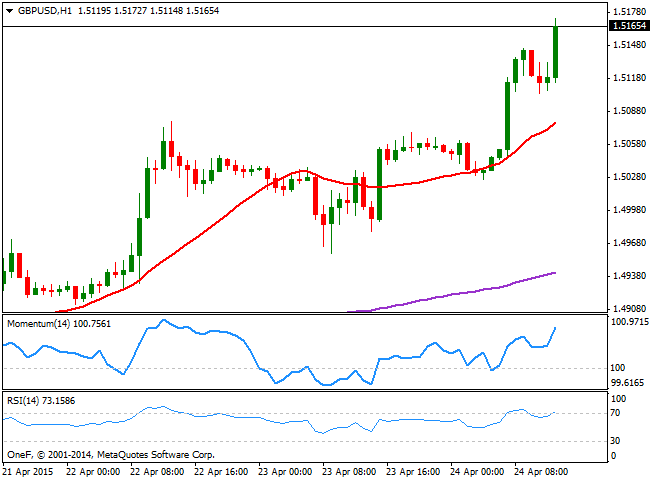

GBP/USD Current price: 1.5164

View Live Chart for the GBP/USD

The GBP/USD pair traded as high as 1.5145, a fresh 1-month high in the European morning, boosted by market's optimism. Having found buyers on retracements towards the 1.5100 region, the pair accelerates north after tepid US data and trades at levels not seen since early March above 1.5160. The 1 hour chart shows that following a limited correction from overbought levels, the technical indicators are heading strongly north in overbought levels whilst the price extends further above its 20 SMA. In the 4 hours chart the technical indicators also head strongly north in overbought territory, with scope now to test the 1.5200 figure, should dollar decline extends.

Support levels: 1.5135 1.5100 1.5065

Resistance levels: 1.5165 1.5200 1.5240

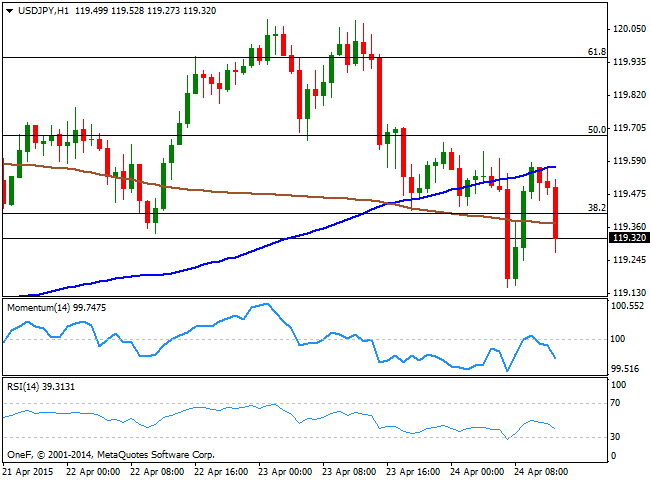

USD/JPY Current price: 119.32

View Live Chart for the USD/JPY

The USD/JPY recovered from a daily low of 119.14 reached during the past Asian session, albeit retreats from a session high in the 119.60 region following poor US Durable Goods Orders. The 1 hour chat shows that the technical indicators turned sharply lower around their mid-lines, whilst the price is being rejected from its 100 SMA, all of which favors additional declines. In the 4 hours chart the price has held below its 100 SMA ever since Thursday's US session, whilst the technical indicators head slightly lower below their mid-lines, supporting the shorter term view. A break below the 119.00 figure however, is required to confirm additional declines, eyeing the 118.60 region as the next bearish target.

Support levels: 119.00 118.60 118.20

Resistance levels: 119.65 120.10 120.50

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.