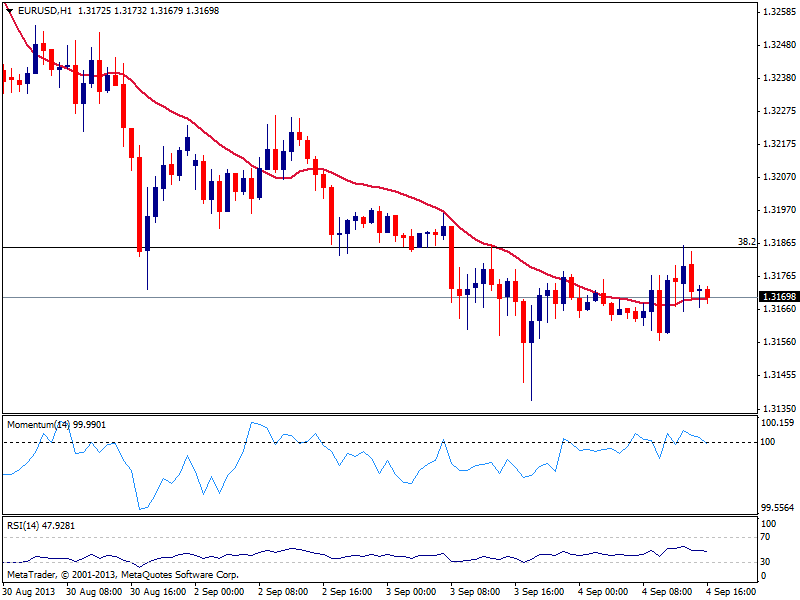

EUR/USD Current price: 1.3169

View Live Chart for the EUR/USD

So you think is worth trading the EUR/USD? Think twice: the world has reduced to a 30 pips range for the past 48 hours, with a short lived spike of 20 pips to the 1.3137 low yesterday in the middle. Market needs a trigger, and won’t find it today, with the ECB on Thursday and US NFP on Friday. Both events may provide some action, with the ECB having the less chances of triggering strong movements in the pair, as there’s little the Central Bank can do at this point. In the meantime, the pair continues trading below 1.3185, 38.2% retracement of its latest bullish run, and with intraday charts presenting a neutral stance. The 1.3100 level stands as the 50% retracement of the same rally, and stops below it will likely continue building over the next 24 hours, with 1.3250 as last probable, but not likely, bullish target for today.

Support levels: 1.3140 1.3100 1.3060

Resistance levels: 1.3180 1.3210 1.3250

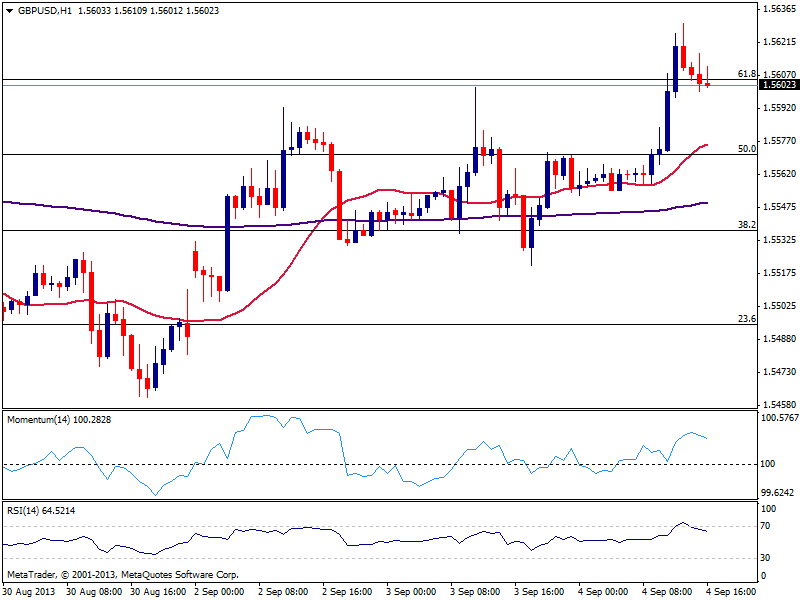

GBP/USD Current price: 1.5608

View Live Chart for the GBP/USD

The GBP/USD maintains the bullish tone based on stronger UK data, breaking above the 61.8% retracement of its latest daily fall at 1.5605. Struggling around the level, the hourly chart shows indicators turning lower, correcting overbought readings in the short term. The 4 hours chart shows indicators also losing upward potential in positive territory, although far from turning bearish: price needs to accelerate below 1.5900 to lose the upward potential, at least in the short term.

Support levels: 1.5590 1.5550 1.5520

Resistance levels: 1.5630 1.5660 1.5700

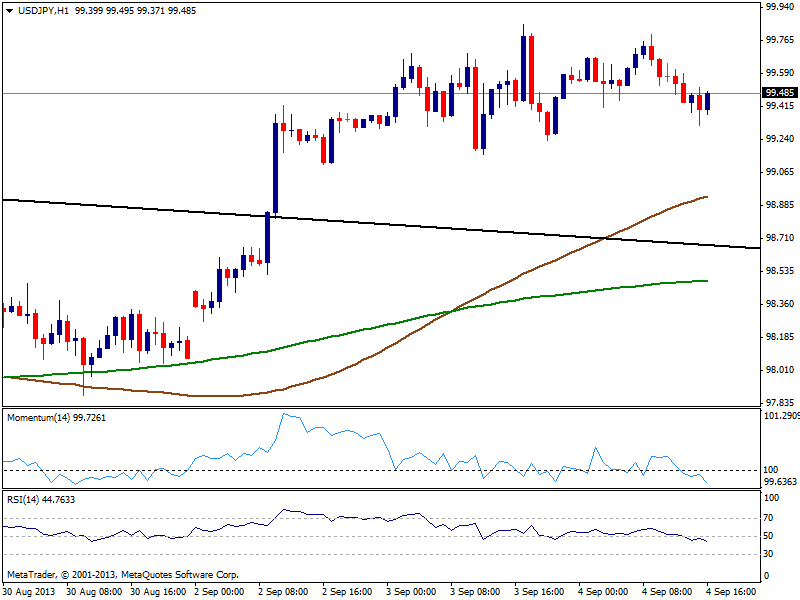

USD/JPY Current price: 99.47

View Live Chart for the USD/JPY

Unchanged since last updates, the pair lost some ground after the release of worse than expected US Trade Balance, with the hourly chart showing an increasing bearish potential, as indicators turn south below their midlines. However, buyers continue to appear on approaches to the 99.20/30 area, and there’s little room for falls beyond it ahead of key data later this week.

Support levels: 99.20 98.90 98.50

Resistance levels: 99.70 100.00 100.30

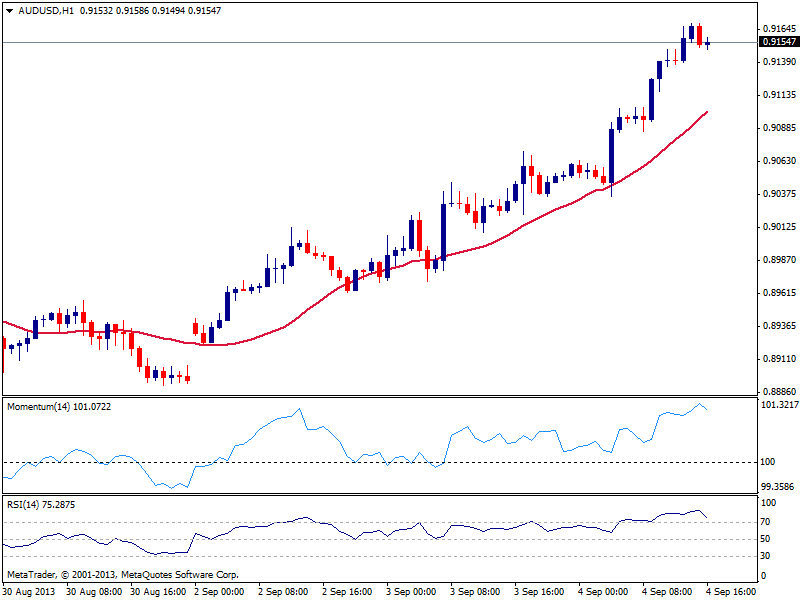

AUD/USD Current price: 0.9154

View Live Chart for the AUD/USD

Commodity currencies outperform this Wednesday, with the AUD/USD surging up to 0.9169 and holding nearby. The hourly chart shows indicators in extreme overbought levels, losing the upward potential yet still not suggesting a downward correction, while the 4 hours chart shows the same picture. As long as above 0.9140, the upside is favored in the short term, with scope to test the 0.9200 level later today.

Support levels: 0.9140 0.9070 0.9025

Resistance levels: 0.9170 0.9200 0.9250

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.