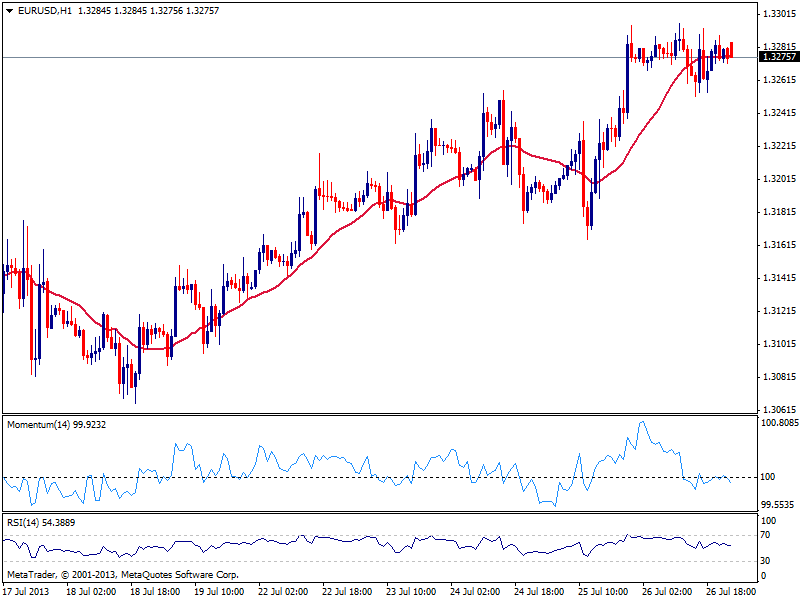

EUR/USD Current price: 1.3275

View Live Chart for the EUR/USD

Little change for the EUR/USD as the week starts, as investors await news from Central Banks: later this week, both the FED and the ECB will have their monetary policy meetings. As for the technical picture, short term the pair stands in range, hovering around its 20 SMA in the hourly chart and indicators around their midlines, showing not much interest around at the time being. Trapped in between 1.3250 and 1.3300 since Thursday, a break of either extreme may trigger some stops and produce a 30/50 pips range. The 4 hours chart maintains the bullish tone, which reflects bulls are still in control. Dips may be seen as buying opportunities even if the pair eases down to the 1.3200 area.

Support levels: 1.3255 1.3210 1.3170

Resistance levels: 1.3295 1.3330 1.3365

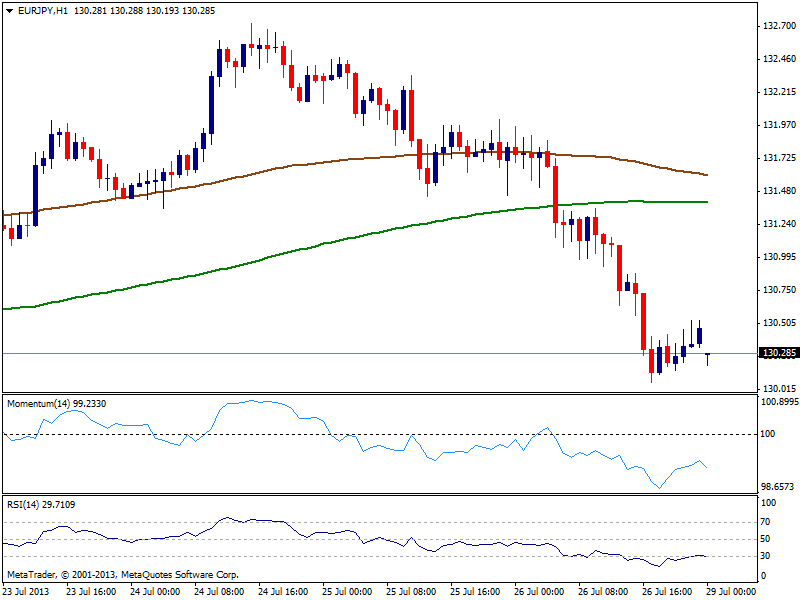

EUR/JPY Current price: 130.28

View Live Chart for the EUR/JPY

Yen stands among the strongest currencies across the board these days, and the EUR/USD approaches 130.00 figure, maintaining a bearish tone both in the short and the longer term. The hourly chart shows price well below moving averages and indicators heading lower in negative territory, supporting a retest of Friday low of 130.00; a break below this last should signal a stronger bearish continuation, eyeing the 128.80 level.

Support levels: 130.00 129.40 128.80

Resistance levels: 130.60 131.00 131.70

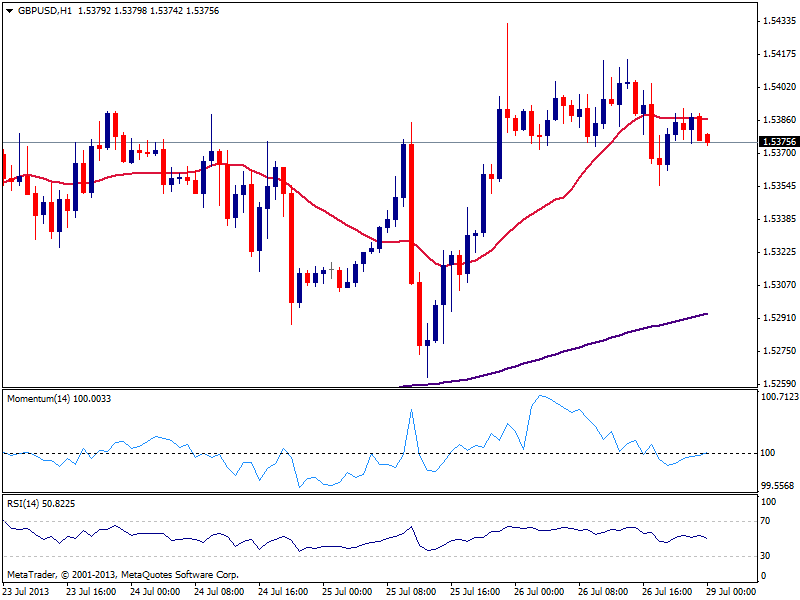

GBP/USD Current price: 1.5375

View Live Chart for the GBP/USD

The GBP/USD consolidates its recent gains, holding pretty well near the 1.5400 area. Despite the slightly negative tone seem in the hourly chart, with price below 20 SMA and indicators below their midlines, the movement seems barely corrective and far from suggesting a reversal. In the 4 hours chart price develops above a flat 20 SMA that offers dynamic support around 1.5360, while indicators head north right above their midlines, which supports an upward continuation, as bearish corrections stand above the 1.53 level

Support levels: 1.5360 1.5320 1.5290

Resistance levels: 1.5410 1.5445 1.5480

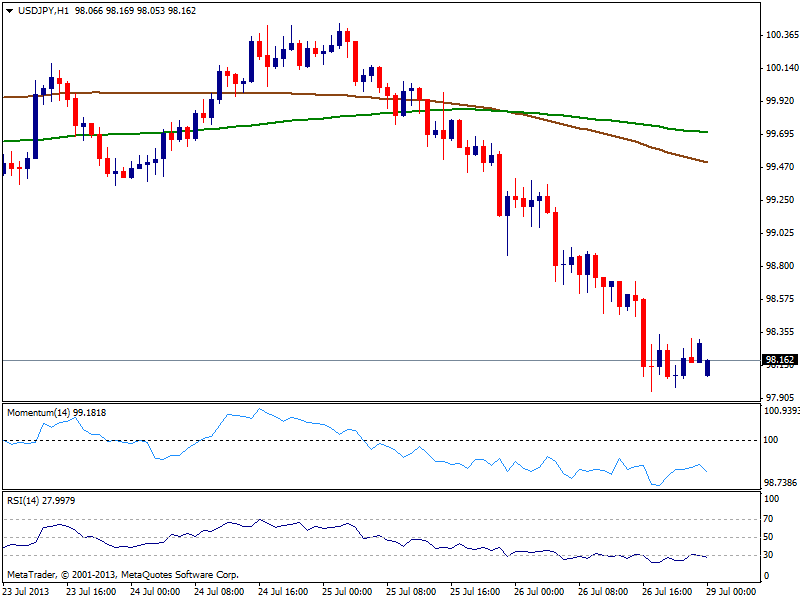

USD/JPY Current price: 98.16

View Live Chart for the USD/JPY

The USD/JPY starts the day below its 100 DMA, currently at 98.45 and immediate resistance level. The hourly chart presents a strong bearish tone, with price well below moving averages, both heading lower above current price, and indicators pointing south after correcting some oversold readings. The 4 hours chart shows a stronger bearish momentum, with past Friday low of 97.95 as level to break to confirm another leg lower.

Support levels: 97.95 97.60 97.20

Resistance levels: 98.45 98.80 99.25

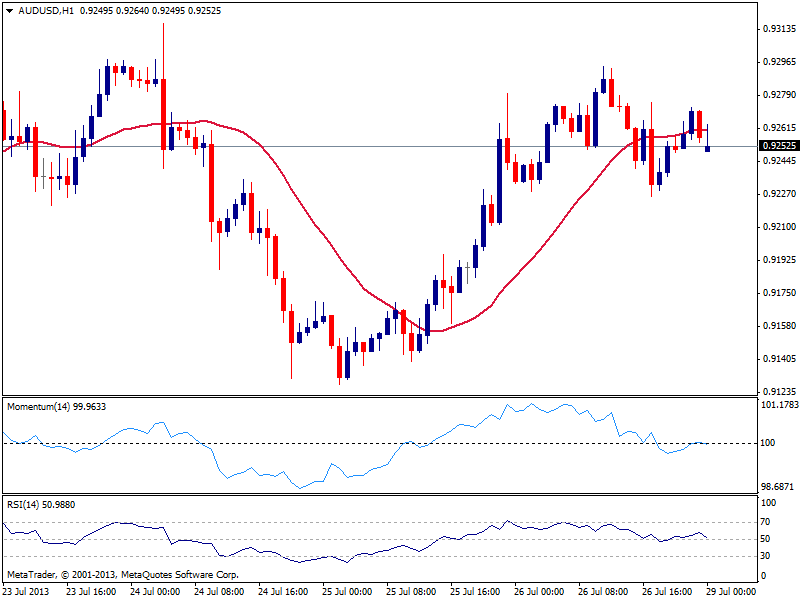

AUD/USD Current price: 0.9252

View Live Chart for the AUD/USD

Opening slightly lower, the AUD/USD stands around the 0.9250 area, pretty neutral according to the hourly chart, with price hovering around its 20 SMA and indicators around their midlines. In the 4 hours chart, technical readings are also neutral, as the price has been trading in between 0.9100 and 0.9300 for already 2 weeks, leaving the pair directionless at the time being. If something, it will be dollar weakness the one setting a trend in the pair the upcoming Wednesday, although Aussie is far from strong and bulls will need to beat sellers waiting around 0.9380 before calling it a victory.

Support levels: 09220 0.9180 0.9135

Resistance levels: 0.9270 0.9310 0.9350

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.