After an early surge to new 2019 highs, both major oil contracts have given up large chunks of their weekly gains. WTI is down for the third consecutive day, while Brent is down for the second day. Prices were barely hanging onto their now small weekly gains at the time of writing. Prior to this week, Brent had risen for five and WTI for eight consecutive weeks.

Clearly, prices had been technically "overbought" and a correction of some sort was imminent. It remains to be seen how far oil prices will fall given the still supportive market conditions, with the OPEC+ group of producers continuing to restrict supply and the US government tightening sanctions against Iran. On top of this, you have ongoing production outages from Venezuela and yesterday an important pipeline in Russia had to be suspended due to contamination.

Thus, if oil prices were to weaken further, this would either have to be due to renewed fears over demand, perhaps from emerging markets given the US dollar rally, or concerns about rising supply in the US.

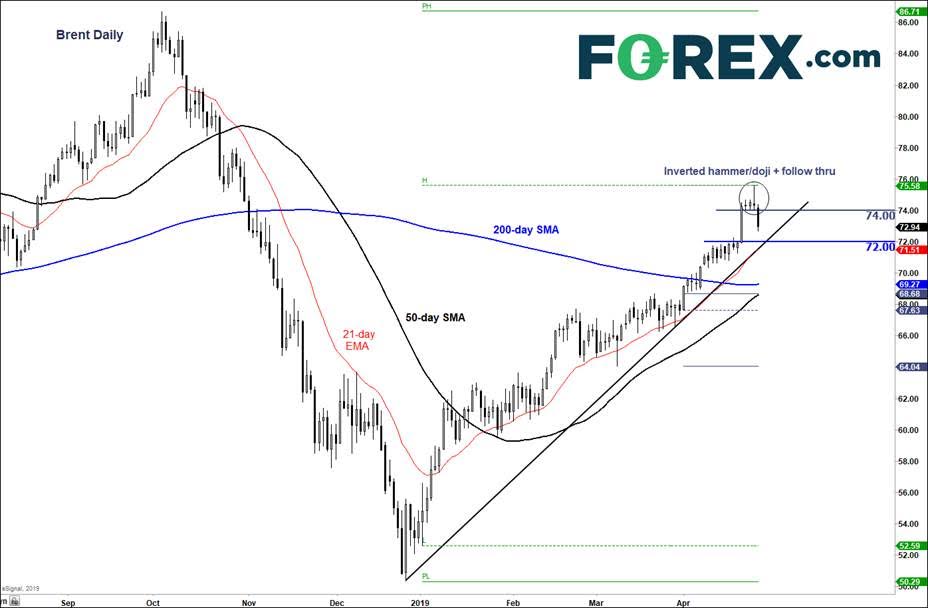

Figure 1: Brent creates potential reversal price action

From a technical standpoint, Brent created a potential reversal formation yesterday when it rallied to a fresh high on the year at just above $75.50, before turning around to close lower. As a result, it created an inverted hammer/doji candlestick pattern on its daily chart. There has been some follow-through to the downside today after prior support at $74.00 gave way. This level is now going to be key. If this is a genuine reversal, the $74.00 should hold as resistance going forward.

However, this could just turn out to be a correction rather than trend reversal. After all, the bullish trend line, which comes in around $71.50, is still intact. Ahead of this trend line, there's potential support at $72.00, a level which was previously resistance.

Therefore, it is far too early to suggest Brent has topped. However, if and when the bullish trendline breaks, only then will the bears have a genuine case.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.