Crude oil rally continued overnight after relatively positive inventories data from the United States. In a report yesterday, the Energy Information Administration (EIA) said that oil stocks dropped by 754k barrels last week. That was a surprise reading considering investors were expecting the stocks to jump by more than 127k. Also, on Tuesday, data from the American Petroleum Institute showed that the stocks rose by more than 3.8 million barrels. In Cushing, inventories dropped by more than 1.72 million barrels while gasoline inventories rose by more than 2.1 million barrels. These numbers came at a time when oil traders have been excited about a return to normalcy because of the Covid vaccine.

The Australian dollar continued rallying during the Asian session as traders reacted to improved economic data. According to Australia’s statistics bureau, the building capital expenditure fell by 3.7% in the third quarter after falling by 4.4% in Q2. Similarly, the plant and machinery capital expenditure, which is an important measure of the GDP fell by 2.2%. Also, the private new capital expenditure fell by 3.0% in Q3 after falling by 5.9% in Q2. The Australian dollar has also rallied because of the overall shift from the US dollar as the vaccination season nears.

Later today, with US markets being closed for thanksgiving, the focus will turn to Europe. In Sweden, the world’s oldest central bank will deliver its interest rate decision at 08:30 GMT. With rates already at 0.0%, analysts believe that the bank will leave the situation unchanged and possibly sound more hawkish because of the vaccine. Other key Swedish data to watch will be the November consumer confidence, manufacturing confidence, and household lending. In Germany, the Gfk Institute will release its survey data on consumer climate. In the Eurozone, the ECB will publish the minutes of its last meeting and private sector loans data.

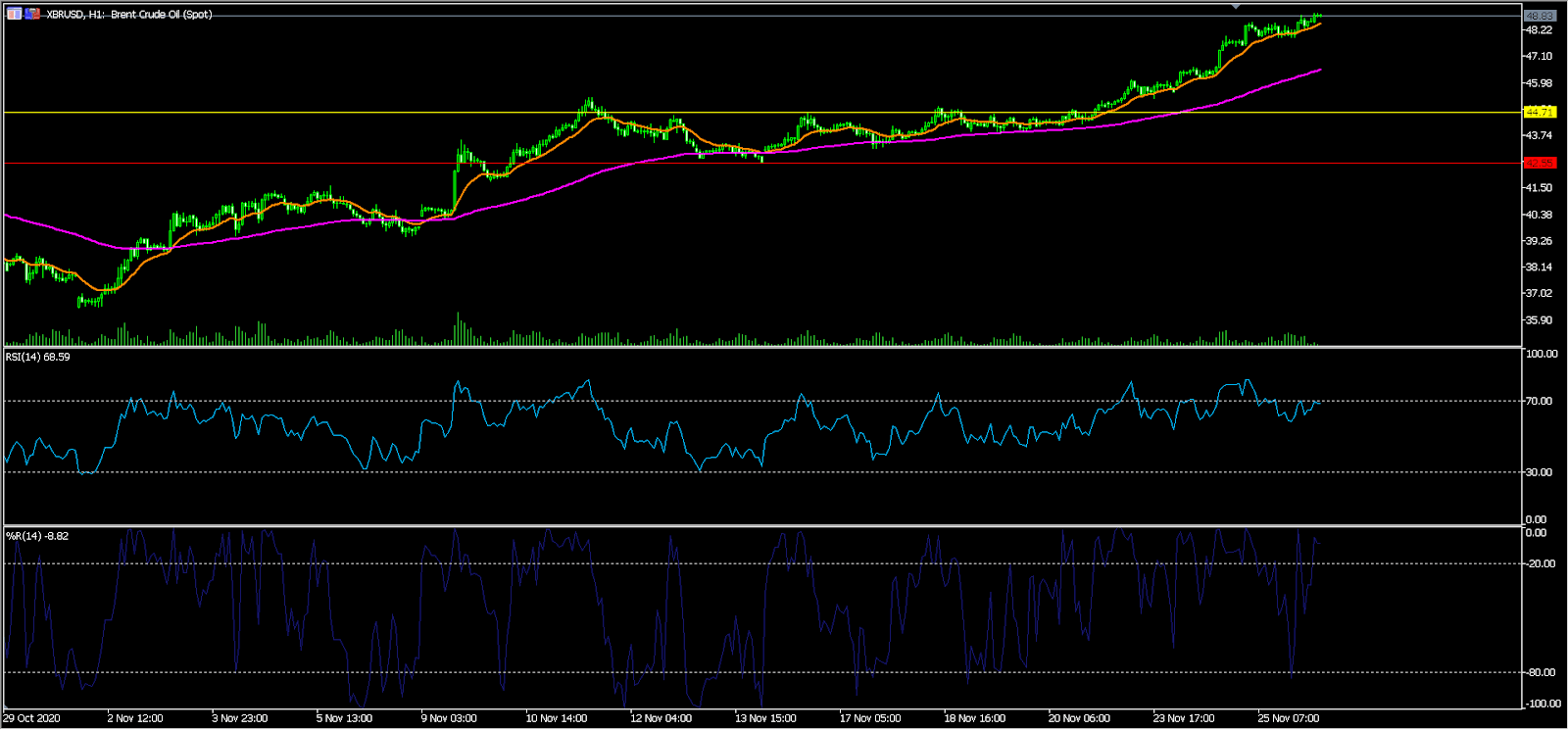

XBR/USD

The XBR/USD pair rose to an intraday high of 48.85, the highest level since March. On the hourly chart, the pair’s upward trend is supported by the 25-day and 15-day exponential moving averages. Similarly, most oscillators, including the Williams percentage range and the relative strength index have moved above the overbought level. With the psychological level of 50 in the horizon, the pair will likely continue rising ahead of an important OPEC+ meeting.

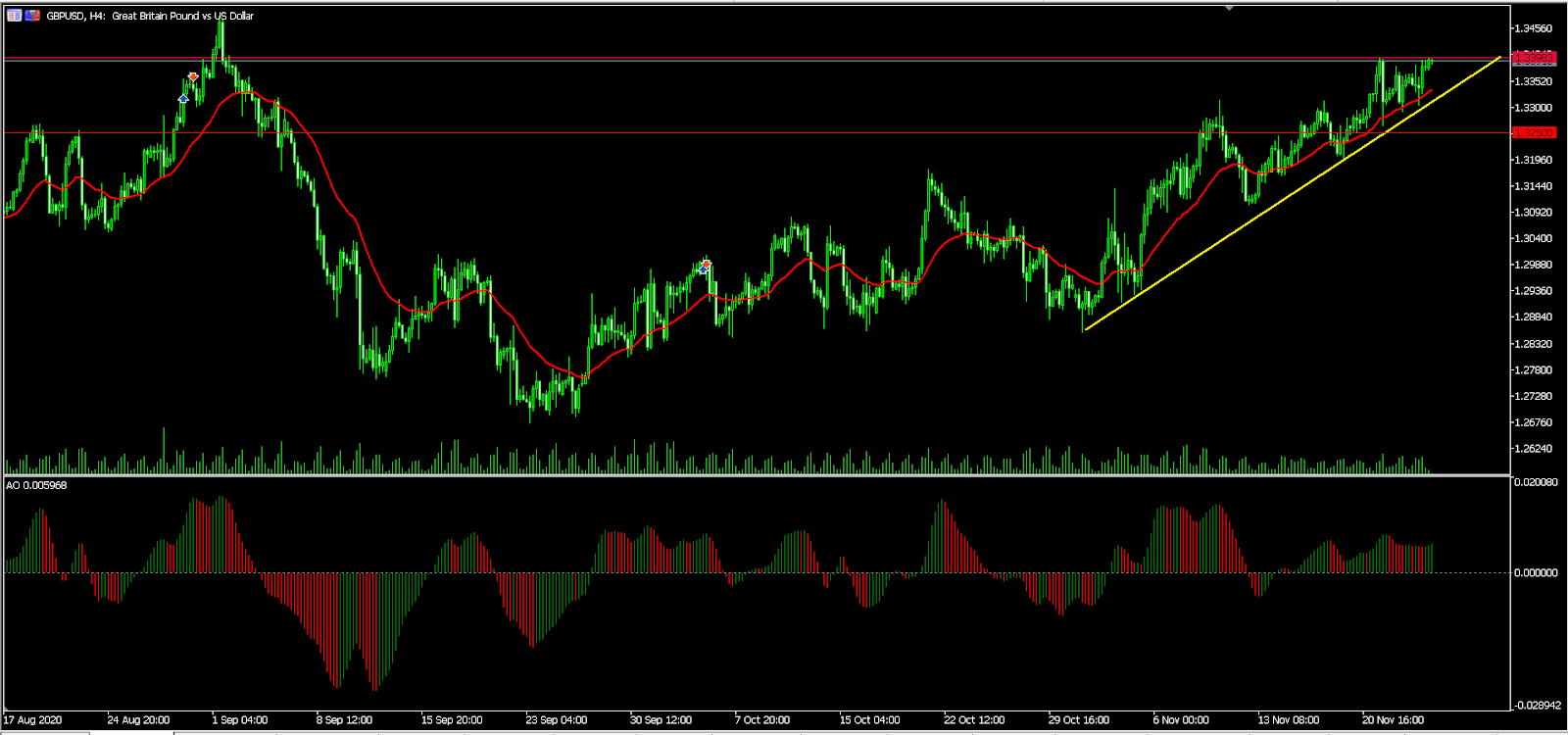

GBP/USD

The GBP/USD price rose after the Rishi Sunak speech on 2021-2022 government spending. It reached a high of 1.3398, which was an important resistance level. It has also formed a double-top pattern at the current price. Also, the pair is above the ascending yellow trendline while the awesome oscillator has moved above the neutral line. Therefore, there are two likely scenarios. First, the upward momentum can continue, pushing the pair above the resistance level at 1.3398. Second, because of the double-top pattern, the pair could fall and possibly move below the rising trendline.

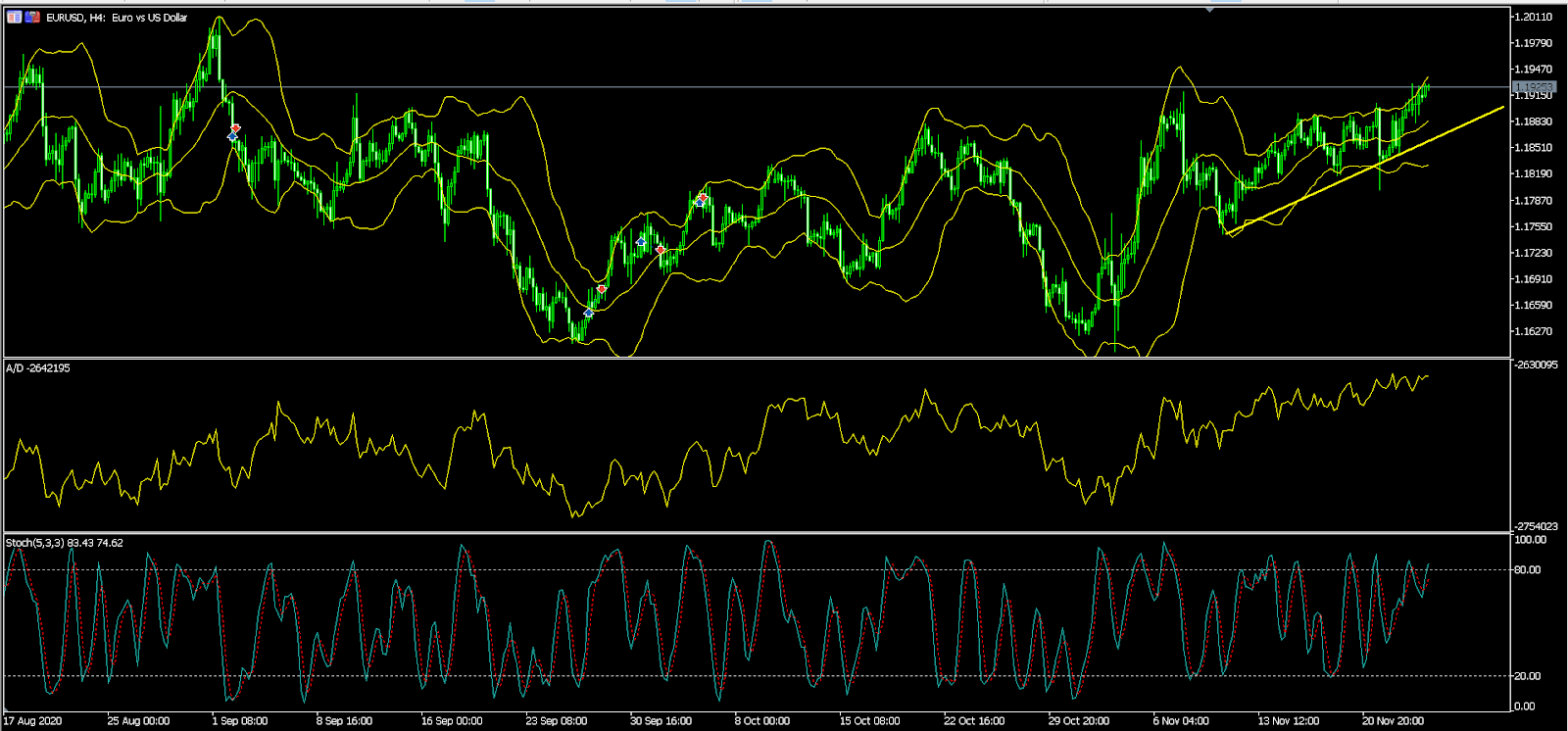

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1925, which is also along an important resistance level. It is the highest it has been since September 1. On the four-hour chart, this price is above the ascending yellow trendline. It is also slightly above the 25-day and 50-day moving averages and along the upper side of the Bollinger bands. The pair is also in the accumulation phase, according to the A/D indicator. Therefore, like the GBP/USD, there is a possibility that it will continue rising, with the next point to watch being 1.1930.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.