WTI oil fell $1 on Tuesday after President Trump threatened to keep trade deal with China until late 2020.

In addition, US threats of tariffs against France, Brazil and Argentina, further soured the sentiment and increased concerns about slowdown in global demand for energies that would further depress oil prices.

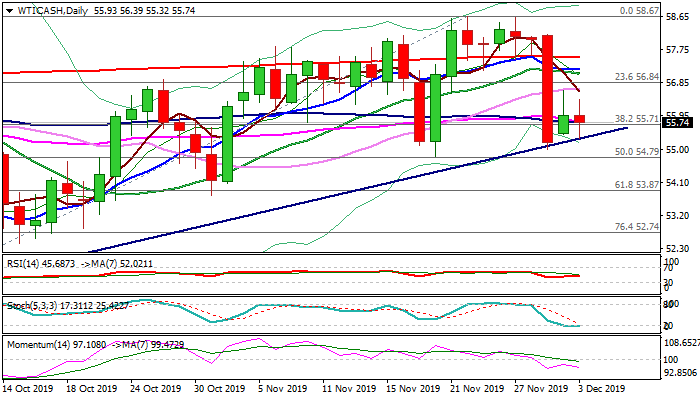

Limited recovery on Monday, following last Friday’s 5% drop and today’s action holding in red, increases risk of extension of pullback from recent tops at $58.67/62.

Today’s repeated close below broken Fibo support at $55.71 (38.2% of $50.91/$58.67) would add to negative outlook for test of key supports at $54.97/91 (trendline support / daily cloud base) and 20 Nov trough ($54.82).

Daily studies turned to bearish setup and support negative scenario, as OPEC meets on Thursday and fears in the market rise that the cartel won’t be able to reach consensus for stronger production cut.

American Petroleum Institute (API) is due to release its weekly crude stocks report later today and official government’s crude inventories report will be released on Wednesday, with both releases expected to provide fresh direction signals.

Res: 56.39; 56.64; 56.84; 57.02

Sup: 55.32; 55.00; 54.79; 54.08

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700, eyes on US first-quarter GDP data

EUR/USD hovers around the 1.0700 psychological level on Thursday during the early Thursday. The modest uptick of the major pair is supported by the softer US Dollar. Later in the day, Germany’s GfK Consumer Confidence Survey for April will be released.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.