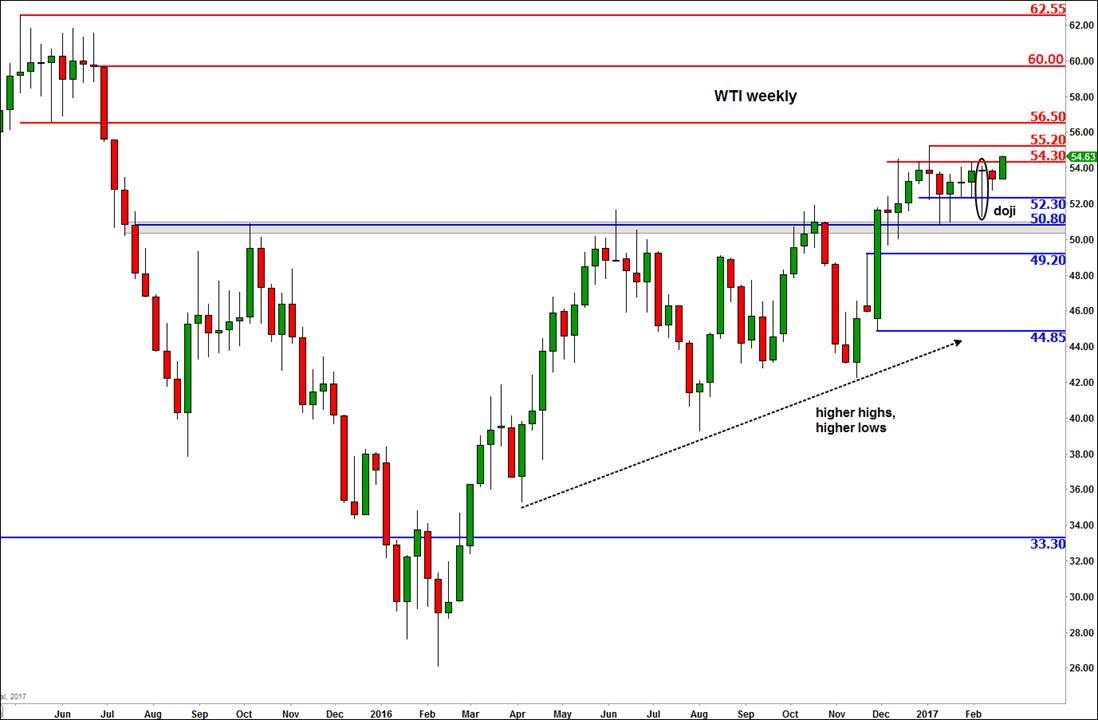

Oil prices have been coiling for several weeks now with both contracts spending most of their time in a tight four dollar range. Brent has been bouncing around between $54 and $58 while WTI has been stuck between $51 and $55. Crucially, both Brent and WTI have managed to hold their own above their respective 2016 high points, a year when prices surged some 45 per cent. Towards the end of 2016, an agreement by members of the Organization of the Petroleum Exporting Countries with some non-OPEC producers to cut oil output sent prices decisively higher. Since then, oil prices haven't really gone anywhere but crucially the pullbacks have been very shallow. This suggests that despite renewed worries about supply surplus in the US, market participants are anticipating oil prices to push further higher. Indeed, according to positioning data from the CFTC and ICE, net long positions in both crude contracts hit record high levels last week. While this suggests that the risk of profit-taking is rising, the fact that these long positions have been accumulated during a time when there was no corresponding rise in prices suggests that the pressure is building for a potentially explosive move higher.

So, oil prices appear to be heading higher as the OPEC and some non-OPEC producers stick with their recent agreement. For now, investors are not paying much attention to the situation in the US. Here, supplies are on the rise again: crude and gasoline stockpiles rose to fresh record highs last week as refineries cut output and gasoline demand softened, according to the Energy Information Administration. The next release of the official weekly US oil inventories data is on Thursday, a day later than usual due to the Presidents' Day holiday on Monday. However, I don't think the market will pay much attention to this, unless we see some shocking numbers.

From a technical perspective, the tight consolidation above last year's key broken resistance levels suggests oil prices have been coiling to break higher. The consolidation has also allowed momentum indicators such as the Relative Strength Index and other oscillators to unwind from "overbought" thresholds mainly through time rather than price, which is again very bullish. Consequently, I am anticipating both oil contracts to break out of their recent ranges and head higher. A potential break above $58.35 on Brent could see the London-based oil contract head towards $63.00, the last support pre-breakdown back in June 2015. The corresponding bullish target for WTI is at $60. As things stand, I will only turn bearish on oil if both contracts break back below their recent ranges i.e. at $54.00 on Brent and $50.80 for WTI. That is unless we see other significant bearish patterns beforehand. But for now, we remain pretty much bullish and therefore think that the path of least resistance is to the upside.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.