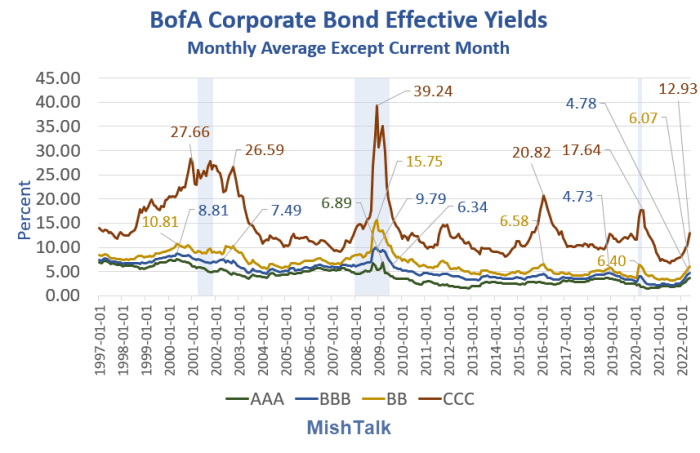

Despite stock market carnage, corporate bond yields still scream complacency.

Corporate bond data via St. Louis Fed, chart by Mish

Chart notes

-

Yields are monthly averages except for current month.

-

Current month reflects yields on May 17, 2022.

Yield categories

-

AAA: Top Tier.

-

BBB: Lowest Investment Grade.

-

BB: Highly Speculative Junk Bonds.

-

CCC: Vulnerable to Nonpayment.

Complacency abounds

-

CCC-rated debt currently yields 12.93% vs the 2008 peak of 39.24%. In 2016, a non-recession year, CCC-rated debt yielded 20.82%.

-

BBB-rated debt currently yields 4.78% vs the 2008 peak of 9.79%. In 2018, a non-recession year, BBB-rated debt yielded 4.73%.

-

BB-rated debt currently yields 6.07% vs the 2008 peak of 15.75%. In 2016 a non-recession year, BBB-rated debt yielded 6.58%.

Yields are rising but largely reflect the mythical soft landing thesis.

Fed has room to hike

As long as the credit markets remain complacent the Fed has ample room to hike.

And the Fed will continue to hike until there is a recession, a credit event, or inflation comes down.

Which one?

I suggest the Fed will pause on recession, at least for a few months, and may pause before that if inflation starts to bend. My last call was a pause after a July hike, and I am sticking with that opinion.

Other bright minds I follow believe the Fed will keep hiking until inflation is way lower unless there is a credit event.

It's possible both views are correct. A recession, credit event, and a drop in inflation can all hit simultaneously.

How fast will the hikes come?

We are all guessing, but for now assume the Fed gets in a half-point hike in June, and another half-point hike in July.

That would put the Fed Funds Rate at 1.75-2.00%.

I am not positive we get that high. A quarter-point hike or even no hike in July is a reasonable shot if retail sales and housing get crushed and inflation moderates somewhat.

The neutral rate

Neutral is the Fed rate that neither promotes growth nor attacks inflation.

Many on Twitter keep expressing the idea that the neutral interest rates is close to the CPI.

I assure you neutral is nowhere close to 8% or even 4%.

Where is neutral?

For discussion of the neutral rate, please see The Fed Searches For the Neutral Interest Rate, Where the Heck Is It?

It would not surprise me in the least is neutral was 1.50%. And if so, the Fed is highly likely to overshoot.

If the Fed hikes to 3.0%, I am sure the Fed will have overshot neutral, but I also doubt we get there regardless of inflation.

I would expect some sort of credit event before rate gets that high.

What next?

That picture is more clear.

In the short- to mid-term, expect more hikes and much more stock market carnage.

The stock market is nowhere close to value territory as Target, Walmart, Amazon and other company earnings misses have shown.

Target plunges 25%, what about Yesterday's big Retail Sales blowout?

For discussion of earnings misses, please see Target Plunges 25%, What About Yesterday's Big Retail Sales Blowout?

Also see my timely April 30 post S&P 500 Earnings Estimates for 2023 Rise, It Won't Happen.

The technical stock market damage is huge and the fundamentals are very poor. I will post some more charts later today or tomorrow.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.