Relative to recent history, this week’s Commitments of Traders Report contains few notable changes. Looking at the data, the most significant moves include rising net long positions in the euro and falling net long positions in the Australian dollar. Changes in other currencies and commodities were relatively modest. On the bullish side, speculators continue to accumulate net long positions in the British pound. On the bearish side, the US dollar and commodity currencies (including the Canadian dollar) remain out of favor.

Turning to extremes in positioning, net long positions in the Japanese yen, the British pound and crude oil are looking fairly one-sided. This has been the case in recent history, and continues this week. Speculators have been chasing recent strength in the yen and the pound, while crude oil has been a consensus long position since late last year.

The purpose of this weekly report is to track how the consensus is positioned across various major currencies and commodities. When net long positions become crowded in either direction, we flag extended positioning as a risk. Crowded positions do not suggest an imminent reversal, but should be considered as a significant risk factor when investing in the same direction as the crowd. This is shown below:

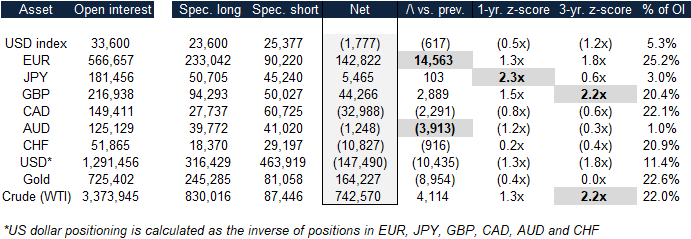

CFTC COT speculator positions (futures & options combined) – April 10, 2018

Source: CFTC, MarketsNow

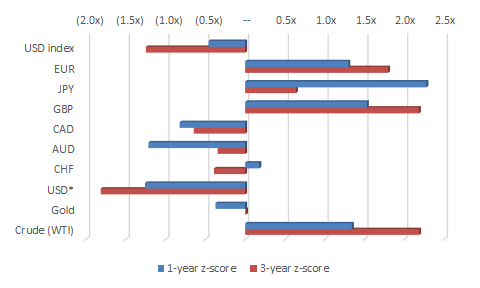

Notable extremes, significant changes in weekly positions, and large net positions as a proportion of open interest are highlighted above. Extremes in net positions are highlighted when speculator positioning is more than two standard deviations above trailing 1-year and 3-year averages. Weekly changes are highlighted when they are significant as a proportion of open interest. Finally, net positions as a proportion of outstanding interest are highlighted when they are large relative to historical averages. 1-year and 3-year z-scores are visually represented below:

1-year and 3-year z-scores based on net speculator positions

Source: CFTC, MarketsNow

Looking at the changes in more detail, euro speculators are increasingly confident that the ECB will end its asset buying program later this year. While economic data from the Eurozone has been worsening recently, speculator long positions in the euro are now the highest since late January 2018 (+142,822 contracts today vs. +147,318 contracts in January). At the time, total open interest in the currency was significantly higher (728,311 contracts) as traders made bigger bets as a response to low volatility. While the number of net long positions is lower than January’s peak, the position as a proportion of total interest is higher (25.2% today vs. 20.2% in January) as open interest as fallen.

Turning to the Australian dollar, speculators are now net short the currency. Looking at recent history, speculators have consistently chased momentum and failed to successfully navigate turning points. Between late December and early January 2018, AUD speculators were net short (just as the currency staged a significant turnaround). After being caught on the wrong side, speculator net short positions flipped to positive on January 9, 2018. While speculators managed to catch the remainder of the move up until early February, they overstayed their welcome and have remained net long since that time. Now that net positions are once again short, the pattern would suggest that the Australian dollar is likely to rebound.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. MarketsNow will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.