Stocks were slightly higher at the open. But the major indices quickly dropped.

Just minutes after the opening bell the S&P and NASDAQ were in negative territory. And it looked like we were going to have a repeat of Friday’s slide.

But then a HUGE housing report at 10am ET jolted the markets, and stocks rallied.

The forecast for May’s Pending Home Sales was a modest 18.9%. But the increase was double what was expected! The 44.3% increase was the largest jump since 2001 when the National Association of Realtors began tracking these numbers.

The better than expected housing numbers left traders optimistic about the economy, and stocks rallied throughout the day.

There was a final push higher in the last 10 minutes of trading, and the major indices finished the session at highs of the day.

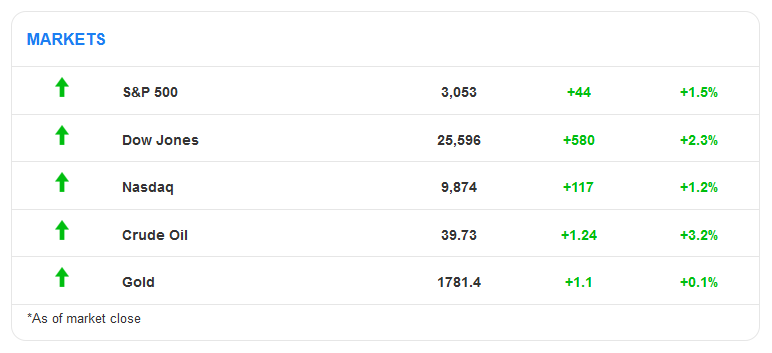

Here’s where the major markets ended the day:

Boeing (BA) helped lift the DOW higher today with a whopping 14.4% gain. Traders loved the idea that the new 737 MAX could be moving towards its airworthy certifications!

Southwest (LUV) shares rallied today in part due to an analyst upgrade. LUV ended the day higher by 9.6%.

Chesapeake (CHK) filed for bankruptcy on Saturday. The New York Stock Exchange has suspended trading and will de-list shares of the fracking giant.

Facebook (FB) bounced back after a rough Friday. The company has taken some heat over the company’s approach to posts by President Donald Trump and other controversial content. As a result, major advertisers like Coca Cola, Starbucks, Verizon, and many others have backed out. The stock ended the day higher by 2.1% after being down as much as 4.2%.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.