The cold makes people happy (and more productive… in every way… ahem). The warmth makes people unhappy (and less productive). And, as Rodney and readers have been debating a lot lately, temperatures across the globe are changing. Frankly, I was surprised at the hot button this topic proved to be!

But, just like productivity, and even happiness (weather considerations included), global warming is cyclical. I learned long ago that there is always a hierarchy of cycles for any particular phenomenon. The weather. Demographics. Markets. You name it. You wouldn’t believe what my hierarchy of economic and market cycles have teed up for us this year!

There’s always a single, dominant trend, but also always another two or three that have significant impacts worth including. Of course, there are dozens of other cycles of every duration, but if you considered them all, your brain would explode. Besides, most are insignificant and too variable.

Three cycles…

There are three particular cycles that have a bearing on the noticeable changes we’ve seen in the Earth’s climate in recent decades and centuries.

The first is the longest-term Ice Age Cycle. It bottomed around 20,000 years ago, after which it entered a rapid warming period from 12,000 to around 5,000 years ago. These Ice Age Cycles come about every 100,000 years and are mapped out in the infamous three Milankovitch Cycles, which describe the collective effects of change in the Earth’s movement on our climate. According to the Russian’s research, the cycles should have seen cooling a bit since five centuries ago, but are now warmer than ever.

Have you noticed how good Russians scientists seem to be at identifying and isolating cycles? Think of Milankovitch or Kondratieff, whose work led me to discover the Four-Season Economic Cycle, which warns that the end of this year’s Dark Window will be more devastating than any other in history.

Must be the cold.

Besides, scientists are cycle masters. Economists, not so much.

Clear evidence we’re to blame…

This divergence from clear cycles was evidence to me that man-made cycles were indeed influencing natural ones.

Central Banks have staved off the worst of the Economic Winter Season (not prevented it, mind you… we’re still facing that epic crash), and humanity in general is changing global warming and cooling cycles.

That brings me to the second cycle in this hierarchy of three: rising CO2 levels from pollution (and methane, ocean acidification, fertilizer and effluent run-off into soil and water). This is dangerous stuff! The crime of the century, from my view. Not recycling your wastes is like shitting in your own back yard.

This is more like an exponential rising trend than a cycle. Its impacts are also cumulative, making it harder to reverse and that much more dangerous. CO2 and warming since 1800, and especially since 1900, correlate perfectly. And it will very likely have major consequences in the future for warming and the toxicity of everything.

There is another, important, shorter-term cycle involved as well: sunspots.

Where have all the sunspots gone?

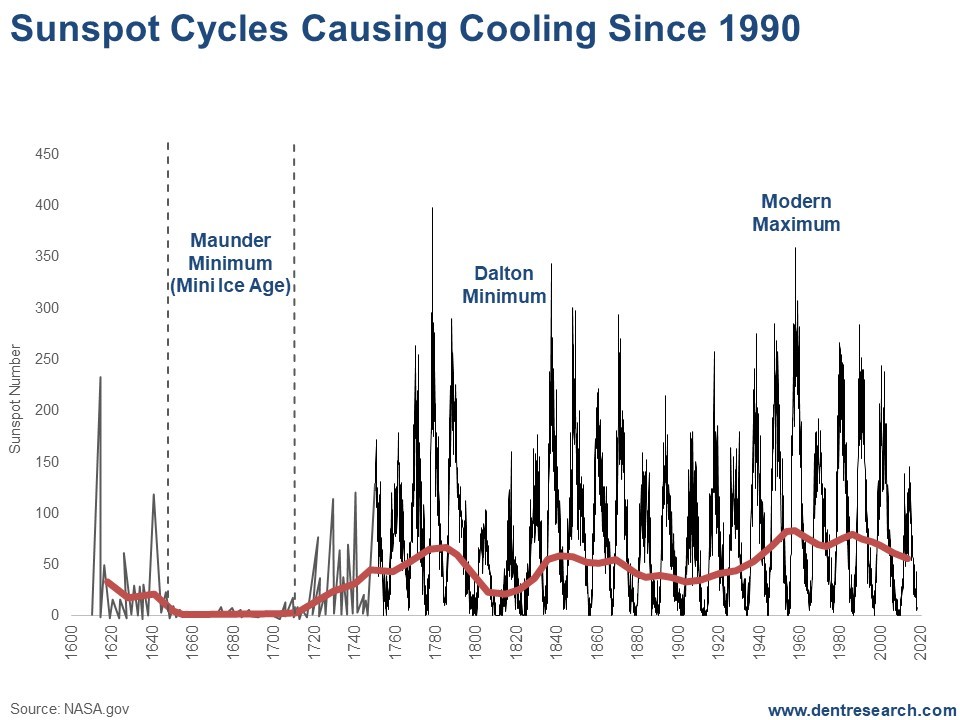

Sunspot cycles have been diminishing in intensity since 1959, and much more dramatically since 1990. Scientists expect this to continue for another 10 to 20 years, maybe longer. It would be the joke of this century and a hand well played by God if we ended up seeing a mini-ice age in the coming decades after fears of runaway global warming!

The following chart shows sunspot cycles back to the last mini-age in the 1600s, called “The Maunder Minimum.”

The biggest impact of this cycle was an 80-year period of very minimal sunspot activity causing a mini-ice age between the mid-1600s and early 1700s. It’s even possible the present cycle could morph into something that bad, but it’s more likely it will be more moderate like the Dalton Minimum of the early 1800s.

But, you can’t use this shorter-term, lesser Sunspot Cycle to argue that we don’t have to worry about longer-term CO2 accumulation and warming trends. And, even if this cycle counters that trend even more and for longer, human pollution of this unprecedented depth and breadth has serious consequences on its own.

Sunspot Cycles also play an important role in economic and market activity, as I demonstrate in Zero Hour. In fact, this cycle is one of four in my hierarchy of cycles for economic and market forecasting. The other three are the Demographic Spending Wave, the Geopolitical Cycle (which I talked about on Monday), and the Technology Cycle.

The latter is a 45-year cycle, but as I recently discovered, most cycles have a magnified effect every second turn. So, every 90 years, the Technology Cycle has an outsized impact on the economy and markets.

Guess where we are in that cycle this year? Yup! Right on the 90-year mark. It’s one of the reasons I’ve forecast we’ll see a Dark Window in the markets in 2019… and why there will be a catastrophic crash to end it.

But that’s a topic for another day.

The content of our articles is based on what we’ve learned as financial journalists. We do not offer personalized investment advice: you should not base investment decisions solely on what you read here. It’s your money and your responsibility. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments such as futures, options, and currency trading carry large potential rewards but also large potential risk. Don’t trade in these markets with money you can’t afford to lose. Delray Publishing LLC expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.