_20151027141420.jpg)

Of course, at the beginning of the year, FED's head, Janet Yellen, warned that they could rise rates in any meeting, including those with no press conference scheduled. But the October meeting will hardly be the case, as they had their chance last month, and passed. The best the market can anticipate these days, is a December lift off.

Watch: Fed Interest Rate Decision Live Coverage with Valeria Bednarik, Mauricio Carrillo and Dale Pinkert

Additionally, no significant changes in the FOMC statement are expected, besides that maybe the FED will acknowledge the latest soft employment figures, but remaining confident on the sector's growth. Chinese slowdown, and weaker oil prices, will likely have their chapters too, as usual.

Anyway, with the market focused on December, a no-change in the previous wording will likely be seen as dollar positive, as hopes for a rate move before the year-end will remain high. On contrary, a downward surprise with renewed concerns over the dollar's strength, or references to poor economic developments, will result in investors running to price in a delay for next 2016, and therefore sent the USD lower across the board. Also, investors may be looking at the post-meeting commentaries from some of the FOMC officials, for some clues on whether they will actually rise rates.

Market's reactions are expected to be limited, except of course, in the case of a surprise rate hike. That would be a market shocker that can send the greenback running hundred of pips across the board. But as said before, there are the fewest probabilities ever, of such happening tomorrow.

EUR/USD technical outlook

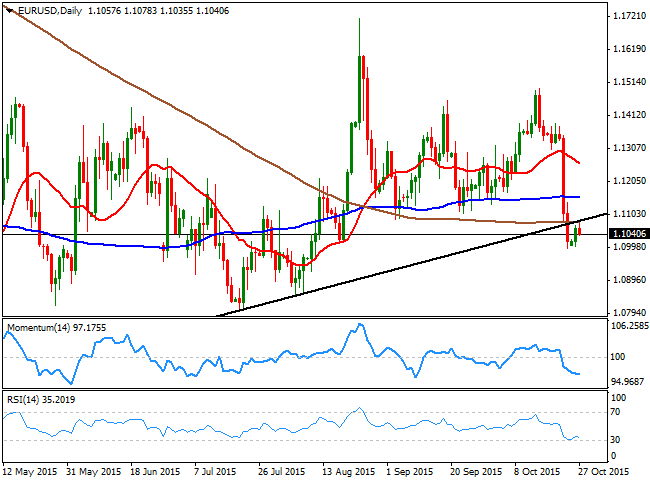

As long as a rate hike remains on the cards, EUR/USD gains will be limited, as Draghi has clearly warned the markets that it will act in December if needed, pretty much saying that if the FED does not raise rates, he will extend facilities in Europe to keep the EUR lower. The pair has been holding above the 1.1000 figure ever since the week started, but the daily chart shows that the bearish tone prevails, given that the pair is unable to recover above the long term ascendant trend line broken last week, and even completed a pullback to it this Tuesday before turning back south. Additionally, the pair is trading back below its 100 and 200 SMAs, while the technical indicators seem ready to resume their declines well into negative territory. The RSI particularly, has corrected its oversold conditions and heads back south around 34, all of which supports additional declines. The main supports below 1.1000 come at 1.0960 and 1.0920, while below this last, the base of these last months' range at 1.0840 is next. The pair needs to recover above 1.1120 to see some upward constructive tone, with 1.1160 and 1.1200 as the next levels to watch post FED.

USD/JPY technical outlook

The USD/JPY is back to its comfort zone around 120.35, the level that has acted like a magnet for the past two months. The BOJ will have its monthly economic policy meeting after the FED, early Friday, and speculation has mounted over the possibility of an extension of the ongoing stimulus in Japan, the main reason behind the latest recovery in the pair. It could be that with a on-hold FED, with no change in the wording, the pair will trade around the current level until the Bank of Japan meeting. Anyway, and ahead of the FED, a dovish US Central Bank may send the pair down to 119.30, a strong Fibonacci support, while further declines below this last can see the price extending down to 118.55. To the upside, 120.70 is the immediate resistance, followed by the 121.45 level, the 200 DMA and the level sellers have defended ever since late August.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.