With quite limited volumes across the forex board, investors are placing their hopes, partially, in the ECB monthly economic policy decision, to be unveiled this Thursday. Partially, because there are more Central Banks' decisions coming before the month ends. Both, the FED and the BOJ will have their economic policy meetings, with the first expected to remain on hold, but with increasing chances of a move coming from Japan authorities.

The fact is that besides the usual dovish stance, the European Central Bank is expected to offer little to the market these days. Despite some market talks of a QE extension during the past weeks, Mario Draghi is largely expected to maintain the bond buying program launched in January, unchanged. If something, he will try to down talk the common currency, as the EUR/USD pair has returned to pre-QE levels, and therefore limiting local exports.

Adding to the local situation, Chinese economic slowdown continues worsening, with the latest GDP reading in the country falling down to levels not seen in over six years, whilst oil prices remain subdued. Low inflation is being also blamed on the continued slide in oil prices by almost all central bankers, but sometimes seems more as an excuse than a cause.

Watch: ECB Meeting Live Coverage by Valeria Bednarik, Yohay Elam and Dale PinkertWith the dollar having lost its shine amid a continued delay from the FED on a rate hike, the unwind of bulls in the American currency is not just a problem for the US. European stocks markets soared when stimulus was announced, as the EUR got cheaper, and exporting become more competitive. But with the year about to end, inflation is actually below zero, and stocks have gave back most of its yearly gains.

Earlier this week, Nowotny, the Austrian National Bank Governor, said that given that inflation is still far from the Central Bank's target, the ECB may need to loosen fiscal policies to boost growth, or use additional tools, fueling speculation the ECB will actually announce some measure in its upcoming meeting. But as said before, no concrete action, beyond more Draghi jawboning, is expected.

Read: What is ECB Quantitative Easing?

If the ECB decides to continue buying €60bn a month, mostly in government bonds, repeating that the program will extend until September 2016, or further if needed, the market will likely be disappointed and sell the common currency.

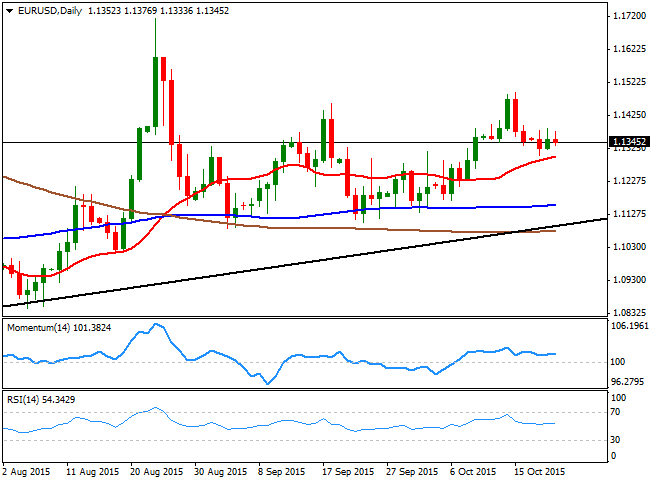

EUR/USD technical view

From a technical point of view, the EUR/USD pair retains a bullish tone in the daily chart, despite the ongoing absence of directional strength as the price has remained firmly above a bullish 20 SMA ever since the month started. There is a daily ascendant trend line coming from April low at 1.0519 which comes these days around 1.1120 a major static support level. Also, strong selling interest has been surging ever since early May on approaches to the 1.1460 region, dismissing the spike up to 1.1713 from late August.

So far this week, the pair has been unable to advance beyond 1.1400, which means that if somehow Draghi gives the EUR a push, the pair needs to break above it test the 1.1460 level, en route towards 1.1500, this Thursday.

The pair is far from the major support mentioned, but if the price breaks below 1.1280, the downside is favored towards the 1.1120/60 region for the upcoming sessions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.