- Canada has probably gained jobs in December after a significant loss in November.

- A better than expected result rebound may be seen given past volatility.

- The loonie is well-positioned to gain amid rising global and local oil prices.

- The simultaneous release of the US Non-Farm Payrolls report suggests trading CAD against another currency.

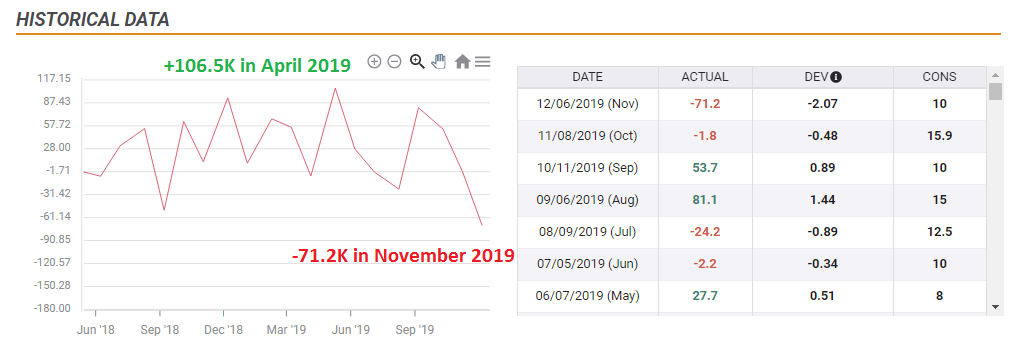

What goes up, must come down – but may now leap again. After Canada lost no fewer than 71,200 jobs in November, economists now expect an increase of 20,000 in December – but that may be modest, allowing the loonie to extend its gains.

Why expect more significant job gains?

Canada has suffered two months of job losses in the recent past – in June and July. It was followed by a leap of 81,000 positions in August. History may not always repeat itself in full but may rhyme.

Moreover, changes in Canadian employment have been considerable. The fall in November was one end of the extreme, and the other end was a surge of 106.5 positions in April. Rises or drops of around 20,000 are moderate in comparison to the recent past.

And, the recent stabilization of the global economy after months of fear also provides hope for greater hiring.

CAD positioning, timing, and other factors

The Canadian dollar is well-positioned ahead of the publication. The C$ has been gaining ground after the US killing of top Iranian general Qassem Suleimani. The heightened tension in the Middle East has harmed other commodity currencies such as the Aussie and kiwi, and the Canadian dollar stood out due to the nation's oil exports.

The global increase in petrol prices comes on top of rosy predictions for the local industry. The Conference Board has published a forecast for an annual rise of 4.2% in the next four years, thanks to pipeline optimization.

Canada publishes its employment figures on Friday, January 10, at 13:30 GMT – the same time as the US Non-Farm Payrolls. The reaction to American's jobs figures tends to be choppy, with wild swings in both directions. To have a cleaner trade on the Canadian figures, it may be wiser to trade CAD against other currencies such as the euro, pound, yen, or Australian dollar.

Apart from the headline jobs statistic, two other figures are worth mentioning. The Unemployment Rate, which rose to 5.9% in November, is set to drop to 5.8%. While the jobless has political implications, it is usually ignored by traders as it depends on the Participation Rate. If unemployment rises alongside an increase in participation, it is not necessarily a negative development. And if the rate falls but amid a shrinking workforce, cheering may wait for another occasion.

The second figure to watch out for is Average Hourly Wages. Salaries rose at a rapid clip of 4.36% in November, significantly better than 3.1% in the US. A substantial change in pay may also impact the loonie, especially if headline employment change meets expectations.

Three scenarios

1) Better than expected job gains: There is a good case for a considerable rebound in jobs, better than average estimates. In this scenario, the Canadian dollar has significant room to rise, as it already enjoys an uptrend. The probability is high.

2) Within expectations: If Canada gained around 20,000 positions last month, the response would likely be more muted, allowing wage growth to have an outsized impact. IF paychecks remain around November's levels, the C$ still has room to edge higher given the positive bias. The probability is medium.

3) Below expectations: A meager increase in jobs cannot be ruled out, nor can a third consecutive month of losses. In this case, the loonie may find itself in a lonely position, falling even if other currencies gain against the greenback amid a weak US labor market report. The probability is low.

Conclusion

Canada's jobs report for the last month of 2019 has a good chance of beating expectations, leading to significant gains for the loonie. In case it meets expectations, there is still room to advance, but it also depends on wage growth. An unlikely disappointment may send the C$ plunging.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.