- Economists expect Canada to post a modest job gain of 10,000 for February.

- The Canadian dollar is vulnerable amid the fallout from the coronavirus outbreak.

- Strong figures are needed to keep the C$ from falling.

When you've got nothing, you've got nothing to lose – goes Bob Dylan's song – but Canada does have something to lose. The labor market is looking good and a high-interest rate by the Bank of Canada – even after this week's cut. Without a strong jobs report, expectations for further reductions may push the loonie lower.

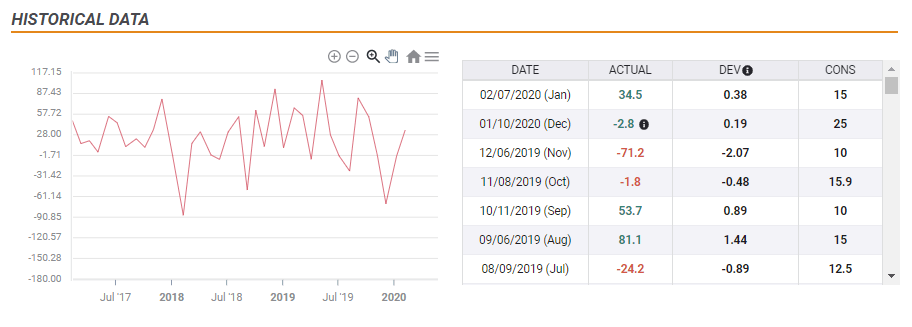

Back in January, Canada reported an increase of 34,500 jobs, beating expectations. While employment figures are choppy in the North American nation, they have generally been upbeat since early 2019 onwards.

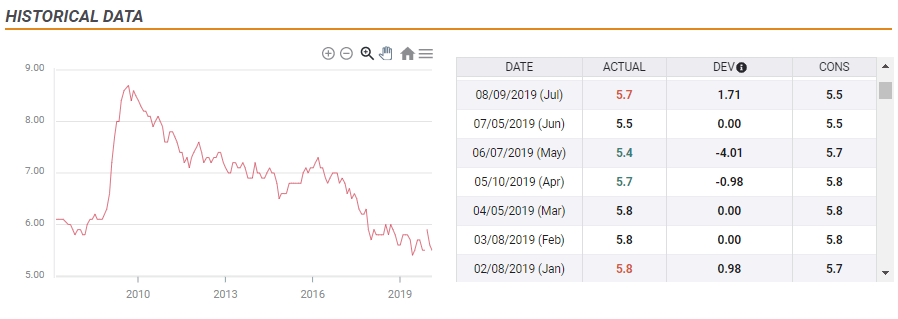

The Unemployment Rate stood at 5.5%. a relatively low level. The long-term trend is positive, as the chart shows.

An increase of 10,000 positions is on the cards for February and the jobless rate is forecast to edge up to 5.6%. While the bar is low for an upside surprise – it may not be enough for the loonie.

The coronavirus disease is spreading around the world and governments' attempts to stop its spread are causing economic disruption. Central banks are cutting rates in an effort to do whatever they can – even though their impact is limited. Lower rates encourage spending, but the problem is not demand but rather supply.

Even if the BOC prefers applying that logic, it would be forced to act as evidence mounts about the economic damage. A critical figure is this jobs report which may only slow down the pace of cuts. The global trend is negative and Canada is not immune to the virus.

Taking this positioning into account, here are three scenarios:

Three scenarios for CAD

1) Within expectations: An increase of up to 20,000 jobs would be considered meeting early estimates. In this base case scenario, the Canadian dollar would retreat as it would be insufficient to stop the rate cut.

2) Above expectations: An advance of over 20,000 jobs would already keep the Canadian dollar bid and perhaps postpone the next reduction of borrowing costs. If Canada gained in February more than 35,000 posts – beating January's increase – it would already send the C$ soaring. However, such a jump in jobs is highly unlikely.

3) Below expectations: If Canada lost jobs in February, it would send the loonie significantly lower as a soft figure would exacerbate the C$'s already delicate position.

It is essential to note that the Canadian labor market figures are released on Friday, March 6, at 13:30 GMT – at the same time as the US Non-Farm Payrolls. Therefore, to see the true impact of Canada's figures, it would be wiser to avoid the dollar and to trade CAD against other currencies such as the euro, pound, or yen.

Conclusion

Canada's jobs report for February is released amid the coronavirus crisis and finds a vulnerable Canadian dollar. The BOC's trend is to cut interest rates, and the employment statistics may either accelerate or slow this move. Robust figures may be needed to push it higher.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.