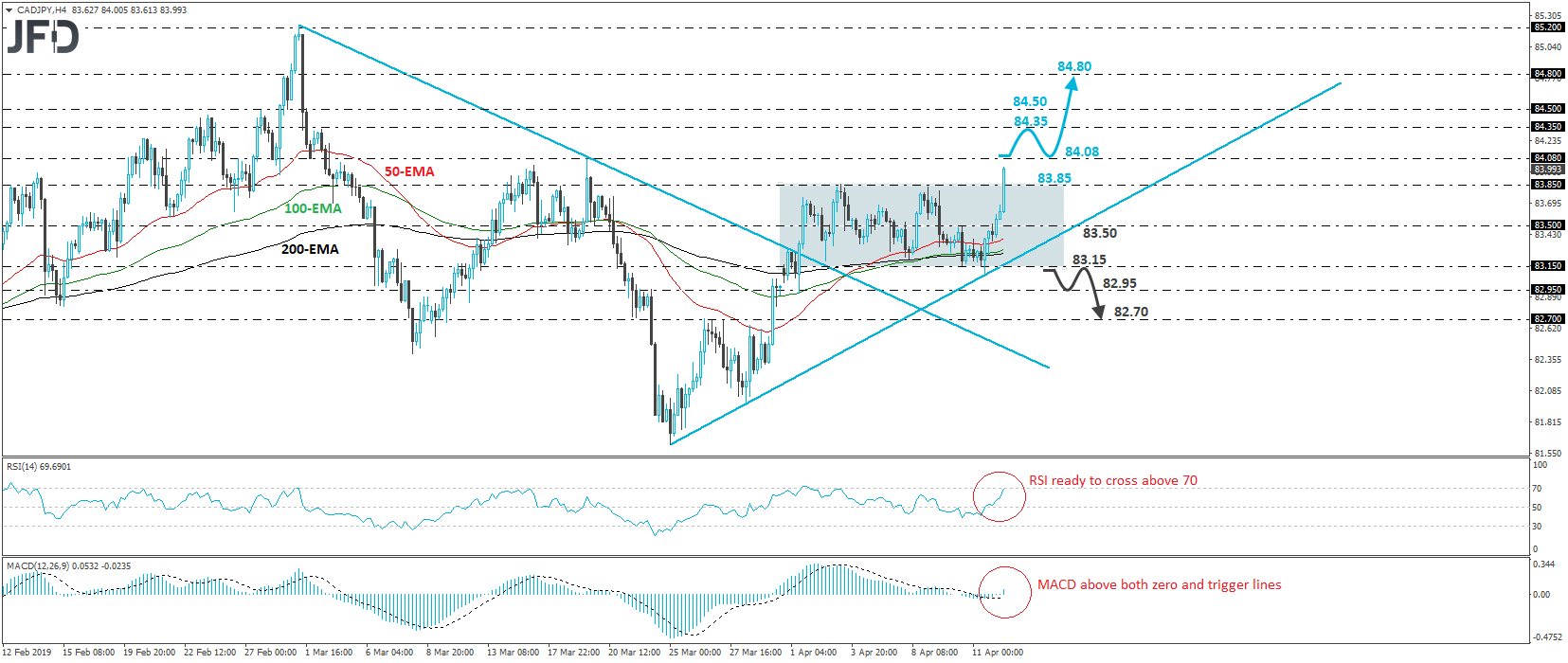

CAD/JPY surged on Friday, breaking above the 83.85 barrier, which acted as the upper bound of the sideways range the pair had been trading within since April 1st. Combined with the fact that the rate is trading above the upside support line drawn from the low of March 25th, the upside exit out of the aforementioned range suggests that the near-term outlook is positive again, in our view.

We would expect the bulls to continue driving CAD/JPY north and perhaps testing the 84.08 level soon, defined by the peak of March 19th. A clear break above that hurdle may allow more upside extensions, perhaps towards the 84.35 area, which is the peak of March 4th. If that level proves to be just a temporary pit-stop for the bulls, then the 84.50 mark may come into play, a zone where the rate formed an intraday swing low on February 28th. Another break, above 84.50, may allow the pair to climb towards the 84.80 territory, defined by the high of February 28th, as well as an intraday swing low on March 1st.

Taking a look at our short-term oscillators, we see that the RSI edged north and now appears ready to move above its 70 line, while the MACD lies above both its zero and trigger lines, pointing up as well. These indicators detect accelerating upside speed and support the notion for some further short-term advances.

On the downside, a dip below 83.65 would bring the rate back within the aforementioned range and turn the picture to flat. The move that would encourage us to start examining the bearish case is a dip below 83.15. Such a dip would confirm the break below the upside support line drawn from the low of March 25th, as well as a forthcoming lower low on the 4-hour chart. The rate could then slide towards the 82.95 level, marked by the low of April 1st, the break of which could extend the slide towards the 82.70 area, near the inside swing highs of March 26th and 27th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.