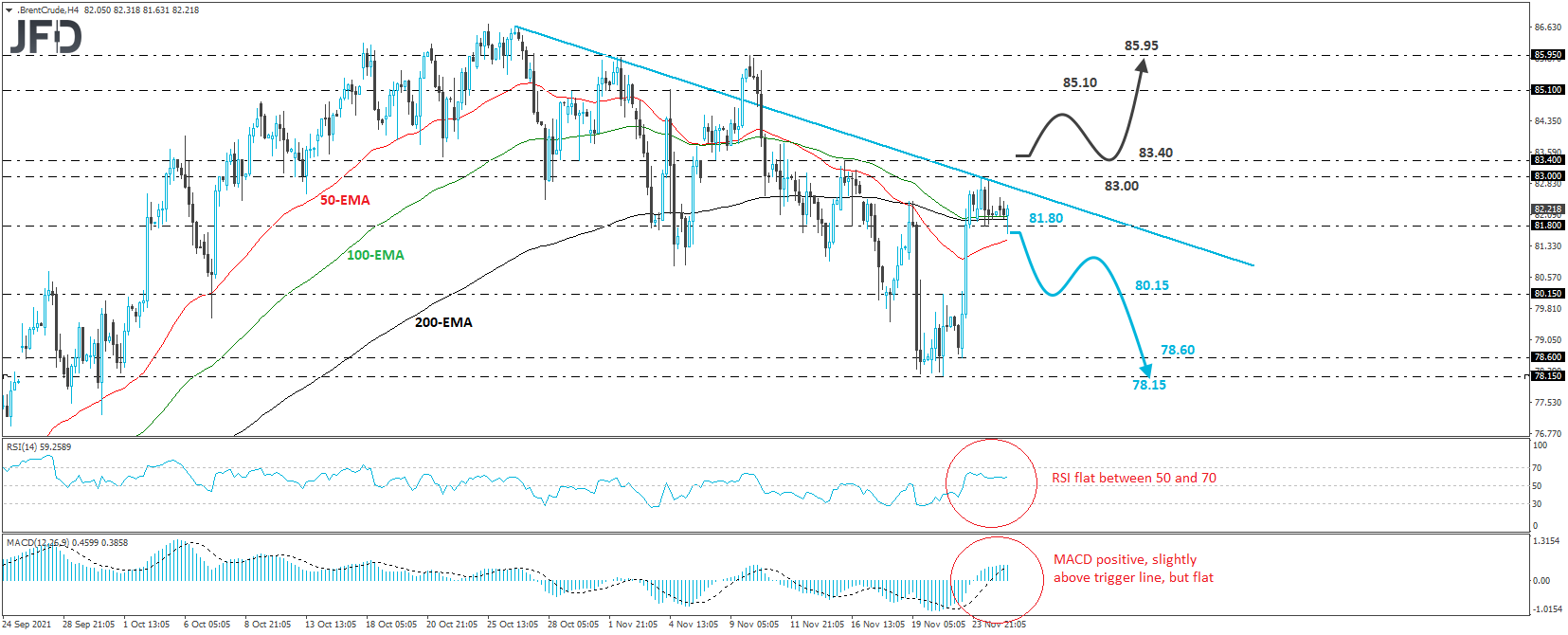

Brent crude oil has been trading in a consolidative manner since Tuesday when it jumped higher after hitting support t 78.60. That said, it stayed below the downside resistance line taken from the high of October 26th, and above the 81.80 barrier. In our view, despite Tuesday’s rally, the outlook remains somewhat negative, but in order to start examining a forthcoming negative wave, we would like to see a dip below 81.80.

Such a dip could initially encourage the bears to push the action down to the 80.15 barrier, which is marked by Monday’s inside swing high. However, if they are not willing to stop there, then a break lower could extend the fall towards the low of Tuesday, at 78.60, or the 78.15 territory, which stopped Brent from moving lower on Friday and Monday.

Shifting attention to our short-term oscillators, we see that the RSI lies above 50, but it points east, while the MACD, although positive and slightly above its trigger line, is flat as well. Both point to positive momentum, but a weakening one. They could top soon. That’s why we believe that the bears may take advantage of that, but as we already noted, we prefer to wait for a confirmation break below 81.80.

Now, in order to start examining whether the bears have taken the driver’s seat, we would like to see a break above 83.40, marked by the high of November 16th. The price will already be above the aforementioned downside line, and we could see advances towards the peak of November 4th, at 85.10. If the bulls are not willing to stop there, then a break higher could pave the way towards the 85.95 zone, which prevented further advances on November 2nd and 10th.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.